Are markets entering a new phase of risk aversion?

Recent developments suggest so.

Weak U.S. PMI data and renewed tensions between the U.S. and China have reignited safe-haven flows, strengthening assets like the Japanese yen and gold. As global uncertainty grows, traders are increasingly positioning for a safe-haven shift, reassessing traditional dollar-based strategies.

In this article, we explore how USD/JPY is responding to this changing environment, analyze key technical setups, and examine cross-asset impacts — providing actionable insights for traders navigating the evolving market dynamics.

- 🌎 1. US-China Tensions and Economic Weakness: Is Risk-Off Back?

- 💬 2. Market Sentiment on X: Yen Regains Its Safe-Haven Status

- 📊 3. USD/JPY Technical Analysis and Strategic Trade Setups

- 🔄 4. How Dollar Weakness Is Reshaping Cross-Asset Strategies

- 📌 Final Chapter: Key Takeaways and FAQ|Mastering the Safe-Haven Shift

🌎 1. US-China Tensions and Economic Weakness: Is Risk-Off Back?

Global markets are facing renewed turbulence as two key risk factors reemerge: escalating U.S.-China tensions and signs of economic weakness in the United States. Together, these developments are reigniting risk-off sentiment and driving investors toward traditional safe-haven assets like the Japanese yen and gold.

🇨🇳 US-China Relations: From De-escalation Hopes to Rising Frictions

Initially, hopes for de-escalation had fueled optimism across equities and risk assets. However, the recent shift in tone from the White House — suggesting that tariff reductions now depend solely on China’s actions — has revived geopolitical concerns.

While Beijing has shown little willingness to make concessions, Washington’s stance has hardened, raising the possibility of prolonged economic conflict.

This renewed tension not only clouds the outlook for global trade but also triggers classic risk-off behavior among market participants.

As seen in recent price actions, the yen has begun appreciating against the U.S. dollar, while European and U.S. equity markets are struggling to maintain recent gains.

🇺🇸 US Economic Weakness: PMI Signals a Slowdown

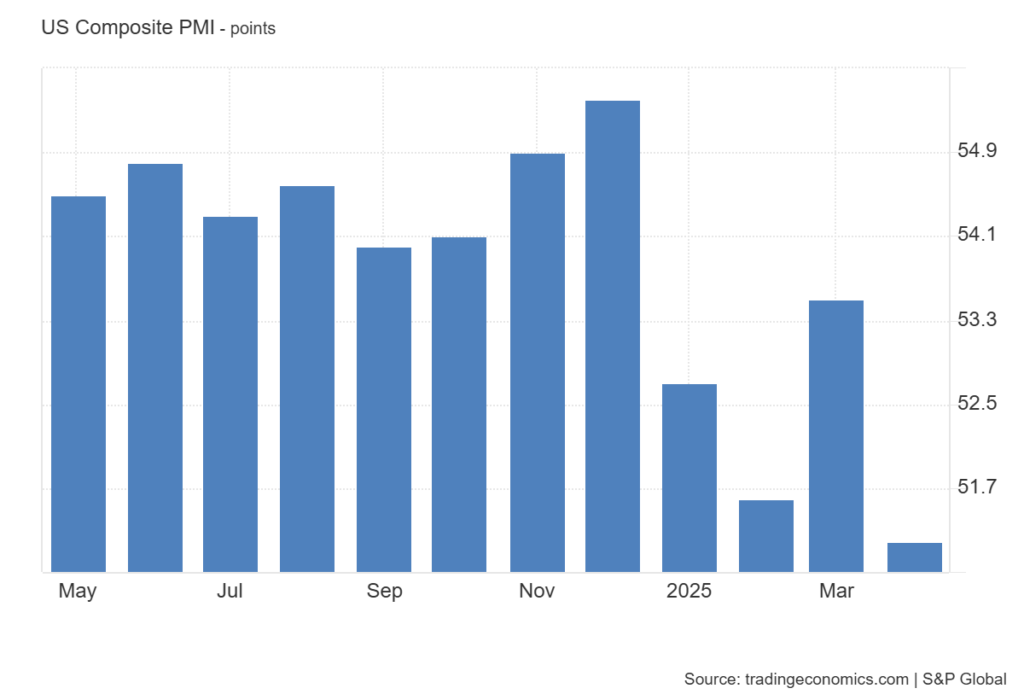

Adding to the cautious mood is a clear signal from U.S. economic data.

