The latest UK PMI figures sent mixed signals to the markets, with a strong rebound in services clashing with deeper weakness in manufacturing. For GBP/USD traders, this divergence adds complexity to short-term direction and interest rate expectations. Here’s what the numbers show — and how the market is reacting.

Headline Summary

- UK Services PMI: 53.2 (Forecast: 50.9) – 7-month high

- Manufacturing PMI: 44.6 (Forecast: 47.2) – 18-month low

- GBP/USD reacted with short-term gains but faced resistance near 1.3000

- Market remains torn between a service-led recovery and manufacturing-led recession fears

Economic Overview

On March 24, 2025, S&P Global released the UK Flash PMI data, revealing a sharp contrast between sectors.

The services sector surprised to the upside, with a reading of 53.2 – the strongest since August 2024 – supported by rising domestic and overseas demand.

This marked the first growth in new work reported in 2025, suggesting an early sign of economic resilience.

In contrast, manufacturing PMI dropped to 44.6, its lowest since October 2023, reflecting ongoing export weakness, global demand concerns, and potential tariff risks.

While services continue to face wage-driven input inflation, manufacturers reported a steep decline in output and business confidence, reinforcing concerns about structural headwinds in the sector.

What Traders on X Are Saying

✅ Bullish Voices:

UK shows early signs of shaking off stagnation since Labour took power.

GBP futures positive post-PMI; potential upside in GBP/USD and UK equities.

Some relief amid economic gloom, led by stronger services data.

❌ Bearish Reactions:

One strong PMI does not make a recovery. Growth remains soft.

Services bounce might be weather-related. Manufacturing still weak.

Energy costs and policy fears hitting UK manufacturers hard.

⚖ Cautious Takes:

Rebound is welcome but expectations remain below last year’s levels.

BoE policy likely influenced by PMI, but upcoming Spring Budget also critical.

GBP/USD Technical Outlook

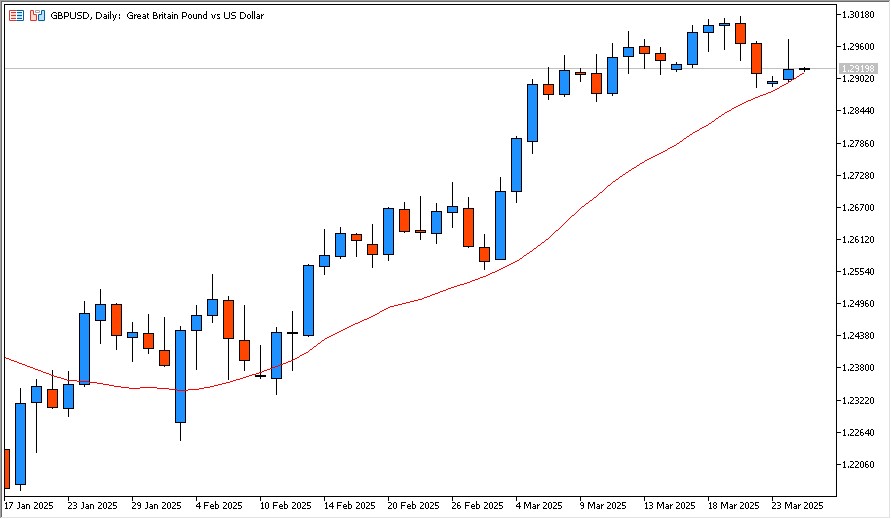

As of March 25, 8:30 AM JST, the daily chart for GBP/USD shows:

- 20-day moving average trending upward – indicating ongoing bullish momentum

- Price action capped by resistance at 1.3000, with support near 1.2870

- A break above 1.3000 would validate trend continuation; failure may trigger a retracement to 1.2670

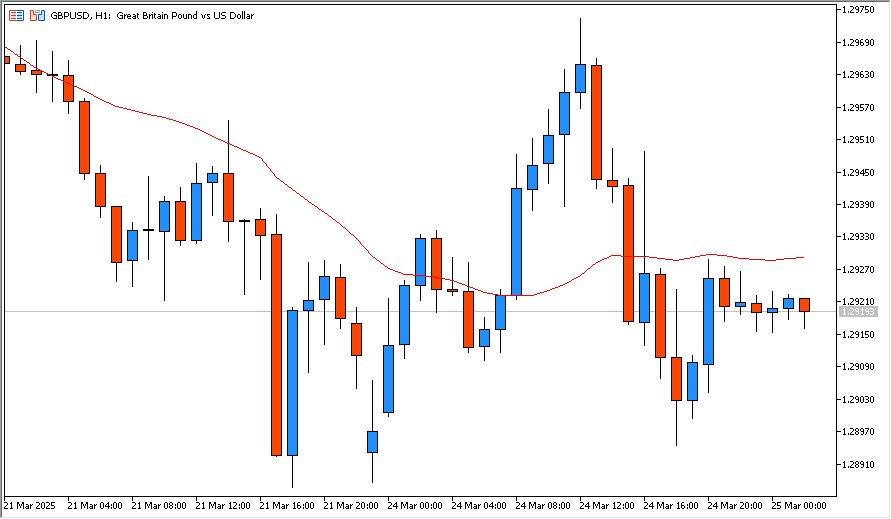

The 60-minute chart suggests a consolidation phase, with price stuck between 1.289 and 1.300, and the 20-MA flattening – signaling indecision.

Strategy Implications for Traders

- Short-term bias: cautiously bullish as long as price holds above 1.2870

- Upside breakout above 1.3000 could attract momentum buyers

- Downside risk if manufacturing drag weighs further on sentiment and policy outlook

Watch for:

- UK Spring Budget (Wed) for fiscal direction

- BoE commentary on inflation vs. growth balance

- US tariff policy shifts, which may add to export pressures

Final Thoughts

The latest UK PMI data paints a picture of economic divergence, with services showing resilience and manufacturing deepening into contraction.

For GBP/USD traders, this presents both opportunity and risk: a currency supported by sticky inflation and services strength, but held back by external headwinds and internal uncertainty.

Patience and clear technical levels will be key in navigating the next move.