Introduction: Why the Swiss Franc Still Matters in 2025

In a world where inflation has eroded confidence in once-stable currencies and geopolitical flashpoints shake markets without warning, the Swiss Franc (CHF) has retained its image as a quiet, resilient force. More than just a “safe haven,” the Swiss Franc has evolved into a currency that reflects deep-rooted economic discipline, geopolitical neutrality, and central bank agility.

As we enter 2025, investors, traders, and even international travelers are once again turning their attention to the Swiss Franc—not only for protection, but also for strategic opportunity.

This guide will explore:

- The fundamentals of the Swiss Franc, including its history and structural traits.

- Interest rate trends and monetary policy developments by the Swiss National Bank (SNB).

- The CHF’s positioning compared to the JPY, USD, and EUR.

- Key takeaways from events like the 2015 “Swiss Shock.”

- Practical insights for FX trading and currency exchange in 2025.

Whether you’re managing capital in volatile conditions, building a diversified portfolio, or planning a Swiss Alps vacation, understanding CHF in 2025 is more relevant than ever.

- 💱 Chapter 1: What Is the Swiss Franc?

- 🇨🇭 Chapter 2: Swiss Interest Rates and the SNB’s Policy Shift Since the End of Negative Rates

- 🛡️ Chapter 3: Why the Swiss Franc Is a True Safe Haven

- ⚖️ Chapter 4: CHF vs JPY, USD, and EUR: Strengths and Structural Differences

- 📉 Chapter 5: The 2015 Swiss Franc Shock – A Flashpoint in FX History

- 💳 Chapter 6: Exchange and Conversion Essentials for Travelers and Investors

- 🏛️ Chapter 7: What Supports the Swiss Franc’s Credibility?

- 📈 Chapter 8: Trading Strategies for CHF in Today’s Market

- 🔎 Chapter 9: Reflections and Takeaways

💱 Chapter 1: What Is the Swiss Franc?

Code, Symbols, History, and Unique Traits

The Swiss Franc (CHF) is one of the most respected and stable currencies in the global financial system. It is often referred to as a “safe haven currency,” standing alongside the Japanese Yen and the US Dollar. However, the Swiss Franc has its own unique geopolitical, historical, and economic underpinnings that distinguish it in international markets.

🔢 ISO Code and Symbols

- ISO Code: CHF

- Symbol: Fr. (used domestically), SFr., or simply CHF in trading platforms

- Subunit: 1 Swiss Franc = 100 Rappen (in German), centimes (in French), centesimi (in Italian)

💶 Coins and Banknotes

Switzerland issues the following:

- Coins: 5, 10, 20, 50 Rappen; 1, 2, and 5 Francs

- Banknotes: 10, 20, 50, 100, 200, and 1000 Francs

The Swiss National Bank (SNB) ensures high-quality security features and multilingual designs representing Switzerland’s cultural diversity.

📜 Historical Origins

The Swiss Franc was introduced in 1850, replacing over 800 regional currencies. It was initially pegged to silver and later to gold under the Latin Monetary Union. Since the Bretton Woods collapse in 1971, the CHF has floated freely, gaining strength due to Switzerland’s:

- Political neutrality

- Strong financial infrastructure

- Low inflation track record

🇨🇭 The Swiss Franc as a Symbol of Stability

What makes CHF distinct isn’t just its low volatility or tight spreads — it’s the political and financial model of Switzerland. As a neutral country, Switzerland rarely participates in conflicts or aggressive fiscal expansions. This has led to:

- Conservative monetary policy

- High levels of trust from global investors

- Persistent current account surpluses

🔍 Trader’s Perspective

In the FX market, CHF is often traded against:

- USD (USD/CHF)

- EUR (EUR/CHF)

- JPY (CHF/JPY)

- GBP (GBP/CHF)

CHF pairs are known for lower liquidity than majors but attract investors during risk-off phases due to safe-haven flows.

✅ This chapter sets the foundation. In the next section, we’ll explore how Switzerland’s interest rate strategy and monetary policy shape the behavior of the Swiss Franc in today’s volatile markets.

🇨🇭 Chapter 2: Swiss Interest Rates and the SNB’s Policy Shift Since the End of Negative Rates

🏛 The End of a Historic Era: Switzerland Exits Negative Rates

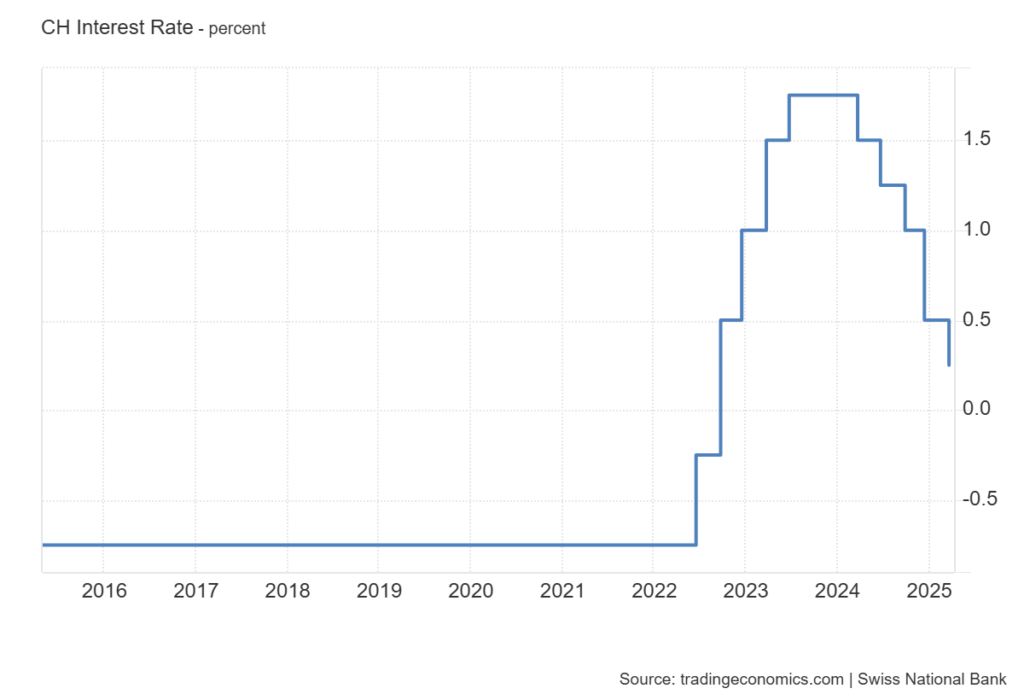

In September 2022, the Swiss National Bank (SNB) shocked markets by ending nearly eight years of negative interest rates, raising its policy rate to 0.50%. This marked a decisive shift in Swiss monetary policy, aligning it closer to global normalization trends. By 2024, the SNB had gradually lifted rates to 1.75%, reflecting rising inflationary pressures and a new era in Swiss monetary governance.

