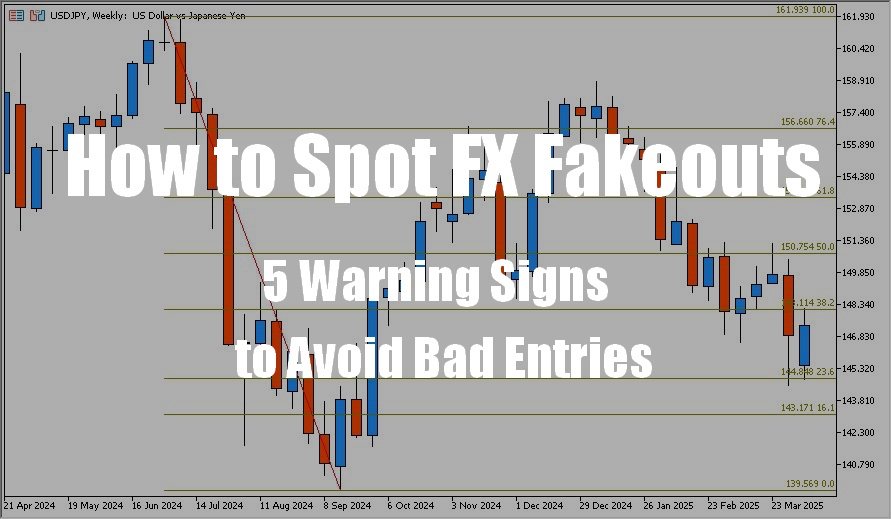

Ever entered a breakout trade, only to watch the price snap back and hit your stop-loss within minutes?

Welcome to the world of fakeouts—one of the most frustrating and costly traps in forex trading.

Fakeouts can shake your confidence, drain your capital, and make you question your strategy. But here’s the good news:

Most fakeouts follow recognizable patterns. And once you know what to look for, you can avoid being the one who gets trapped.

In this article, you’ll learn:

- What causes fakeouts and why they happen

- 5 specific warning signs to spot a fakeout before it’s too late

- Practical tips to avoid bad entries

- And how to actually profit from fakeouts by trading them in reverse

Let’s help you stop chasing bad breakouts—and start trading smarter.

✅ Key Summary (for top-of-article bullet list or search snippet)

- ⚠️ Fakeouts happen when a breakout looks real but quickly reverses

- 🔍 5 chart-based signs—like weak candles and low volume—can help you detect traps

- 🧠 Waiting for confirmation and using multiple timeframes is key

- 🔁 Some fakeouts can become profitable opportunities when traded in reverse

📘 What Is a Fakeout and Why Does It Happen?

In forex trading, a fakeout (short for “false breakout”) occurs when price breaks above resistance or below support—only to reverse quickly, trapping traders and triggering stop-losses.

At first glance, the move looks legitimate. The candle closes beyond a key level. Momentum seems to be building. You enter…

Then boom—price snaps back in the opposite direction, and your trade is stopped out.

🤔 Why Do Fakeouts Happen?

Fakeouts aren’t random. They often occur due to structural dynamics in the market:

1. Stop-Hunting by Institutions

Big players know where retail traders place their stop-losses—just outside recent highs or lows.

They push price just enough to trigger those stops and generate liquidity to fill their own larger orders.

This manipulation is common. It’s not illegal—it’s strategic.

2. Low-Liquidity Conditions

Fakeouts often happen:

- During Asian session hours (especially pre-Tokyo)

- Before major economic events

- On Friday afternoons or Monday opens

With fewer participants, price moves easier, and shallow breakouts are more likely to reverse.

3. Lack of Follow-Through

Sometimes, a breakout lacks real buying or selling power. It fails to attract volume or continuation, making the move unsustainable.

A breakout without conviction is often just noise—until the market shows its true hand.

🧠 Key Takeaway:

A fakeout isn’t a chart glitch—it’s how smart money creates traps.

Your job isn’t to avoid all traps—it’s to spot the setup before it triggers you.

🔍 5 Warning Signs of a Potential Fakeout

Fakeouts often come with subtle clues before they spring the trap.

By learning to spot these signs, you can reduce bad entries and stay on the right side of the trade.

Here are 5 common warning signs that a breakout might not be what it seems:

⚠️ 1. Weak Candle Structure After the Break

If the candle that breaks a key level:

- Has a small body,

- Leaves long wicks, or

- Closes as a doji or spinning top…

…it suggests hesitation, not momentum.

Strong breakouts usually come with large-bodied candles that show decisive intent.

✅ If the price breaks out but struggles to move after, stay skeptical.

📉 2. Low Volume Behind the Move

No volume = no conviction.

If a breakout occurs without an increase in volume, it may be a “fake” move meant to lure in traders without real backing.

Use tools like tick volume (MT4/MT5) or volume indicators (TradingView) to check participation.

🕒 3. Breakouts During Low-Activity Sessions

Many fakeouts happen when the market is “thin”—such as:

- Asian session (especially early Tokyo hours)

- Pre-London or pre-New York hours

- Late Friday or early Monday gaps

These times offer low liquidity, which means fewer orders are needed to push price briefly past key levels.

