When geopolitical tensions flare or economic uncertainty rises, investors often flee riskier assets and rush to safe havens. This phenomenon is known as “risk-off”—a market sentiment shift that can dramatically impact currencies, commodities, and equities.

In this article, we break down the mechanics of risk-off sentiment from a forex trader’s perspective. You’ll learn why gold tends to rally, why the Japanese yen strengthens, and how to position your trades effectively when fear takes hold of the markets.

✅ Key Takeaways

- “Risk-off” describes a market environment where investors avoid risk and seek safety.

- Gold (XAU/USD) often rallies as a classic safe haven asset during risk-off conditions.

- The Japanese yen (JPY) tends to appreciate, driven by capital repatriation and its perceived safety.

- Risk-off sentiment can trigger sharp declines in equities and commodity currencies like AUD or ZAR.

- Understanding capital flows and investor psychology is critical for trading during market fear.

- 📖 Chapter 1: What Is “Risk-Off”? Definition and Core Concepts

- 📉 Chapter 2: How Markets React During Risk-Off Phases

- 🧠 Chapter 3: The Psychology and Capital Flows Behind Risk-Off

- 🕰️ Chapter 4: Case Studies – Major Risk-Off Events and Market Reactions

- 🎯 Chapter 5: How to Trade Risk-Off Sentiment in Forex Markets

- 🔁 Chapter 6: Risk-On vs. Risk-Off – Key Differences and How to Tell Them Apart

- 🧭 Conclusion: Mastering Risk-Off for Smarter FX Decisions

📖 Chapter 1: What Is “Risk-Off”? Definition and Core Concepts

In financial markets, the term “risk-off” refers to a shift in investor sentiment where participants reduce exposure to high-risk assets and move capital into perceived safe havens. It’s a psychological pivot from greed to caution, often triggered by geopolitical shocks, economic slowdowns, or sudden volatility.

🔍 In Plain Terms

Think of it this way:

“Risk-off” is the market equivalent of battening down the hatches during a storm.

Traders and investors collectively retreat from aggressive positions and seek assets that preserve capital over generating returns. This shift is not always rational or symmetrical—it’s emotionally driven and can happen rapidly across global markets.

🧭 What Typically Causes a Risk-Off Environment?

Common catalysts include:

- Escalating geopolitical tensions (e.g., military conflicts, sanctions)

- Unexpected economic data misses (like weak jobs reports or recession signals)

- Central bank policy uncertainty or aggressive tightening

- Financial contagion risks (e.g., bank failures or sovereign debt concerns)

These events inject uncertainty into the market, prompting investors to exit positions in stocks, high-yield bonds, and risk-sensitive currencies.

💡 Key Concept: Risk-Off vs. Risk-On

| Market Sentiment | Description | Common Asset Reaction |

|---|---|---|

| Risk-On | Optimistic mood; investors seek yield and return | Stocks ↑, Commodity currencies ↑, Gold ↓ |

| Risk-Off | Fear-driven; capital preservation becomes priority | Gold ↑, JPY ↑, CHF ↑, Equities ↓ |

The opposite of “risk-off” is “risk-on,” where risk appetite returns and capital flows back into higher-yielding, riskier assets.

💱 Safe Haven Flows: A Core Dynamic

Risk-off sentiment tends to push money into:

- Gold (XAU/USD): Seen as a store of value, especially when fiat currencies lose appeal.

- Japanese Yen (JPY): Favored for its stability and capital repatriation behavior.

- Swiss Franc (CHF): Trusted due to Switzerland’s neutrality and economic soundness.

- U.S. Treasuries: Considered the safest debt instruments globally.

These flows are often visible on FX charts long before the mainstream narrative catches up—making them key indicators for traders.

📉 Chapter 2: How Markets React During Risk-Off Phases

When markets shift into “risk-off” mode, capital quickly migrates away from risky assets and flows into safe havens. This transition isn’t just psychological—it’s visible across multiple asset classes, often creating strong, tradeable trends.

Let’s break down how different markets typically behave during these fear-driven phases.

💴 FX Market: The Yen and Franc Shine, Risk Currencies Fall

Safe-Haven Currencies Strengthen:

- Japanese Yen (JPY): Often the strongest performer during risk-off due to capital repatriation by Japanese institutions and its low-yield nature.