The S&P Global Flash Composite PMI for April dropped to 51.2, down sharply from 53.5 in March — marking the slowest expansion in private sector activity in 16 months.

Key observations include:

- Services PMI decelerated from 54.4 to 51.4, a notable slowdown.

- Manufacturing PMI slightly improved, but broader business sentiment weakened.

- Price pressures remain elevated, particularly due to tariffs impacting manufacturing inputs.

- Business expectations for the year ahead have fallen to levels not seen since the pandemic.

These signals indicate that stagflation risks — slowing growth combined with sticky inflation — are starting to weigh on market psychology.

🧠 Quick Takeaways for Traders

| Risk Factor | Market Impact |

|---|---|

| US-China Tensions | Boosts safe-haven demand (JPY, Gold, CHF) |

| US Economic Weakness | Increases risk of dollar sell-off and bond market volatility |

| PMI and Inflation Signals | Support rotation toward defensive assets |

With geopolitical risk rising and U.S. growth momentum fading, traders should prepare for a market environment where risk-off dynamics dominate — particularly favoring safe-haven currencies like the yen over the dollar in the short to medium term.

💬 2. Market Sentiment on X: Yen Regains Its Safe-Haven Status

As market uncertainty intensifies, real-time sentiment analysis reveals a clear shift toward traditional safe-haven assets — particularly the Japanese yen.

A review of trending posts on X (formerly Twitter) shows that traders are increasingly positioning themselves for a risk-off environment, and the yen is at the center of this rotation.

💬 Key Themes Emerging from X

Several major themes surfaced across multiple X posts during the latest market turmoil:

✅ 1. Yen Strength Supported by BoJ’s Hawkish Tilt

Posts from market commentators, like @financialjuice, highlighted how the Bank of Japan’s recent communication, hinting at the possibility of future tightening, has boosted safe-haven demand for the yen.

Ueda’s signaling of possible further BoJ tightening is pushing the Yen into safe-haven territory.

The idea that the BoJ — traditionally ultra-dovish — might tighten policy underpins investor expectations that JPY assets will outperform if global risks escalate further.

✅ 2. Diminishing Confidence in the US Dollar

Some traders, including @skizznit, voiced skepticism about the Federal Reserve’s credibility and the broader resilience of the U.S. dollar.

Powell slow-walked rate hikes while inflation soared. The top 2% made money, the 98% got crushed.

This sentiment reflects a growing narrative that systemic risks and policy missteps could lead to sustained dollar weakness — creating a fertile environment for safe-haven flows into JPY, CHF, and gold.

✅ 3. Risk-Off Behavior: Yen, Gold, and CHF in Demand

Other posts, such as those from @Credit_Junk, highlighted increased flows into gold and the Swiss franc, both traditional safe-havens.

The common thread? A clear rotation out of the dollar and risk assets, and into defensive plays.

JPY is a safe-haven asset. A lot of institutional flows are exiting the dollar.

📈 Sentiment Mapping from X

| Asset | Sentiment Shift | Driver |

|---|---|---|

| JPY | Stronger | BoJ hawkish hints, risk-off |

| Gold (XAU) | Stronger | Inflation fears, USD weakness |

| CHF | Stronger | European risk aversion, safe-haven demand |

| USD | Weaker | Fed credibility doubts, stagflation risk |

🧠 Quick Takeaways for Traders

- Safe-haven demand is no longer speculative — it’s actively underway.

- The Japanese yen is being reestablished as a primary risk-off asset, alongside gold.

- Watch for further sentiment shifts if US-China relations worsen or if upcoming US economic data disappoints.