Be cautious of breakouts that occur when the market is asleep.

📏 4. Breakout Goes Against the Higher Timeframe Trend

Always zoom out.

If you’re trading a breakout on the 5-minute chart, but the 1-hour or 4-hour trend is pointing the other way, the move might be a pullback, not a breakout.

✅ Use multi-timeframe analysis to confirm alignment before trusting the breakout.

🎯 5. Obvious Stop-Loss Zones Get Triggered Then Reversed

If price breaks:

- Just above recent highs

- Just below recent lows

- Then quickly snaps back…

…it’s likely stop-hunting behavior—designed to clear weak hands and create liquidity.

When many traders see the same breakout level, smart money sees an opportunity to trap them.

🧠 Bottom Line:

The best trades don’t rush you—fakeouts do.

Learn to pause, observe, and wait for real confirmation before clicking “buy” or “sell.”

🛡️ 3 Practical Tips to Avoid Getting Faked Out

Spotting fakeouts is one thing—avoiding them in real-time is another.

Here are 3 practical habits that can help you stay safe and enter with confidence.

✅ Tip 1: Wait for the Candle to Close

Don’t chase a breakout based on a candle that’s still forming.

Markets love to fake moves during a candle’s life, only to reverse before it closes.

🔎 A breakout only becomes meaningful after the candle closes beyond the level.

This simple habit can help you:

- Avoid emotional entries

- Let the market “prove” itself

- Stay out of early traps

✅ Tip 2: Always Check the Higher Timeframe

Before you take a breakout trade on a lower timeframe (e.g. 5min, 15min), always ask:

❓“What is the 1H or 4H chart doing?”

If the higher timeframe trend contradicts your breakout, there’s a good chance you’re seeing a counter-trend fakeout.

✅ Confluence between timeframes strengthens breakout reliability.

✅ Tip 3: Use Volatility Indicators (Like ATR)

The Average True Range (ATR) is a great tool for gauging market “energy.”

- If ATR is low, breakouts may lack strength and be short-lived

- If ATR is rising, there’s enough momentum to support a breakout

You can also:

- Use ATR to size your stops more logically

- Stay out of “choppy zones” with low volatility

📌 Fakeouts often occur when volatility is compressed—learn to spot those traps.

🧠 Trader’s Mindset:

You don’t need to catch every move.

You just need to catch the ones that matter—and avoid the ones designed to catch you.

♟️ How to Use Fakeouts to Your Advantage

Most traders try to avoid fakeouts—but the more advanced you become, the more you’ll see:

Fakeouts aren’t just traps—they’re opportunities.

If you can identify when a breakout fails, you can often trade in the opposite direction with better odds.

Here’s how to turn fakeouts into powerful setups:

🔁 Strategy 1: The Failed Breakout Reversal

This is the classic “trap and reverse” setup.

How it works:

- Price breaks a key support/resistance level

- The breakout fails to hold, and price closes back inside the range

- A rejection candle (e.g., pin bar or engulfing bar) appears

- You enter in the opposite direction of the breakout

- Stop-loss goes just beyond the wick of the fakeout

✅ This works best when the failed breakout happens at a well-known level (like a daily high/low)

🔄 Strategy 2: Wait for the Retest—and Rejection

Sometimes, a fakeout will retest the broken level after reversing.

Entry plan:

- Let the breakout happen

- Let it fail

- Wait for price to come back and test the level again from the other side

- If it gets rejected—that’s your signal to enter

This adds confirmation and reduces emotional decision-making.

🎯 Bonus: Fakeouts Happen Where Most People Place Stops

That’s not a bug—it’s a feature.

- Everyone sees the same breakout

- Everyone puts their stops in the same place

- Institutions use that cluster of liquidity to fuel their own entries

By recognizing this, you can position yourself after the trap is sprung, not inside it.

🧠 Advanced Mindset:

Smart trading isn’t about predicting—it’s about responding.

Fakeouts are a test. Your job is to wait, observe, and act once the trap is obvious.

📘 Final Thoughts: Learn to Pause, Not Chase

Fakeouts are a fact of life in forex. They’re not rare mistakes—they’re how the market tests your discipline.

The difference between a rookie and a skilled trader isn’t who sees the breakout first.

It’s who waits… watches… and only acts when the trap has revealed itself.

🔑 Here’s what to remember:

- Not all breakouts are real—confirmation matters

- Price action speaks louder than indicators—but both together are powerful

- Fakeouts often follow predictable patterns—learn them, don’t fear them

- You don’t need to avoid every fakeout—you need to stop being caught by them

🧠 Final mindset shift:

Every time you hesitate to enter, that’s not weakness—it’s growth.

Great traders don’t chase—they wait for the market to make its move, then act with clarity.

Whether you’re trading breakouts or ranges, one truth remains:

The market rewards patience. Let others fall for the trap. You’ll be the one waiting to strike.