🟦 Introduction — Can Simple Really Work in Forex?

“Can a simple strategy really deliver consistent results in Forex trading?”

That’s a question I’ve asked myself countless times. As a trader, I’ve tested many systems—from complex indicator mashups to news-based strategies. But recently, I developed a method that requires just three market checks per day. No constant screen watching. No stress. Just data-driven simplicity.

To test whether this method is truly repeatable and effective, I decided to document a real trade on USD/JPY using what I call the Ama-chan 3-Check Method. This article walks you through the setup, entry logic, exit decision, and most importantly—how I captured 210 pips in a single trade.

- 🟦 Chapter 1: Strategy Overview — The Ama-chan 3-Check Method

- 🟦 Chapter 2: Live Trade Recap (May 8, 2025) — Entry, Exit, and Reasoning

- 🟦 Chapter 3: Post-Trade Analysis — What Went Right and What Can Improve

- 🟦 Chapter 4: Performance Tracker — Pips, Win Rate, and Long-Term Edge

- 🟦 Chapter 5: Final Thoughts & What’s Next

🟦 Chapter 1: Strategy Overview — The Ama-chan 3-Check Method

The Ama-chan 3-Check Method is a streamlined USD/JPY trading strategy built on simplicity and structure. It revolves around checking the charts only three times a day—after each 8-hour candle closes (Tokyo open, London open, and New York close). This allows traders with busy schedules to avoid screen fatigue while still catching significant market moves.

Here’s the core logic of the method:

- Key Indicators Used:

- 9-period Moving Average (9MA)

- 36-period Moving Average (36MA)

- Setup Criteria for a Long Trade:

- The 9MA is above the 36MA (a bullish alignment).

- The latest 8-hour candle closes above the 9MA (confirming momentum).

- Entry Timing:

- Ideally just after the 8-hour candle closes, but in practice, a slightly early entry is allowed to avoid widened spreads during the NY–Tokyo rollover.

- Exit Strategy:

- Pre-set Take-Profit and Stop-Loss based on recent volatility.

- Let the trade run without micromanaging—this is part of the method’s “hands-off” appeal.

Unlike scalping or intraday trading styles that demand constant attention, this approach is semi-automated in mindset: you assess, enter, and walk away. It’s designed to fit into real life—whether you’re trading around work, family, or sleep.

📘 Curious how this method is structured in detail?

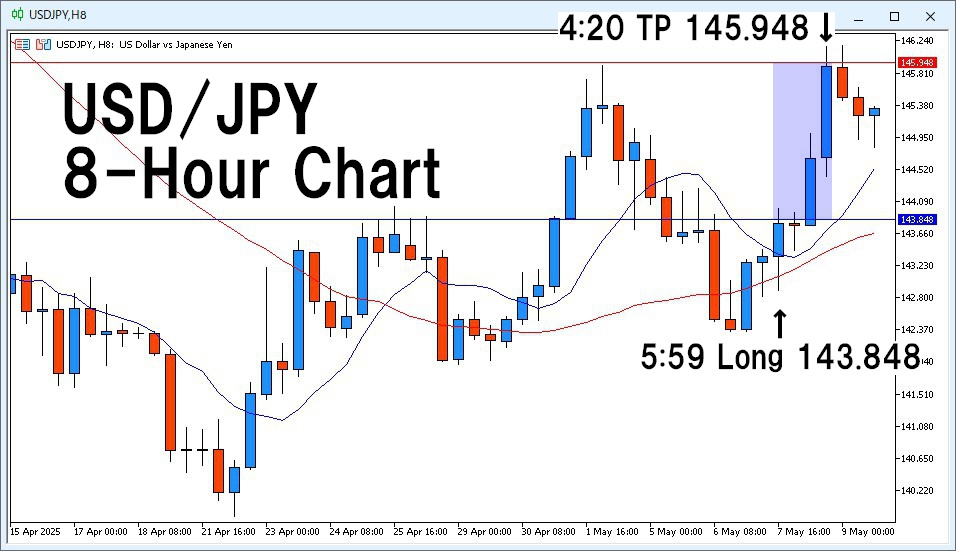

🟦 Chapter 2: Live Trade Recap (May 8, 2025) — Entry, Exit, and Reasoning

Let’s walk through a real USD/JPY trade executed using the Ama-chan 3-Check Method. This case study not only showcases how the method works in real-time but also offers insights into execution timing, risk management, and strategy discipline.

