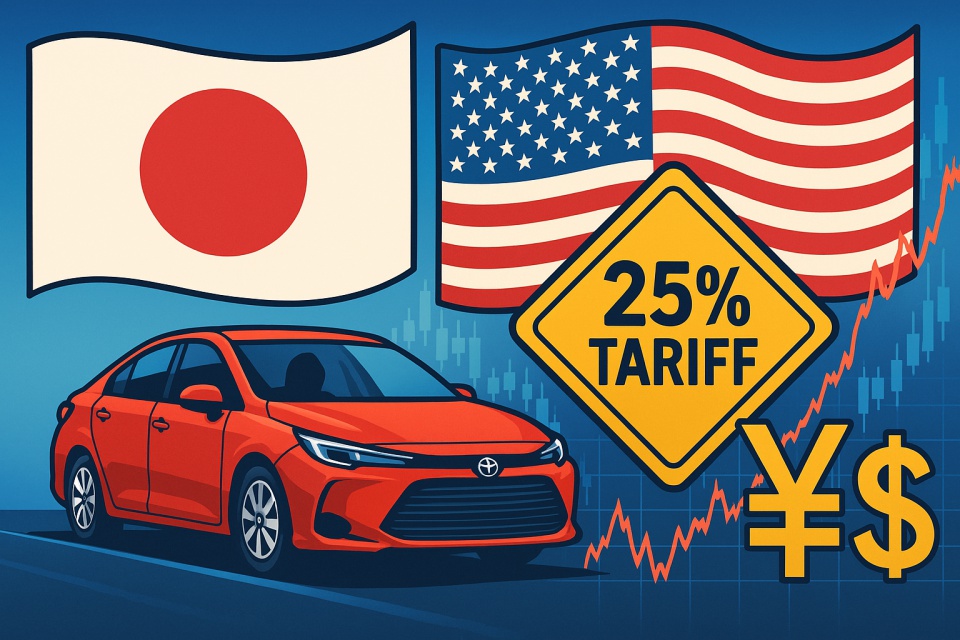

As tensions rise ahead of a potential 25% U.S. tariff on Japanese cars, FX markets are on high alert.

Japan’s most critical export sector is under fire, and the impact is already rippling across equities, bond yields, and the USD/JPY pair.

Whether you’re a short-term trader or a macro-driven investor, understanding the full scope of this policy risk is essential to staying ahead of the market.

📌 What You’ll Learn in This Article:

- The key facts behind Trump’s proposed auto tariffs and the April 2 timeline

- How Japan’s economy and stock market are reacting—and why it matters for FX

- Real-world sentiment from influential market voices on X

- Scenario-based USD/JPY trading strategies for both risk-off and relief scenarios

- An outlook on volatility, interest rate dynamics, and safe-haven flows

📊 This is more than a headline—it’s a structural shift in how USD/JPY trades. Let’s dive in.

- 🇺🇸 Key Takeaways: Trump’s Auto Tariff Shock and USD/JPY Outlook

- 🇯🇵 Japan’s Export Reliance and Economic Impact

- 🔄 Intermarket Reactions: Equities, Bonds, and Currencies

- 🎯 What FX Traders Should Be Watching Now

- 🗣️ Market Sentiment on Social Media

- 🔀 Scenario-Based Trading Strategies for USD/JPY

- 🔮 Outlook: Policy, Volatility, and JPY Strength

- ✅ Conclusion: Prepare for April 2 and Beyond

🇺🇸 Key Takeaways: Trump’s Auto Tariff Shock and USD/JPY Outlook

Here’s a quick summary of what you need to know:

✅ Trump’s 25% Auto Tariff Targets Japanese Exports

On March 27, 2025, U.S. President Donald Trump signaled a dramatic increase in auto tariffs—from 2.5% to 25%—on vehicles imported from Japan. This move strikes directly at Japan’s largest export sector and has triggered strong market reactions.

✅ Japanese Automakers and Stocks Hit Hard

Toyota, Honda, Mazda, and other Japanese automakers saw their stock prices drop 3–6% following the announcement. Japan’s auto exports to the U.S. accounted for over 30% of total exports in 2024, making this tariff a major economic blow.