📈 The Current Rate Landscape (2025)

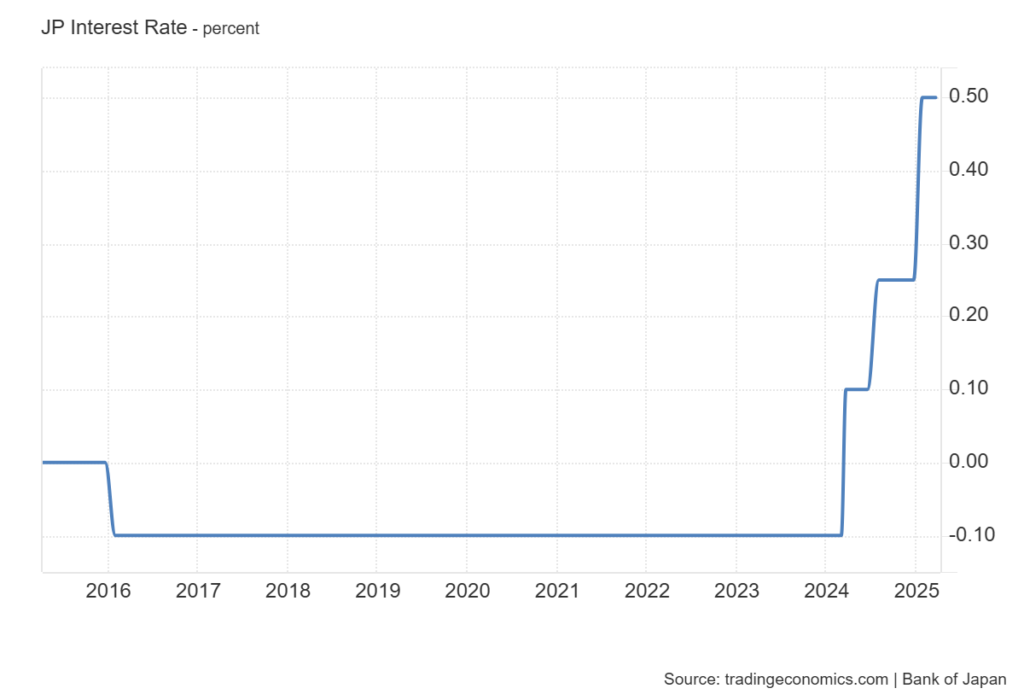

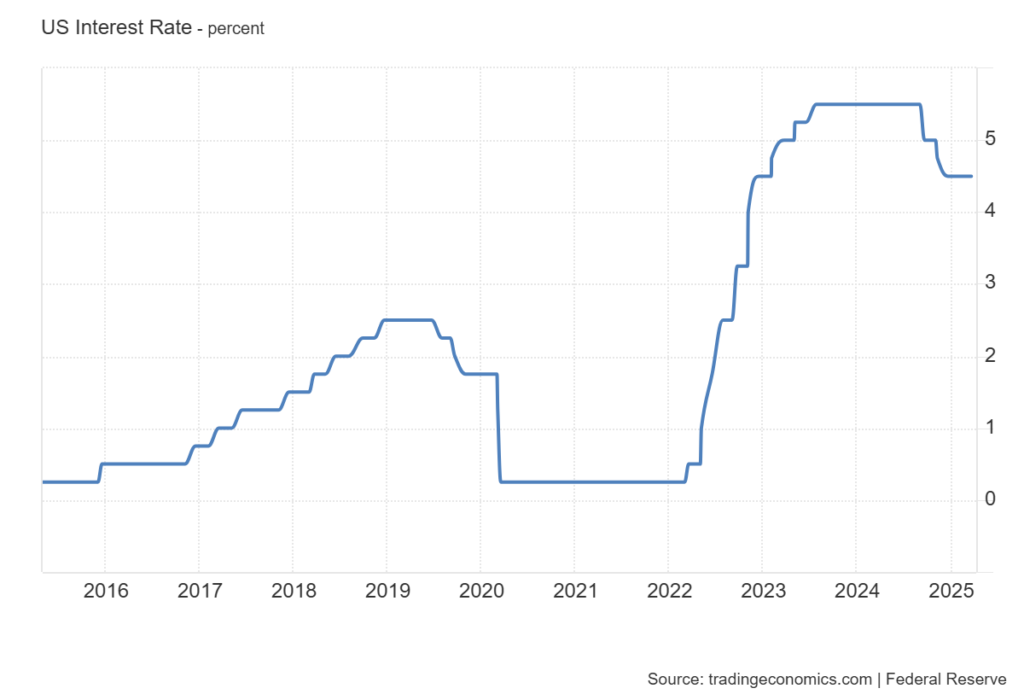

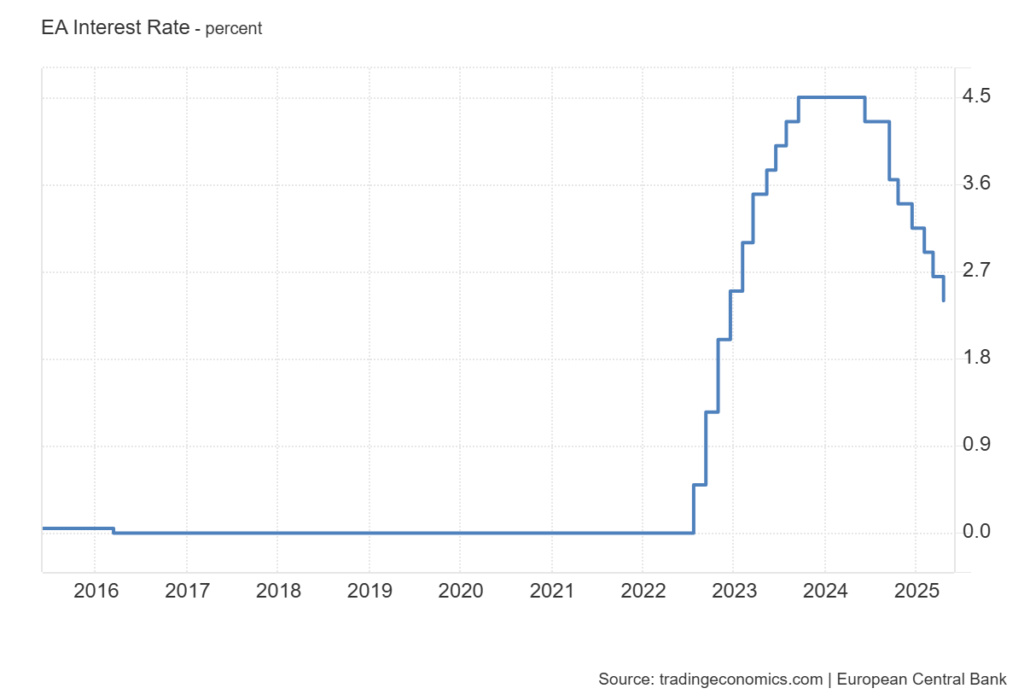

As of April 2025, Switzerland’s policy rate stands at 1.75%, well below the U.S. Fed’s 4.75% but significantly higher than Japan’s still-modest 0.10%. Though the SNB remains cautious, the bank has shown readiness to act swiftly if inflation deviates from its targeted path of “below but close to 2%.”

| Country | Policy Rate (Apr 2025) | Inflation (2023) |

|---|---|---|

| Switzerland 🇨🇭 | 1.75% | 2.14% |

| United States 🇺🇸 | 4.75% | 4.12% |

| Japan 🇯🇵 | 0.10% | 3.27% |

| Euro Area 🇪🇺 | 3.50% | 5.42% (avg est.) |

🧠 SNB’s Strategy: Precision Over Aggression

The SNB’s monetary strategy is guided by three key principles:

- Definition of Price Stability: Inflation below 2% per year.