📅 Trade Setup

- Date & Time (JST): May 8, 2025, 06:00 (just before the 8-hour candle close)

- Currency Pair: USD/JPY

- Direction: Long

- Entry Price: 143.848

- Lot Size: 0.01 lot

- Strategy Used: Ama-chan 3-Check Method

🔍 Why Enter Here?

- The 9MA was positioned above the 36MA — confirming bullish structure.

- The 8-hour candle was about to close above the 9MA, signaling momentum continuation.

- Entry was made 40 seconds before the candle closed, to avoid spread widening that often occurs right after the NY session ends.

Although ideally the method calls for waiting until the candle officially closes, this trade slightly front-ran the signal for practical reasons (to avoid poor execution during spread expansion). This will be adjusted in future trades.

✅ Exit Details

- Exit Price: 145.948 (take-profit hit)

- Stop-Loss: 143.148

- Time of Exit: May 9, 2025, 04:20 JST

- Result:

- +210 pips gained

- ¥2,100 JPY profit (approx. $13.50 USD at the time)

- Swap: +¥12

- Commission: ¥0 (zero)

The trade was exited automatically at the take-profit level, requiring no manual intervention. The setup, entry, and exit followed the system rules with minimal deviation.

🟦 Chapter 3: Post-Trade Analysis — What Went Right and What Can Improve

Every trade—win or lose—offers a chance to refine your strategy. This one was a clear success, but it still came with lessons worth noting.

🟢 What Worked Well

- Fundamental Tailwind: The trade coincided with a sharp rally in USD/JPY, triggered by a high-impact market comment.

On May 8, President Donald Trump made a bold statement: “You better go out and buy stocks now.”

This sparked broad risk-on sentiment and a strong USD rally.

The timing of this trade lined up perfectly with that momentum. - Technical Confirmation:

- Trend alignment (9MA > 36MA)

- Price breaking and closing above the 9MA

- A clean 8-hour candle structure

- Set-and-Forget Execution:

The use of preset stop-loss and take-profit levels allowed the trade to run without emotional interference. It hit the take-profit target automatically.

🔴 What Could Be Improved

- Premature Entry:

Entry was made before the 8-hour candle had officially closed.

While the reason was practical—to avoid the spread widening that occurs after the NY session ends—it’s technically a deviation from the rule.

✅ Adjustment for Future Trades:

Going forward, I’ll wait for the candle to close before entering. If spread widening is a concern, I may delay entry by a few minutes or use limit orders.

This analysis confirms that the strategy works when followed with discipline—but even small deviations can introduce risk. Keeping to the method strictly will help assess its true performance.

🟦 Chapter 4: Performance Tracker — Pips, Win Rate, and Long-Term Edge

To assess whether the Ama-chan 3-Check Method has real potential, I’m tracking each trade transparently—win or lose.

📈 Current Results

- Number of Trades: 1

- Wins: 1

- Losses: 0

- Total Pips Gained: +210 pips

- Win Rate: 100% (so far)

- Average Pips per Trade: +210 pips

🧠 Notes on Sample Size

Of course, one trade is not statistically meaningful. But this first result is encouraging. The method is designed to focus on quality over quantity, with fewer, high-conviction trades per week.

Over time, this tracker will evolve into a more complete picture of:

- Edge consistency

- Strategy reliability

- Profit factor

I’ll continue logging and publishing every trade based on this system so that you can see real-world performance, not just theory.

🟦 Chapter 5: Final Thoughts & What’s Next

This first live trade using the Ama-chan 3-Check Method was a solid success—210 pips in one swing, backed by both technical structure and favorable market sentiment.

But this isn’t about one lucky trade.

It’s about building a strategy that’s:

- Repeatable

- Emotionally manageable

- Aligned with real-life schedules

As I continue forward, I’ll be applying the same rules to USD/JPY setups and publishing each trade outcome—whether it hits TP, SL, or gets manually exited.

📘 Curious how this method is structured in detail?

Don’t miss the dedicated guide👇

📢 Next Trade Coming Soon

I’m already eyeing the next opportunity. The next 8-hour candle close will determine whether conditions align again. Stay tuned—results will be published in the next journal update.

If you’re a trader struggling with screen fatigue or overcomplication, this method may offer the clarity and structure you need.