📊 3. USD/JPY Technical Analysis and Strategic Trade Setups

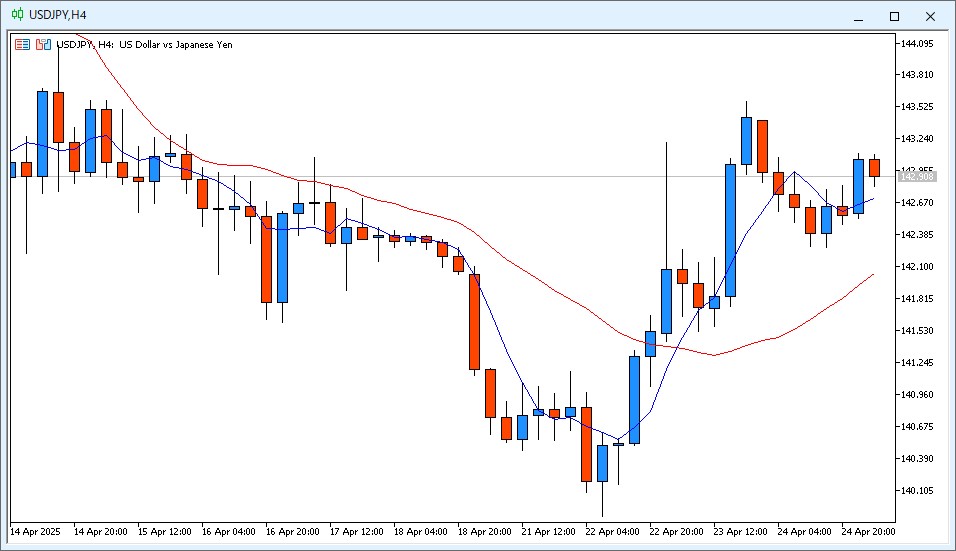

The USD/JPY pair has entered a critical phase, showing clear signs of a bearish trend amid shifting market dynamics. Risk-off sentiment, combined with fading U.S. economic momentum, is exerting downward pressure on the dollar while boosting the yen’s safe-haven appeal.

In this section, we examine the key technical indicators shaping the current USD/JPY landscape and outline actionable trading strategies for different market scenarios.

📈 Daily Chart: Downward Bias Confirmed by Moving Averages and RSI

The daily chart presents a clear downward bias:

- 5-day MA has crossed below the 20-day MA, indicating short-term bearish momentum.

- RSI remains below 50 and points downward, reinforcing selling pressure.

- Price action is struggling below key resistance at 143.50, the weekly high.

Key Support Zones:

- 140.00 psychological level: Temporary support, previously tested.

- 139.00 area: A break below this level would confirm further downside.

🕑 4-Hour Chart: Short-Term Rebounds Facing Resistance

On the 4-hour timeframe:

- Minor rebounds are capped below the 5-period MA.

- Price remains within a descending channel, forming lower highs and lower lows.

- RSI on the 4-hour chart is also stuck below 50, indicating that rallies are likely to be sold.

This pattern suggests that any near-term bounces are opportunities to enter short positions, especially below the 143.00–143.50 resistance zone.

🧠 Strategic Trade Setups

| Scenario | Strategy | Entry Zone | Target | Stop Loss |

|---|---|---|---|---|

| Bearish Continuation | Short on rebounds | 143.00–143.50 | 140.00, then 139.00 | Above 144.00 |

| Aggressive Sell Breakout | Short on 139.00 break | Below 139.00 | 137.50 | Above 140.20 |

| Countertrend Bounce | Very cautious long | Only above 144.50 | 145.00–145.50 | Below 143.80 |

🔥 Trader’s Note

Given the broader macro backdrop — weak U.S. data, persistent U.S.-China tensions, and emerging risk-off flows — the path of least resistance for USD/JPY remains to the downside.

Patience is key: letting short setups develop near resistance zones offers a favorable risk-reward profile.

Stay alert to volatility around upcoming U.S. data releases, as sudden swings could offer tactical trading opportunities.

🔄 4. How Dollar Weakness Is Reshaping Cross-Asset Strategies

The broad weakening of the U.S. dollar is not only impacting USD/JPY but also creating ripple effects across major cross-asset markets.

Safe-haven flows and shifts in investor sentiment are redefining strategies for trading major currency pairs and commodities.

In this section, we analyze the latest technical and sentiment trends for EUR/USD, XAU/USD (Gold), and AUD/USD — and offer strategic insights for navigating the new landscape.