- Conditional Forecasting: Forward-looking, 3-year inflation projections based on a constant policy rate.

- Market-Based Flexibility: The SNB uses both interest rate tools and FX interventions if necessary, ensuring adaptability.

🔍 Why This Matters for FX Traders

Unlike the Fed or ECB, the SNB doesn’t rely heavily on forward guidance. This unpredictability can create unexpected volatility in CHF pairs—especially during monetary policy assessments or geopolitical tensions. In such times, CHF often acts as a magnet for safe-haven flows, regardless of its interest rate disadvantage.

📊 Long-Term Implications

The return to positive rates strengthens the Swiss Franc’s appeal in the global carry trade landscape. However, due to its low inflation and safe-haven nature, CHF remains a currency that benefits from risk aversion more than yield-seeking—a rare combination in today’s FX markets.

🔚Further Reading

– Swiss National Bank – Press Release (20 March 2025)

– Swiss National Bank – Introductory Remarks (20 March 2025)

🛡️ Chapter 3: Why the Swiss Franc Is a True Safe Haven

The Swiss Franc (CHF) has long been considered a pillar of stability in the world of currencies. While other so-called “safe haven” currencies like the Japanese Yen or U.S. Dollar have their own strengths, the CHF stands apart in three key ways: its geopolitical neutrality, fiscal discipline, and transparent monetary policy. Let’s explore why investors around the world continue to trust the Swiss Franc when uncertainty strikes.

🕊️ Geopolitical Neutrality and Historical Stability

Switzerland’s tradition of neutrality dates back to the 16th century and was officially recognized in 1815 at the Congress of Vienna. As a result, the country has consistently avoided involvement in global conflicts. This neutrality provides the foundation for a stable domestic environment, free from the political volatility that often undermines other currencies.

Geneva’s status as a host to numerous international organizations, including the UN and Red Cross, reinforces Switzerland’s global image as a mediator and humanitarian leader. For investors, this means confidence in a country unlikely to be directly affected by military conflict or sanctions.

📈 Current Account Surpluses and Fiscal Prudence

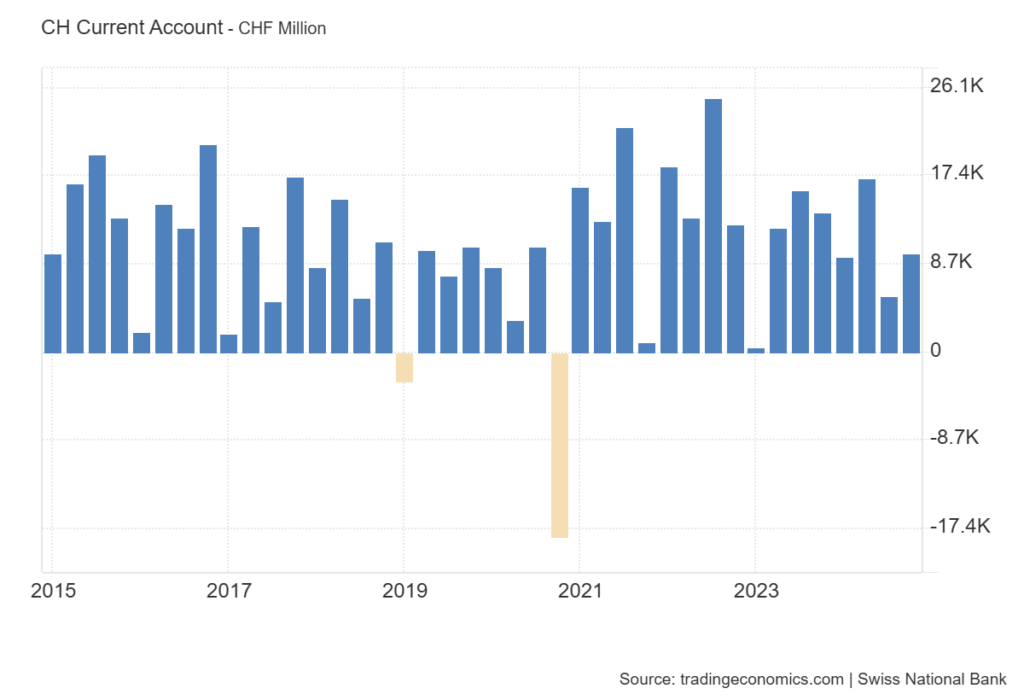

One of the defining features of Switzerland’s economic policy is its long-standing current account surplus. Unlike many developed nations, Switzerland consistently exports more than it imports, supporting demand for the CHF and reinforcing trust in the country’s financial stability.