✅ Economic Forecasts: Japan’s GDP at Risk

Major institutions such as Nomura and Dai-ichi Life estimate that Japan’s GDP could decline by 0.2–0.5% if the tariffs are enacted. Economists also warn of possible downstream effects on employment, investment, and the broader supply chain.

✅ FX Traders Eye April 2 as a Key Event Date

Markets are now watching April 2, when the official tariff implementation may be announced. USD/JPY has become increasingly sensitive to tariff-related headlines, with traders bracing for volatility.

✅ Broader Implications: Trade War 2.0?

Analysts fear this may signal the return of a full-scale trade war under Trump’s second term—this time targeting allies like Japan. The tariff’s ripple effect could reshape currency markets, global trade flows, and safe-haven dynamics.

🧠 Summary for Traders:

If you’re trading USD/JPY or related crosses, this isn’t just a headline—it’s a fundamental shift.

April 2 could mark a volatility trigger, and market sentiment is already on edge.

🇯🇵 Japan’s Export Reliance and Economic Impact

The auto tariff shock isn’t just a headline—it’s a direct hit to Japan’s economic core. Let’s break down the scale of exposure and what’s at stake.

🚗 Autos Are Japan’s Top U.S.-Bound Export

According to Japan’s Ministry of Finance, total exports to the U.S. in 2024 reached ¥21.3 trillion (approx. $142 billion). Of that, automobiles accounted for 28.3%, making them the single largest export category.

When auto parts like engines and transmissions are included, the figure jumps to 34.1%—roughly ¥7.26 trillion (approx. $48 billion).

🏭 Tariff Targets Japan’s Core Industrial Base

Japan’s automotive industry represents:

- ~3% of total GDP

- ~10% of total employment

- A major driver of corporate profits and capital investment

The proposed 25% tariff would increase the cost of Japanese vehicles sold in the U.S. dramatically. With price-sensitive American consumers, this could:

- Cut export volumes

- Force price hikes

- Lead to declining sales and reduced production

📉 GDP Drag Estimates from Economists

Two major reports outline the macroeconomic damage:

- Nomura Research Institute: Japan’s GDP could fall by 0.2% due to reduced exports and weakened corporate activity.

- Dai-ichi Life Research Institute: Including downstream effects (parts suppliers, logistics, retail), GDP impact could reach −0.52%.

This level of contraction raises the risk of a technical recession—especially if other export-dependent sectors get caught in retaliatory measures or U.S. policy tightening.

💼 Corporate Outlook: Lower Earnings, Reduced Investment

Analysts from Goldman Sachs forecast the following operating profit losses for FY2026 due to the tariffs:

| Automaker | Estimated Hit (in ¥ billion) |

|---|---|

| Toyota | −340 |

| Honda | −120 |

| Nissan | −110 |

| Mazda | −110 |

| Subaru | −90 |

To offset losses, companies may consider raising U.S. retail prices, but that carries the risk of further demand destruction.

🌐 Global Supply Chains Also at Risk

Japan’s automakers also rely on plants in Mexico and the U.S., which may face indirect impacts. If tariffs extend to parts or are broadened, supply chain disruption could ripple throughout North America.

💡 FX Implications:

- The tariff shock increases economic downside risk, prompting JPY strength as a safe-haven.

- At the same time, weaker Japanese corporate earnings and capital outflows could pressure the yen longer-term.

- The FX market is entering a phase where geopolitical policy risk is back in play—and Japan is on the front line.

🔄 Intermarket Reactions: Equities, Bonds, and Currencies

Trump’s auto tariff announcement didn’t just rattle the automotive sector—it sent shockwaves across global asset classes. FX traders should pay close attention to how these markets are interconnected.

📉 Equity Markets: Japan and U.S. Automakers Slide

- Tokyo Stock Exchange (March 27):

Japanese automakers tumbled:- Toyota, Honda, Nissan: −3% range

- Mazda, Subaru: −5–6% range

- U.S. Equities:

- General Motors (GM) and other U.S. automakers declined as investors priced in higher input costs (many components are imported).