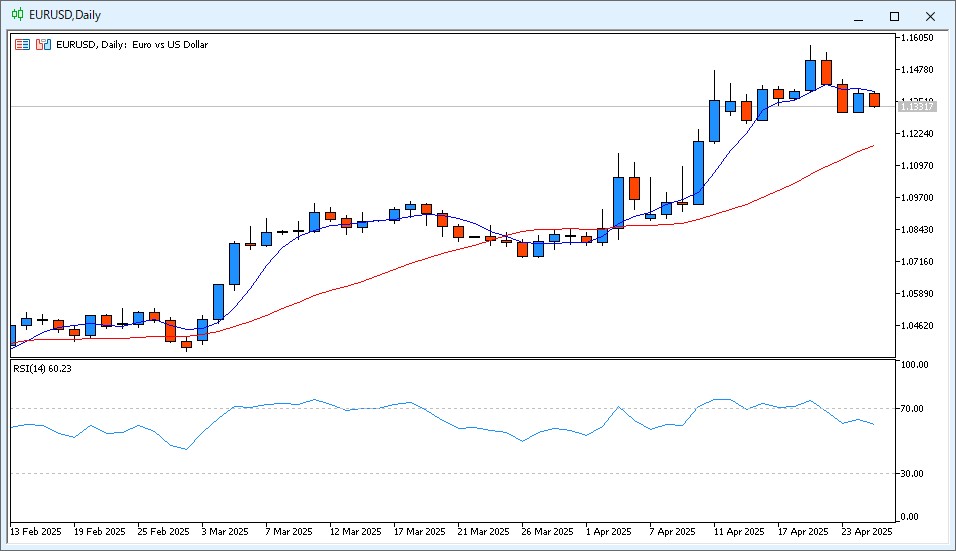

💶 EUR/USD: Bullish Bias Intact but Momentum Slowing

EUR/USD has benefited from dollar weakness, rallying nearly 1,000 pips from its recent lows. However, technical indicators suggest a short-term pause:

- Price remains above both the 5-day and 20-day moving averages.

- RSI is hovering around 60, showing momentum is still positive but less aggressive.

- 1.1400–1.1500 remains a critical resistance zone.

Strategy Tip:

Look for buying opportunities on dips toward the 1.1250–1.1300 area, targeting 1.1400–1.1500.

A break below 1.1200 would invalidate the bullish setup.

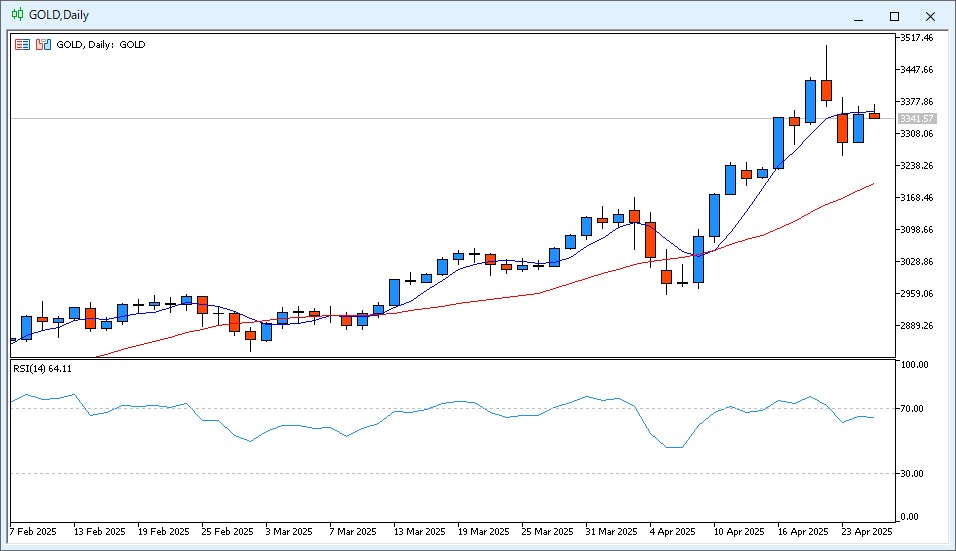

🟡 XAU/USD: Gold Remains a Primary Safe-Haven Magnet

Gold has surged to all-time highs, driven by safe-haven demand and concerns over stagflation:

- The price is strongly supported by both 5-day and 20-day moving averages.

- RSI is around 64, indicating strong but sustainable momentum.

- 3320–3350 USD is an ideal buying zone for dip buyers.

Strategy Tip:

Maintain a bullish bias. Dips are buying opportunities with upside targets of 3450–3500 USD.