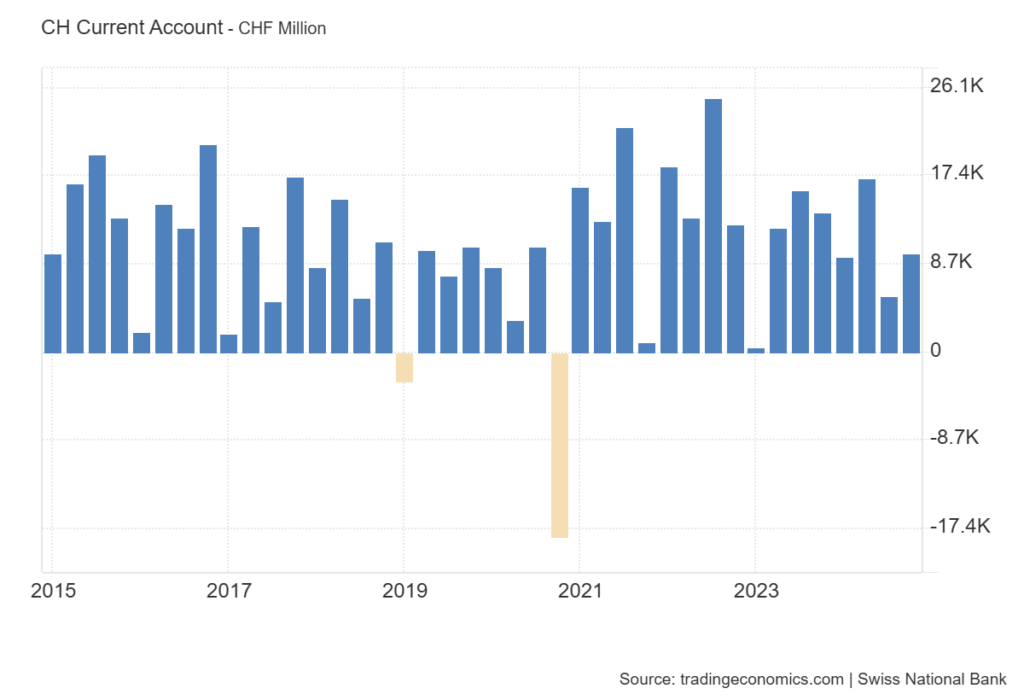

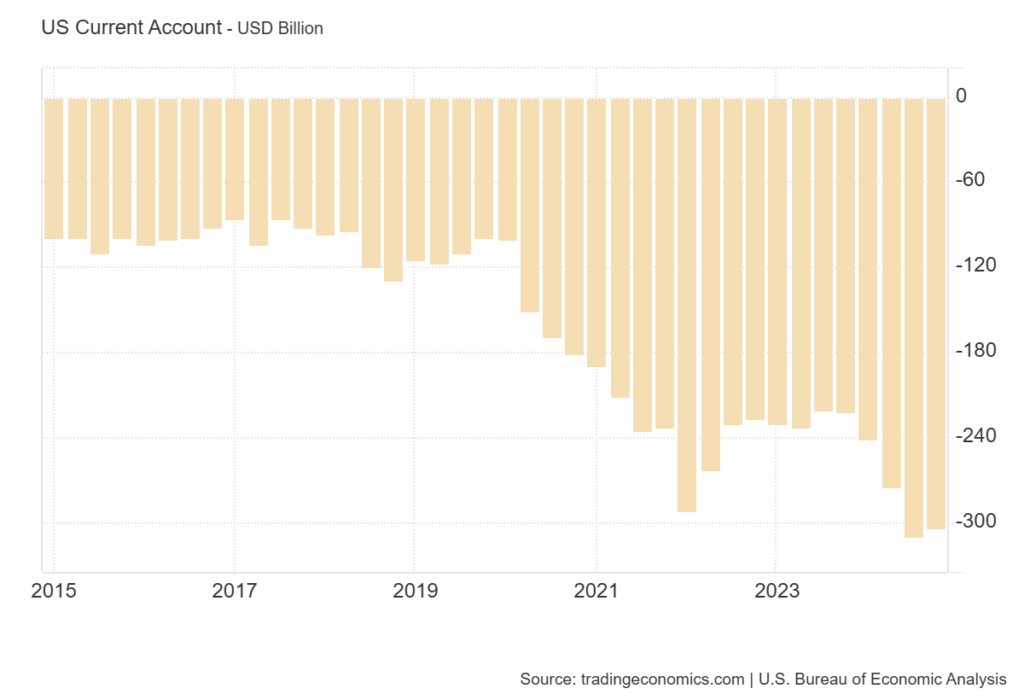

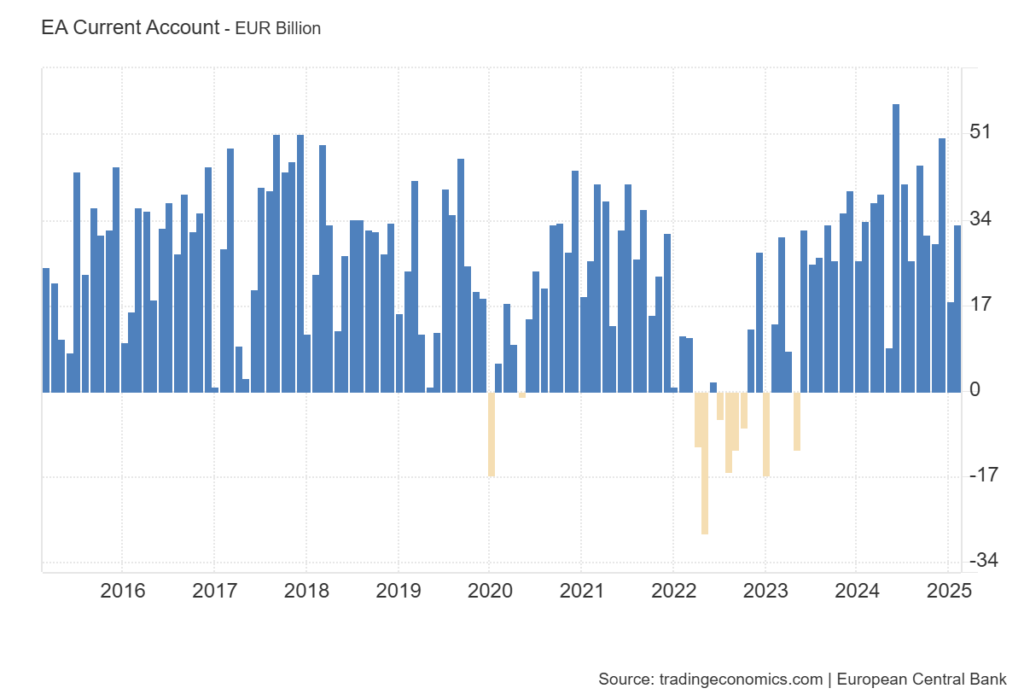

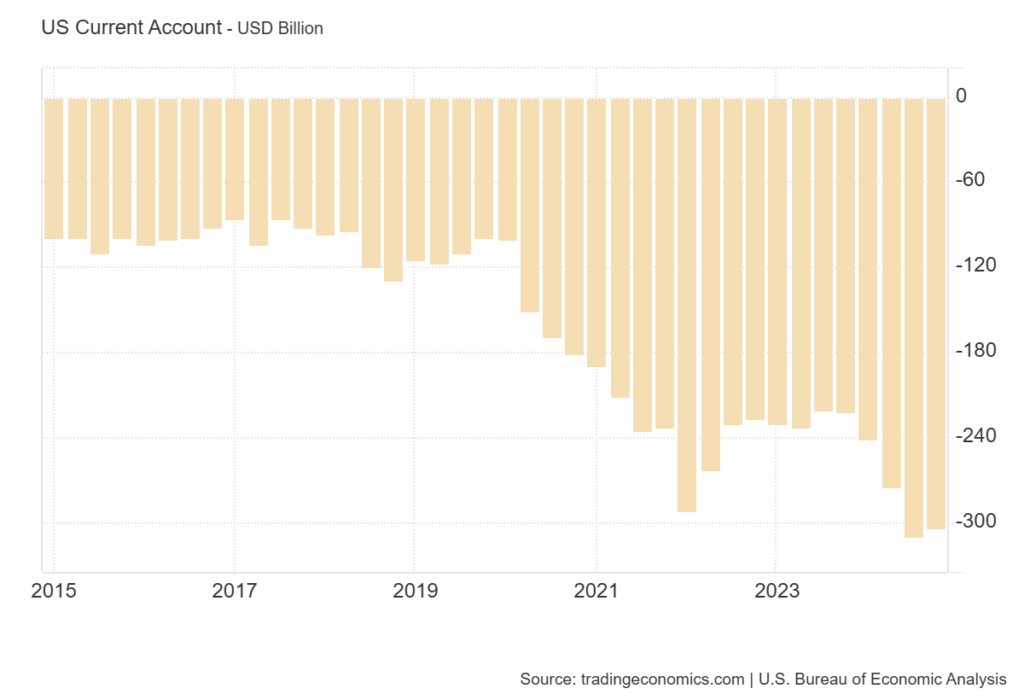

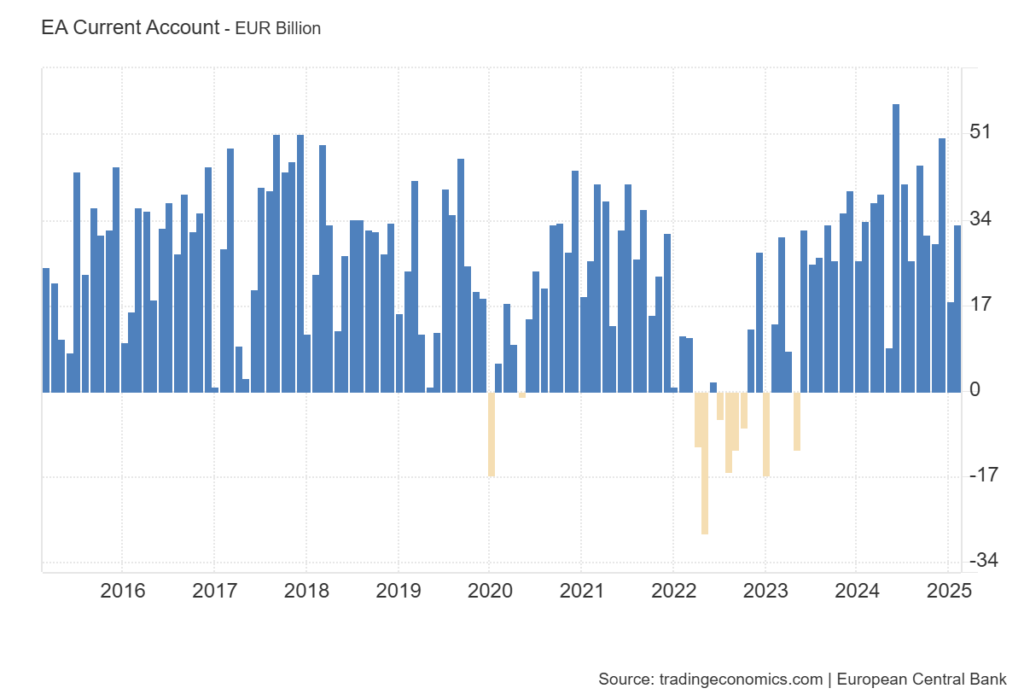

Across the last decade (2014–2024), Switzerland has maintained a positive current account, in sharp contrast to deficits seen in countries like the U.S. and, more recently, Japan. This surplus not only reflects robust export performance but also prudent domestic consumption and savings behavior. It’s an anchor for currency strength during market turmoil.

As the chart below illustrates, Switzerland has maintained a current account surplus consistently over the past decade, underscoring its robust trade balance and capital discipline.

🔍 How Switzerland’s Surplus Compares to Major Economies

Compared to Japan, the U.S., and the Euro Area, Switzerland stands out as a structurally surplus-driven economy. See the visual comparison below.

🧭 Transparent and Cautious Monetary Policy

The Swiss National Bank (SNB) has cultivated a reputation for transparency and long-term focus. Since exiting its negative interest rate regime in 2022, the SNB has adopted a more balanced and preemptive stance. Their policy rate decisions are based on a conditional three-year inflation forecast—emphasizing forward-looking, rather than reactive, responses.

Unlike some central banks that are prone to political influence or abrupt policy shifts, the SNB’s independence and predictability have enhanced investor confidence in the CHF. The SNB communicates clearly, and adjustments are made gradually, preserving market stability.

🔎 Summary: Why CHF Is Trusted When It Matters Most

| Attribute | CHF | JPY | USD |

|---|---|---|---|

| Neutrality | ✅ Recognized since 1815 | ❌ U.S. ally | ❌ Global hegemon |

| Fiscal Stability | ✅ Current account surplus | ❌ Rising deficits | ❌ Persistent deficits |

| Central Bank Independence | ✅ Transparent, forward-looking | △ Reactive tendencies | △ Politically sensitive |

In essence, the Swiss Franc isn’t just a safe haven by reputation—it is structurally designed to weather storms. Its geopolitical stance, economic surplus, and prudent monetary governance create a trifecta of trust. For traders, investors, and multinational corporations, CHF often becomes the currency of choice during times of volatility.

◆