- Ironically, “America First” tariffs hurt American companies relying on global supply chains.

→ Equity weakness adds to overall market risk sentiment, prompting safe-haven flows into the Japanese yen.

💹 Bond Markets: Risk-Off Sentiment Triggers Yield Declines

- U.S. Treasuries saw buying interest as investors sought safety amid trade tension headlines.

- Yields on the 10-year note dipped, contributing to a narrowing U.S.-Japan interest rate differential—a key driver of USD/JPY.

→ FX traders should watch for sustained downward pressure on yields, which historically supports yen strength.

💱 FX Market: USD/JPY Volatility Rises on Trade War Risk

- USD/JPY experienced increased intraday volatility as headlines broke.

- JPY strengthened temporarily due to:

- Risk-off equity flows

- Recession fears for Japan

- Concerns about prolonged trade tensions

However, some USD demand persisted due to:

- U.S. economy’s relative resilience

- Speculation that Japan may ease policy or delay rate normalization in response

📊 Summary Table: Cross-Market Reactions

| Asset Class | Reaction | FX Implication |

|---|---|---|

| Japan Stocks | Sharp decline in auto shares | Risk-off → JPY strength |

| U.S. Stocks | Automaker weakness (e.g. GM) | Market uncertainty → Mixed USD flows |

| Bonds | U.S. yields lower on risk aversion | Lower yields → USD/JPY bearish |

| FX | USD/JPY whipsaw movement | Yen strengthening bias, but fragile |

💡 FX Insight:

The current backdrop resembles past trade war phases (e.g., 2018 China tariffs).

Expect cross-market reactions to amplify USD/JPY volatility—and headline-driven price action to dominate in the short term.

🎯 What FX Traders Should Be Watching Now

With the April 2 tariff announcement looming, USD/JPY traders are entering a potentially volatile window. This section highlights what to monitor in real-time—and how to position accordingly.

🗓️ April 2: Tariff Announcement Timing and Market Reaction

- The exact timing of Trump’s official tariff decree is unknown, but April 2 is seen as the likely date.

- Watch for:

- Leaks or advance headlines from the White House

- Press briefings or U.S. Trade Representative (USTR) comments

- Market reactions during Asia → London → New York sessions

🔄 Implication: Be ready for knee-jerk volatility, especially during low-liquidity hours like Tokyo lunch or pre-London open.

🏭 Auto Sector-Specific Headlines

- Monitor updates from:

- Japanese automakers (earnings guidance, production changes)

- U.S. automakers (GM, Ford) and suppliers

- Industry associations (e.g., Japan Automobile Manufacturers Association)

🔍 Why it matters: New profit warnings or production cuts can accelerate JPY strength, especially if equity markets react negatively.

📊 U.S.-Japan Interest Rate Differentials

- The USD/JPY exchange rate is sensitive to yield spreads.

- If U.S. bond yields fall further due to risk aversion, while Japan stays on hold, the narrowing spread will pressure USD/JPY.

- Watch:

- U.S. Treasury 10Y vs. Japan JGB 10Y

- Fed commentary vs. Bank of Japan tone

📉 Implication: A falling U.S.–Japan rate spread historically aligns with yen appreciation.

📲 Real-Time Risk Sentiment Indicators

Track these for intraday guidance:

- VIX Index: A spike above 20–25 may push JPY higher.

- Nikkei 225 / S&P 500 futures: Equity sell-offs often precede yen buying.

- USD/JPY implied volatility (options): Rising vols signal heightened positioning risk.

⚠️ Short-term traders should consider hedging or using smaller lot sizes around volatile time windows.

🧠 Quick Tip:

In trade war scenarios, macro correlations tend to intensify. Watch for non-FX assets (stocks, bonds, volatility) to guide your USD/JPY bias.

🗣️ Market Sentiment on Social Media

Beyond headlines and economic models, real-time trader sentiment—especially on X (formerly Twitter)—offers valuable insights into market psychology. Here’s what influential voices are saying about Trump’s tariff push and its FX implications.