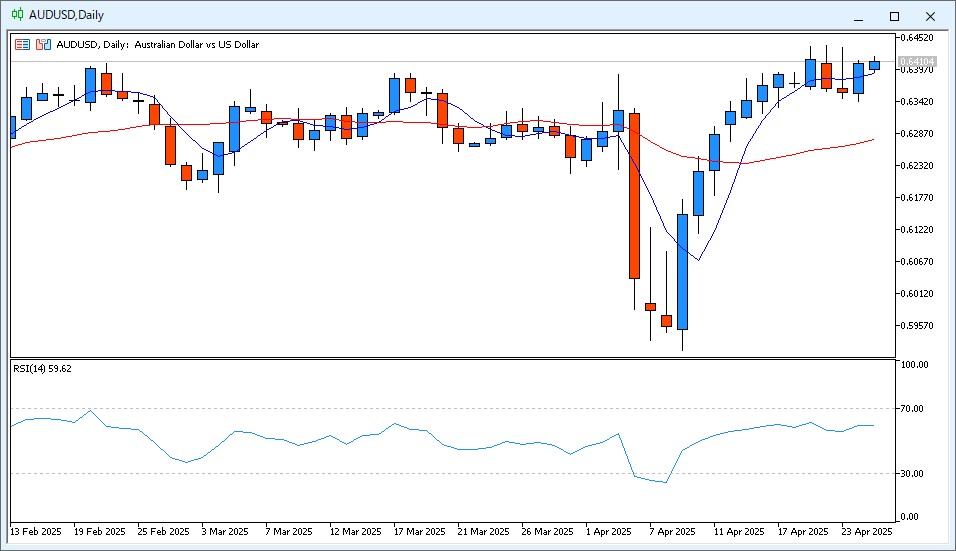

🟠 AUD/USD: Risk Sentiment Battleground

AUD/USD has rebounded sharply from recent lows, fueled by dollar weakness and hopes for China’s economic stabilization:

- 5-day and 20-day moving averages have formed a golden cross.

- RSI is stable near 60, suggesting a healthy uptrend without excessive overheating.

- 0.6380–0.6400 acts as a strong support zone.

Strategy Tip:

Buy shallow pullbacks above 0.6380, targeting a move toward 0.6480–0.6500.

If AUD/USD drops below 0.6340, reassess the bullish bias.

📊 Strategic Summary Table

| Pair | Strategy | Key Levels | Bias |

|---|---|---|---|

| EUR/USD | Buy dips | 1.1250–1.1300 | Bullish |

| XAU/USD | Buy dips | 3320–3350 USD | Strong Bullish |

| AUD/USD | Buy dips cautiously | 0.6380–0.6400 | Cautious Bullish |

🧠 Cross-Asset Sentiment Matrix

| Asset | Sentiment | Driver |

|---|---|---|

| JPY | Stronger | Safe-haven demand |

| Gold (XAU) | Stronger | Inflation fears, dollar weakness |

| EUR | Stronger | Dollar sell-off |

| AUD | Neutral to slightly bullish | Risk sentiment and China factors |

| USD | Weaker | Economic slowdown, geopolitical uncertainty |

📌 Final Chapter: Key Takeaways and FAQ|Mastering the Safe-Haven Shift

📌 Summary of Key Takeaways

The current market environment reflects a classic risk-off rotation triggered by two major forces:

- Weakening U.S. economic data (especially PMI)

- Renewed U.S.-China tensions

As a result:

- The Japanese yen is regaining safe-haven status, outperforming the U.S. dollar.

- Gold continues to attract inflows amid inflation concerns and geopolitical risks.

- Cross-currency pairs like EUR/USD and AUD/USD are reacting to the broad dollar sell-off but with varying momentum.

In short:

The safe-haven shift is not speculative anymore — it’s actively underway, and traders must adjust strategies accordingly.

💬 FAQ|Frequently Asked Questions

❓ Q1. Why is USD/JPY falling despite Japan’s economic challenges?

A.

In risk-off environments, capital prioritizes safety over yields.

The yen’s role as a traditional safe-haven asset dominates short-term flows, even if Japan’s fundamentals are not strong.

Additionally, hints of BoJ tightening have reinforced yen strength relative to the dollar.

❓ Q2. Is the “safe-haven rotation” expected to continue?

A.

Yes, if:

- U.S. data continues to deteriorate (especially job market and inflation figures),

- U.S.-China relations worsen,

- Fed credibility concerns persist.

Traders should monitor U.S. economic releases and diplomatic developments closely.

❓ Q3. Which assets are benefiting most from the shift?

A.

Currently, the key beneficiaries are:

- JPY (Japanese Yen)

- XAU/USD (Gold)

- CHF (Swiss Franc)

EUR and AUD are also gaining, but with less consistency due to their exposure to risk sentiment.

❓ Q4. What are the main technical levels to watch for USD/JPY?

A.

- Resistance: 143.00–143.50

- Support: 140.00 and critical support at 139.00

- A break below 139.00 could trigger an extended sell-off.

🧠 Final Thoughts

Markets are transitioning into a phase where risk management and flexible positioning are critical.

Recognizing the early signs of safe-haven flows — as we are seeing now — often offers a decisive edge for active traders.