⚖️ Chapter 4: CHF vs JPY, USD, and EUR: Strengths and Structural Differences

How the Swiss Franc compares with other major currencies in resilience, policy responsiveness, and long-term credibility

🧭 Overview

In this chapter, we’ll compare the Swiss Franc (CHF) to three global heavyweight currencies: the Japanese Yen (JPY), US Dollar (USD), and Euro (EUR). All are viewed as “safe” to varying degrees—but their underlying structures, fiscal backbones, and central bank strategies differ significantly. Let’s explore these distinctions.

📊 Safe-Haven Trust: Comparative Traits Table

| Currency | Safe-Haven Trust | Monetary Flexibility | Policy Speed | Fiscal Health | Commentary |

|---|---|---|---|---|---|

| 🇨🇭 CHF | ◎ Very high | ◎ Flexible, quick response | ◎ SNB communicates clearly | ◎ Strong surplus | Geopolitical neutrality + monetary consistency |

| 🇯🇵 JPY | ○ Still trusted, but eroding | △ Delayed response | △ Cautious policy shifts | △ Structural deficits | Seen as outdated safe haven |

| 🇺🇸 USD | ◎ Global reserve | ◎ Aggressive tightening | ◎ Fed is market-forward | ○ Debt concerns exist | Dollar remains dominant, but politically exposed |

| 🇪🇺 EUR | ○ Stable but regionally fragmented | ○ Reasonably responsive | ○ ECB improved post-Draghi | ○ Surplus varies | EU complexity adds uncertainty |

📉 Case Study: Market Behavior During the Ukraine Crisis (Feb 2022)

We observed the following monthly outcomes:

| Pair | Open | Close | Change | Observation |

|---|---|---|---|---|

| CHF/JPY | 123.98 | 125.37 | +1.1% | Golden cross formation, trend strengthening |

| USD/CHF | 0.9268 | 0.9167 | -1.1% | Mixed trends, unclear direction |

| EUR/CHF | 1.0403 | 1.0281 | -1.17% | Mid-term downtrend maintained |

📌 Takeaway: CHF strength during crises isn’t just a reaction—it’s a pattern rooted in long-term trust and consistent fundamentals.

📈 Structural Insights: Inflation & Policy Response (2015–2025)

| Metric | 🇯🇵 Japan | 🇨🇭 Switzerland | 🇺🇸 U.S. |

|---|---|---|---|

| Avg. Inflation | ~0.8% | ~0.5% | 2.5–3.0% |

| Peak (recent) | 3.3% (2023) | 2.8% (2022) | 8.0% (2022) |

| Policy Action | Late reaction | Swift, proactive | Strong and early |

📊 Interest Rate Trends: 10-Year Government Bonds (2015–2025)

📌 Takeaway: Despite similar low inflation levels, Switzerland’s proactive stance made a crucial difference. Trust isn’t only about numbers—it’s about how you react to them.