🔥 Japanese Voices Show Anxiety and Division

Yoichi Takahashi (@YoichiTakahashi) – Economist

Tariffs hurt American consumers and manufacturers first. Japan should push for a deal through countermeasures.

🔎 Takeaway: Some Japanese economists suggest leveraging counter-tariffs as a negotiation tactic—highlighting the perceived power imbalance.

Yoshiko Sakurai (@YoshikoSakurai) – Political Commentator

Abe once got a no-tariff promise from Trump. Ishiba should stand up and say NO—anything less proves unfit for leadership.

🔎 Takeaway: Political frustration is visible, suggesting Japan’s policy response could be slow or fragmented, creating uncertainty for FX markets.

📉 U.S. Market Observers: Tariffs Backfire on American Firms

@goto_finance – Japanese Financial Journalist

GM stock dropped. Tariffs meant to protect U.S. jobs are hitting U.S. companies first.

🔎 Takeaway: A common theme—“America First” policies harming U.S. multinationals—reinforces risk-off sentiment and market fragility.

🌐 Global Macro Analysts Warn of Structural Risk

Mario Nawfal (@MarioNawfal)

Mazda, Nissan, and Honda face a massive earnings crunch. Japan’s GDP could drop by 0.2%—a potential trigger for recession.

🔎 Takeaway: The macroeconomic damage is gaining traction among global finance voices, increasing JPY appeal as a defensive currency.

DaiWW (@BeijingDai)

The U.S. was Japan’s last ‘safe market’ after losing to China in appliances, electronics, shipbuilding. If autos fall too, Japan’s future is bleak.

🔎 Takeaway: This post reflects deep structural concerns—suggesting that longer-term yen strength may emerge if global investors view Japan as economically vulnerable.

🧠 FX Strategy Insight:

While headlines drive volatility, sentiment on X shapes momentum.

Right now, the prevailing emotion is a mix of fear, criticism, and resignation—a backdrop that favors safe-haven assets like the yen.

🔀 Scenario-Based Trading Strategies for USD/JPY

With political risk events like tariffs, directional forecasting is never binary. Smart FX traders plan for multiple outcomes. Below are three key scenarios—and how USD/JPY could behave in each.

📌 Scenario 1: Tariffs Go Ahead as Planned on April 2

Market Reaction:

- Japan auto stocks slide further

- Nikkei 225 declines

- Risk sentiment weakens globally

- U.S. bond yields fall

FX Impact:

- USD/JPY dips toward support zones (e.g., 146–145)

- Safe-haven JPY demand rises

- USD may also weaken if U.S. equities get hit

Strategy Ideas:

- Short USD/JPY on pullbacks with stops above recent highs

- Hedge equity exposure using JPY longs

- Look at JPY crosses (EUR/JPY, CAD/JPY) for risk-off plays

🕊️ Scenario 2: Japan Gains Temporary Exemption or Delay

Market Reaction:

- Relief rally in Japanese equities

- USD/JPY rebounds

- Nikkei recovers; risk-on resumes

FX Impact:

- USD/JPY likely tests resistance around 149–150

- Volatility compresses temporarily

Strategy Ideas:

- Buy USD/JPY on dips if momentum confirms

- Fade safe-haven flows into yen

- Watch for short-covering rallies in Nikkei-linked JPY pairs

🧨 Scenario 3: Tariff Tensions Escalate into Broad Trade War

Market Reaction:

- Global risk sentiment deteriorates

- Equity markets fall in U.S., Japan, and Europe

- Investors flee to bonds, gold, and JPY

FX Impact:

- JPY strengthens broadly across G10

- USD/JPY breaks major support levels (e.g., 145 → 143 zone)

- Volatility spikes (VIX > 25)

Strategy Ideas:

- Short USD/JPY and risk-correlated currencies (AUD/JPY, GBP/JPY)

- Go long gold or CHF/JPY

- Reduce leverage and size due to increased volatility

📊 Scenario Matrix Overview

| Scenario | USD/JPY Bias | Volatility | Positioning Strategy |

|---|---|---|---|

| Tariffs implemented | Bearish | High | Short USD/JPY, Long JPY crosses |

| Tariff delay or exemption | Bullish | Medium | Buy dips, fade JPY strength |

| Escalated trade war | Strongly bearish | Very high | Safe-haven rotation, reduce risk |

🧠 Pro Tip:

Avoid binary bets. Instead, use a probabilistic framework and scale into trades around key event windows like April 2.