📈 Long-Term FX Trends (2020–2025)

| Currency Pair | 2020 Avg | 2025 (Current) | CHF Movement |

|---|---|---|---|

| CHF/JPY | ~112 | ~174 | +55% (CHF gained) |

| USD/CHF | ~0.98 | ~0.80 | -18% (CHF gained) |

| EUR/CHF | ~1.10 | ~0.92 | -16% (CHF gained) |

📌 Insight: The CHF’s appreciation isn’t episodic. It reflects an underlying structural robustness.

🧠 Summary: What Sets the Swiss Franc Apart?

- Policy integrity over political posturing

- Financial surplus where others show deficits

- Central bank clarity instead of opacity

- Neutrality as a geopolitical shield

- Long-term strength, not just momentary safety

In the next chapter, we explore one of the most dramatic events in CHF history: the Swiss Franc Shock of 2015—a financial quake that reshaped the currency landscape forever.

📉 Chapter 5: The 2015 Swiss Franc Shock – A Flashpoint in FX History

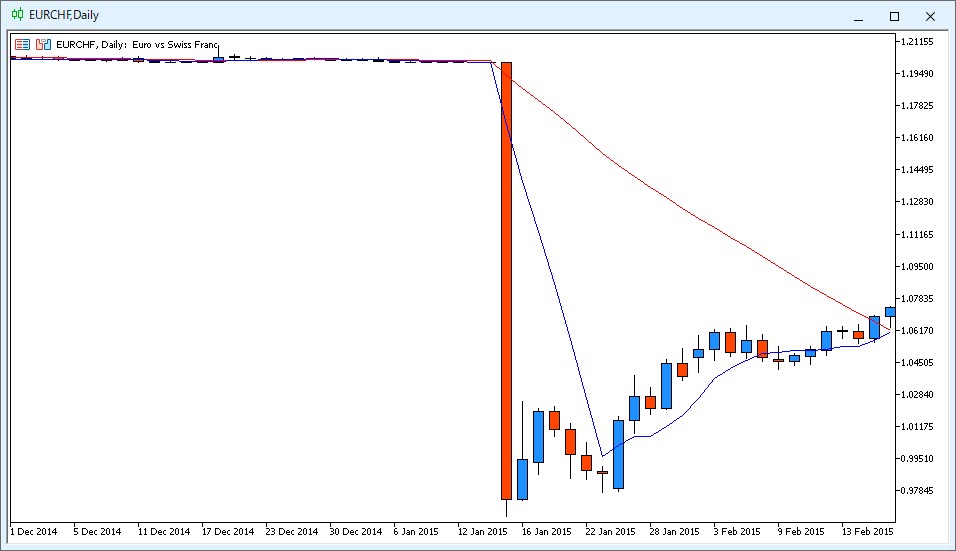

On January 15, 2015, the Swiss National Bank (SNB) shocked global markets by abruptly abandoning the EUR/CHF 1.20 floor, a long-standing currency cap. The result was one of the most violent FX moves in modern history.

⏱️ What Happened?

Without prior warning, the SNB announced it would no longer defend the 1.20 EUR/CHF peg. Within minutes, EUR/CHF plummeted from around 1.20 to below 0.96, a drop of approximately 2,400 pips. This move was accompanied by:

- USD/CHF falling from ~1.02 to ~0.82 (a 2,000+ pip drop)

- CHF/JPY surging from ~115 to over ~138(a 2,300-pip rally)

- Global shock and liquidity evaporation, with many platforms halting CHF trading

📊 The drop was so extreme that it resembled a “market black hole” — stop-loss orders failed, spreads exploded, and price discovery momentarily vanished.

💥 Fallout Across the Industry

The shock led to unprecedented casualties in the FX industry:

- Alpari UK filed for bankruptcy within 24 hours.

- FXCM required a $300 million bailout from Leucadia.

- Multiple brokers, including Global Brokers NZ and others in Japan and Europe, suffered unrecoverable client losses.

- Some retail traders lost millions in minutes due to negative balances and margin calls.

📉 One infamous trader reportedly saw a ¥92 million negative balance, leading to personal bankruptcy.

🧠 Why Did This Happen?

Leading up to the event:

- EUR/CHF had been trending lower since 2013, with clear technical signs of long-term weakness (weekly chart showed a death cross in late 2013).

- Many traders saw the 1.20 floor as a “guaranteed bottom,” creating a crowded long trade.

- The SNB had publicly reiterated support for the peg just days earlier — misleading many into thinking it was safe.

The move thus exploited market overconfidence, making the damage even more devastating.

🗣️ Voices from the Ground

Online forums, social media, and chatrooms exploded with reactions:

- “I lost 42 million yen and my marriage the same day.”

- “4000万円利確して引退します…ありがとうフラン”

- “Saxo Bank recalculated my trade… I now owe them 2.4 million yen”

Some dubbed it “Black Thursday” for the FX world.

🔎 Lessons for Traders

The Swiss Franc Shock serves as a sobering reminder of:

- The dangers of assuming central bank “guarantees” are unbreakable.

- The need for risk management, especially with high leverage.

- Why liquidity events can create fatal slippage, even for professional setups.

It is now widely cited in trading literature, risk management handbooks, and broker compliance manuals.

📘 Historical Documentation

For those who want to explore more:

- SNB Official Press Release – Jan 15, 2015

- Reuters, Bloomberg, and CNBC all published emergency coverage of the shock.

- Archived posts and summaries from forums such as 2ch, X (formerly Twitter), and trader blogs documented firsthand panic and triumph.

🔁 What’s Next?

The CHF’s response in 2015 shaped its perception as a currency capable of devastating volatility—yet also reinforced its reputation as a safe haven in a world of uncertainty.

➡️ In the next chapter, we turn from past shocks to practical insights, exploring how to exchange, convert, and use the Swiss Franc effectively as a traveler or investor in 2025.

💳 Chapter 6: Exchange and Conversion Essentials for Travelers and Investors

Whether you’re planning a scenic trip through the Swiss Alps or allocating capital into a safe-haven currency, understanding how to exchange Swiss Francs (CHF) efficiently is essential. This chapter explores practical strategies for converting currencies, minimizing fees, and navigating real-world scenarios, both for tourists and international investors.

💱 Exchange Methods Compared

| Method | Cost Efficiency | Convenience | Best For |

|---|---|---|---|

| Airport Exchange | ❌ High Fees | ✅ Easy | Emergency last-minute cases |

| Bank Exchange (Japan) | ❌ Limited availability of coins | ✅ Trustworthy | Travelers preferring security |

| Credit Card Payments | ✅ Very Low Fees | ✅ Widely accepted | Everyday purchases in Switzerland |

| Debit Card Withdrawals | ✅ Efficient, but ATM fees vary | ✅ Flexible | Cash needs at destination |

| FX Apps (e.g. Wise) | ✅ Competitive rates | ✅ Online access | Real-time conversions, remittances |

| Local ATM Cash Advance | ✅ Best rates via Visa/Master | ✅ 24/7 Access | Both tourists and business travelers |

💡 Pro Tip: According to traveler feedback, cashless payments are widely accepted even for small purchases like bottled water. Carry minimal cash and rely on cards with low FX fees.

🏦 Should You Convert in Japan or in Switzerland?

- In Japan: Limited to notes only, coins may be unavailable. Exchange counters in major cities or at the airport offer Swiss Francs but with higher spreads.

- In Switzerland: ATMs provide better rates. Some Japanese banks like SMBC Trust offer multi-currency debit cards with zero FX fees.

- Pro Traveler Insight: It’s often better to withdraw small amounts of CHF at local ATMs using a foreign debit card than to convert large amounts at airport kiosks.

💹 Conversion Timing – Tools and Techniques

- Use Real-Time Apps: Tools like Wise Currency Converter allow you to monitor CHF/JPY or CHF/USD trends with line charts and toggle options.

- Check FX Spreads: Understand the difference between mid-market rate and what you actually receive.

- Monitor Market Volatility: As seen in earlier chapters, CHF can spike during geopolitical unrest. Traders may want to hedge timing or use forward contracts.

📷 Chart-Based Scenario (Submitted CHF/JPY Monthly Chart)

As of April 23, 2025, CHF/JPY sits around 172.45, having surged from 169.449 (open) to a high of 176.458 this month. If the monthly close breaks above 178.899, we could see continued CHF strength. This has implications not only for investors but also for tourists converting back to JPY—a stronger CHF means more yen upon return.

🔄 Real-World Traveler Tip

“Don’t stress over finding Swiss Franc coins in Japan. Just carry a reliable debit or credit card with global support. Most places in Switzerland—even vending machines—accept cards.”

🧳 Bottom Line

- Tourists should rely primarily on cards and withdraw CHF locally only when necessary.

- Investors must understand FX spreads and potential timing risks when converting large sums.

- Both groups benefit from using reliable apps and monitoring CHF trends to make smarter currency decisions.

🏛️ Chapter 7: What Supports the Swiss Franc’s Credibility?

Neutrality, Surpluses, and Steady Policy

In the ever-shifting landscape of global finance, few currencies command the same level of long-term trust as the Swiss Franc (CHF). But what gives the CHF its enduring credibility? It’s not just history or perception—it’s the structural backbone of Switzerland’s geopolitical, fiscal, and monetary strategy.

🕊️ A Legacy of Political Neutrality

Switzerland’s long-standing neutrality is more than a historical artifact—it’s a policy choice that continues to shield it from the shocks of war, sanctions, and military alliances. Since the Congress of Vienna in 1815, neutrality has shaped Switzerland’s international role. This stance has allowed the country to act as a mediator in global conflicts, bolstering its image as a bastion of stability.

🇨🇭 “Neutrality isn’t just a stance—it’s Switzerland’s global brand.”

In times of geopolitical risk, investors seek not only economic safety but also political insulation. Switzerland offers both, and the CHF becomes a natural choice for capital preservation.

💰 Current Account Surpluses: Proof of Strength

A quick glance at Switzerland’s current account over the past decade shows a consistent surplus. This is a reflection of its strong export sector (pharmaceuticals, precision instruments, and financial services), prudent consumption, and income from foreign investments.

📈 Current Account Graph: Switzerland

Shows steady surpluses from 2015 to 2025, with no structural deficits.

By contrast, countries like Japan and the U.S. have experienced fluctuations or persistent deficits in their current accounts—weakening their currencies during economic uncertainty. A surplus signals self-reliance and stability, making the CHF a magnet for long-term capital.

🏦 SNB’s Consistent, Forward-Looking Monetary Policy

The Swiss National Bank (SNB) runs a tight ship. Its definition of price stability—keeping inflation below 2%—is clear and consistent. But what sets the SNB apart is its use of forward-looking conditional inflation forecasts and its transparency in communications.

Unlike central banks that resort to unpredictable moves, the SNB’s credibility comes from predictability. Its decision to end the negative interest rate regime in 2022, for example, was gradual, well-communicated, and rooted in macroeconomic logic.

“Consistency is currency. And the SNB trades on that in full.”

🔍 The Combination Is Rare—and Powerful

Few countries can offer this trifecta:

- Political neutrality

- Strong external balance

- Monetary credibility

The Swiss Franc’s reputation isn’t merely earned—it’s structurally reinforced by these enduring pillars. In a world of rising uncertainty, CHF remains a clear choice for both investors and policymakers seeking shelter from volatility.

✅ Next Chapter Preview:

Now that we’ve covered the structural reasons behind the Franc’s credibility, we’ll move from theory to application—what trading strategies work best when dealing with a currency like CHF? Let’s dive into the FX battlefield in Chapter 8.

📈 Chapter 8: Trading Strategies for CHF in Today’s Market

Navigating the Swiss Franc with Confidence and Clarity

In this chapter, we translate macroeconomic insights and technical patterns into actionable trading strategies. With its history of resilience and policy transparency, the Swiss Franc (CHF) continues to be a compelling instrument for both short-term and long-term traders.

🧭 1. Key Market Themes Driving CHF Today

- Safe-Haven Flows: In times of geopolitical stress or financial turbulence, CHF attracts capital due to Switzerland’s neutrality and fiscal strength.

- Diverging Rate Policies: While the SNB has ended its negative rate regime, its pace of rate normalization is more cautious than the Fed or ECB, creating arbitrage and carry trade opportunities.

- EUR/CHF Decoupling: Since the 2015 floor removal, the CHF has increasingly moved independently from the euro, offering unique volatility windows.

🕵️♂️ 2. Technical Setup #1 – CHF/JPY: Watching for Trend Reversals

- Chart: Weekly chart (Jan 2024–Apr 2025) with 13-week and 52-week moving averages.

- Current Observation: Despite a long uptrend, a potential trend reversal looms as a bearish crossover forms. However, the price still remains above both MAs, indicating conflicting signals.

- Strategy:

- Cautious swing traders may look to short below 172.00 if confirmed by MACD divergence or bearish candlestick patterns.

- Longer-term holders should monitor 178.899 (2024 June close) as a breakout level. Above this, new highs could be in play.

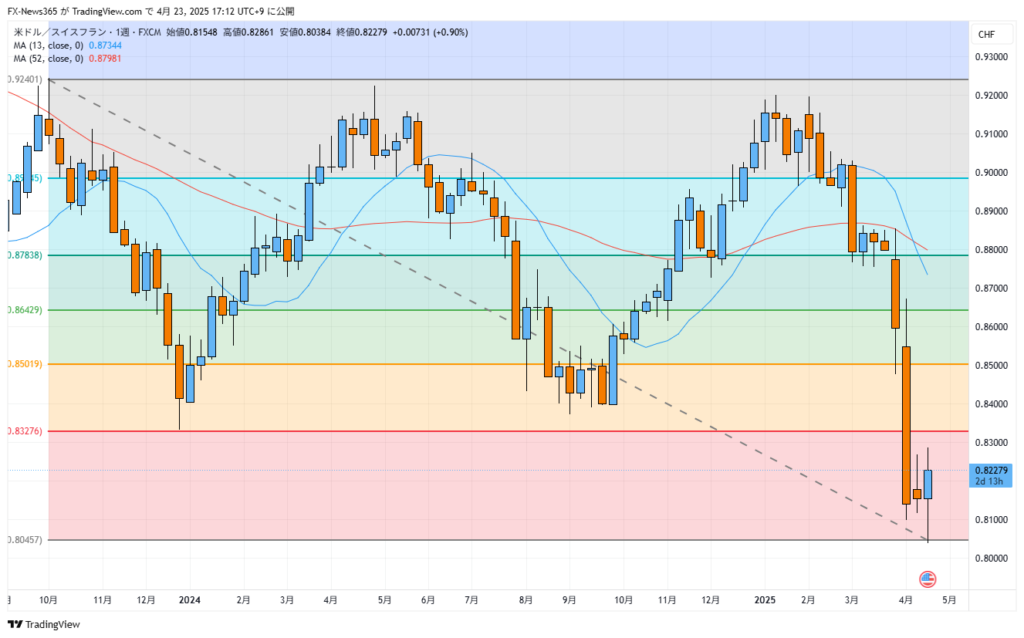

💥 3. Technical Setup #2 – USD/CHF: Major Breakdown in Play

- Chart: Weekly chart (Jan 2024–Apr 2025).