🔮 Outlook: Policy, Volatility, and JPY Strength

As markets digest the implications of Trump’s proposed auto tariffs, traders are left to assess not only the immediate fallout—but also the medium-term trajectory of USD/JPY under a second Trump administration.

🏛️ Policy Uncertainty is Back as a Macro Driver

Trump’s return has reintroduced a geopolitical and trade policy premium into currency markets. Unlike central bank forward guidance, political decisions can be sudden, opaque, and high-impact.

Key implications:

- Market pricing of Japan–U.S. policy divergence becomes more fragile.

- Trump’s unpredictable rhetoric can override traditional FX models, especially in risk-off environments.

- Expect FX volatility to remain elevated heading into further policy announcements.

💹 USD/JPY Faces Crosscurrents of Risk Sentiment vs. Rate Differentials

- In the short term, safe-haven demand favors JPY, especially if equities remain volatile.

- However, Japan’s economic hit from tariffs could weigh on the yen later, especially if the Bank of Japan takes a more dovish stance.

- USD remains supported by relative U.S. economic resilience, unless Treasury yields break lower.

The result? A whipsaw-prone USD/JPY, vulnerable to shifts in risk sentiment and bond markets.

📈 Volatility Is the New Baseline

- Implied volatility in USD/JPY options has risen, reflecting elevated event risk.

- Institutional positioning may remain cautious, reinforcing lower liquidity conditions and wider price swings.

- Watch for “volatility clusters” around:

- April 2 (tariff decision)

- Any updates from U.S. Trade Representative or Japanese government

- Equity market surprises

📊 USD/JPY Outlook Summary

| Factor | Bias | FX Impact |

|---|---|---|

| Trump tariff policy | Risk-off | Bullish for JPY |

| Japanese economic slowdown | Risk-on | Bearish for JPY |

| U.S.–Japan yield spread | Neutral to widening | USD support |

| Political uncertainty | High | JPY appreciation episodes likely |

🧠 Final Insight:

USD/JPY is no longer a pure play on interest rates.

It has become a macro-political pair, sensitive to headlines, positioning, and geopolitical risk.

Adaptability—not prediction—is the edge.

✅ Conclusion: Prepare for April 2 and Beyond

The FX landscape has shifted. With Trump’s tariff threat targeting Japan’s most vital export sector, USD/JPY is no longer trading on rate differentials or inflation data alone—it’s reacting to headlines, market sentiment, and political maneuvering.

📌 Key Points to Remember:

- April 2 is shaping up to be a high-impact event day. Expect heightened volatility in the lead-up and immediate aftermath.

- Japan’s economy is vulnerable to prolonged tariff enforcement, which may create safe-haven demand for JPY in the short run, but could weaken the yen longer-term if recession fears mount.

- USD/JPY will remain in the crossfire between risk-off flows favoring JPY and yield support favoring USD.

- Social sentiment is reflecting widespread anxiety and policy distrust, further amplifying uncertainty.

🎯 What Should FX Traders Do?

- Don’t trade the headline—trade the market’s reaction to the headline.

- Build flexibility into your strategy using scenario-based planning, dynamic risk management, and technical confirmation.

- Focus on intermarket signals: equities, bonds, volatility, and real-time sentiment.

- Be selective with timing—avoid overtrading around policy announcements.

🧭 Final Thought:

The Trump 2.0 era could reshape not only U.S. trade policy but also the behavior of core FX pairs like USD/JPY.

April 2 may be the start—not the end—of a broader currency volatility cycle.

Stay informed, stay nimble, and trade with discipline.