- Key Event: The major psychological support at 0.84000 was clearly breached on the weekly candle of April 7, 2025.

- Implication: Suggests continuation of CHF strength.

- Strategy:

- Breakout traders may short retracements back to 0.84000 with stops above 0.85000.

- Fibonacci analysts may explore extensions from the 2023 high to assess downside targets.

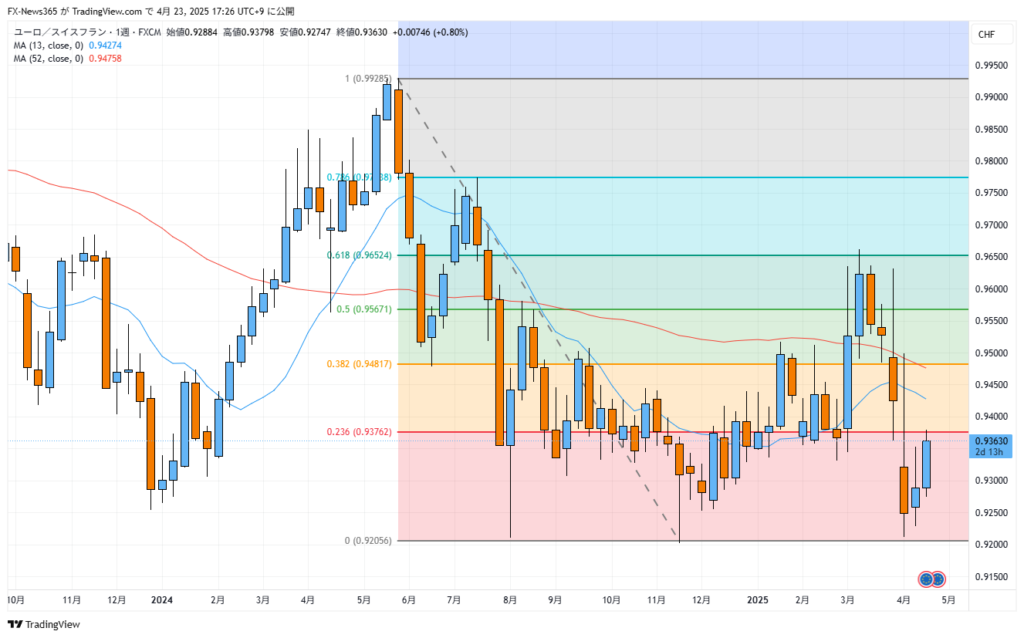

📉 4. Technical Setup #3 – EUR/CHF: Professional Gap Signals a Shift

- Chart: Weekly chart (Jan 2024–Apr 2025).

- Unusual Move: The candle between March 31 and April 7, 2025, shows a gap down from ~0.94300 to ~0.93100 (~120 pips), likely triggered by institutional orders.

- Trend Structure: A confirmed death cross, with 13W MA sharply sloping downward.

- Strategy:

- Gap traders may treat the breakdown zone as resistance, targeting 0.91000 or lower.

- Trend followers may ride the move with trailing stops.

🔄 5. When Fundamentals and Technicals Align

- SNB Communication Policy: Quarterly updates and inflation forecasts provide excellent forward guidance.

- Macro Backdrop: A current account surplus and consistent inflation control enhance CHF’s credibility.

- Tip: Align directional trades with upcoming SNB policy meetings or global risk events.

✅ Key Takeaways

- CHF pairs offer distinct trading personalities. CHF/JPY shows historical strength, USD/CHF presents breakdown opportunities, and EUR/CHF offers volatility for event-driven strategies.

- Always confirm technical setups with macro trends and SNB communications.

- In a market increasingly shaped by monetary divergence, CHF can serve as both a hedge and a momentum vehicle.

🔎 Next up: Chapter 9 — Where we distill the core lessons and offer reflections tailored to both travelers and investors navigating a world in flux.

🔎 Chapter 9: Reflections and Takeaways

What the Swiss Franc Teaches Us in a World in Flux

In an era where financial headlines are dominated by volatility, political instability, and inflationary cycles, the Swiss Franc (CHF) stands as a rare beacon of continuity. But its value is not just in its performance—it lies in the lessons it offers to both investors and travelers alike.

📌 For Investors: Stability Is a Strategy

In FX markets driven by momentum and speculation, CHF reminds us of the power of structure, discipline, and neutrality.

- Non-alignment as a policy advantage: Switzerland’s military neutrality and political independence contribute to consistent investor confidence, especially during crises.

- Inflation discipline + policy transparency = trust: With low, stable inflation and a clearly articulated monetary policy strategy, the SNB avoids the “surprise rate shock” that can destabilize markets.

- Not flashy, but effective: CHF may not offer the yield of emerging market currencies, but it provides something rarer—durability across decades.

Takeaway: The Swiss Franc isn’t just a currency. It’s a case study in how geopolitical positioning, consistent trade surpluses, and institutional credibility can translate into real-world capital flows.

✈️ For Travelers: Trust Over Trend

- Usefulness abroad: From Geneva to Zermatt, CHF’s real-world utility is backed by robust infrastructure, high service acceptance, and transparency.

- Converting with confidence: Knowing when to convert is key. But with tools like live rate trackers (e.g. Wise) and a firm understanding of trends, you don’t have to guess—you can act with clarity.

- Card-first, cash-last: CHF is a currency where credit cards and digital payment infrastructure thrive, but travelers should still carry a small amount of cash—especially in mountainous or rural regions.

🧠 For Everyone: Currency as a Cultural Artifact

The Swiss Franc isn’t just a financial instrument. It’s a reflection of Switzerland’s:

- Multilingual identity (depicted in banknote design),

- Sociopolitical structure (direct democracy, federalism),

- Commitment to discretion (e.g. banking laws, historical neutrality),

- and philosophy of long-term resilience.

🔚 Final Word

As you’ve journeyed through interest rate regimes, geopolitical undercurrents, chart patterns, and the echoes of the 2015 shock, one thing becomes clear:

💬 The value of a currency is never just its price—it’s the trust behind it.

In a time where the global system feels increasingly unstable, the Swiss Franc offers not just a hedge—but a compass.

🎯 Whether you’re hedging a portfolio or planning a Swiss rail adventure, understanding CHF is understanding the quiet power of credibility.

Let the Swiss Franc guide you—not because it shouts, but because it endures.