- Swiss Franc (CHF): Gains ground as investors seek stability in the Swiss financial system.

- U.S. Dollar (USD): Depending on the nature of the crisis, USD can act as a risk haven—especially during global dollar shortages or flight-to-liquidity episodes.

Risk Currencies Weaken:

- Australian Dollar (AUD), New Zealand Dollar (NZD): These commodity-linked, high-yielding currencies typically sell off as investors unwind carry trades.

- Emerging Market Currencies (ZAR, TRY, BRL, etc.): Hit hardest due to political/economic instability and weaker capital buffers.

📌 Key FX Pair Reactions:

- USD/JPY → Falls (JPY strength)

- AUD/JPY → Falls sharply (risk unwind + yen demand)

- EUR/CHF → Drops (CHF safe-haven flows)

📉 Equities: Broad-Based Selling, Volatility Surges

- Stock indices like the S&P 500, Nasdaq, and Nikkei 225 typically fall, especially if the risk event threatens corporate earnings or growth.

- Volatility indices (e.g., VIX) spike as fear spreads.

- Sectors tied to consumer confidence, travel, or credit are hit hardest.

In extreme cases, correlations across stocks rise—investors sell everything to raise cash.

🟡 Gold: The “Crisis Hedge” Asset

- Gold (XAU/USD) often rallies as trust in fiat currencies and financial systems weakens.

- Gold benefits most when:

- Central banks turn dovish in response to risk

- Real yields decline

- Inflation fears persist alongside risk aversion

Notably, gold can initially fall during sudden risk-off shocks (as investors seek cash), but it tends to recover and outperform in sustained uncertainty.

🏦 Bond Markets: Yield Drops as Demand for Safety Rises

- U.S. Treasuries and German Bunds are heavily bought during risk-off, pushing yields lower.

- Yield curve flattening or inversion can occur, signaling recession fears.

- Riskier corporate bonds or EM debt are sold off.

Lower bond yields indirectly pressure currencies like the USD (unless paired with liquidity risk).

📉 Commodities: Energy and Industrial Metals Fall

- Crude oil and copper often decline due to fears of reduced demand.

- This impacts commodity currencies like CAD (oil-linked) and AUD (metal-linked).

📊 Quick Reference: Typical Asset Movements in Risk-Off

| Asset Class | Typical Move | Why? |

|---|---|---|

| JPY, CHF | ↑ (Appreciate) | Safe-haven demand |

| AUD, ZAR, TRY | ↓ (Depreciate) | Risk unwinding, capital flight |

| Gold (XAU/USD) | ↑ | Hedge against uncertainty |

| Stocks | ↓ | Earnings & growth fears |

| Bonds (UST) | ↑ (Yields ↓) | Flight to safety |

| Oil, Copper | ↓ | Global demand concerns |

In the next chapter, we’ll dive into why these shifts happen—not just what moves, but why investors think and act the way they do when fear takes hold.

🧠 Chapter 3: The Psychology and Capital Flows Behind Risk-Off

Understanding what happens during risk-off is important—but understanding why it happens gives you an edge.

At the core of every market move lies a shift in collective psychology, and nowhere is that more evident than during risk-off phases.

🧯 1. Fear Over Profit: The Emotional Pivot

Risk-off begins when uncertainty overpowers the desire for return.

This shift is often sparked by:

- Fear of losses (e.g. crash, default, war)

- Desire to preserve capital

- Lack of clarity or control

As soon as traders feel “it’s not worth the risk,” the flow begins.

Even institutional players start reducing exposure—not necessarily because losses are certain, but because the probability distribution of outcomes becomes too wide.

🧠 In short: Risk-off is a collective move toward safety triggered by rising ambiguity, not just negative news.

💸 2. The Flight-to-Safety Flow: Where the Money Goes

The market doesn’t just “panic”—it reallocates.

Here’s how capital typically moves:

| From (Risk Assets) | To (Safe-Haven Assets) |

|---|---|

| Stocks | Gold, Government Bonds |

| High-yield currencies (AUD, ZAR) | JPY, CHF, sometimes USD |

| Corporate bonds, EM debt | U.S. Treasuries, German Bunds |

| Crypto assets | Fiat cash, precious metals |

This is not a random flight—it’s a disciplined retreat into historically reliable assets.

🧠 3. The “Carry Trade Unwind” Effect in FX

In forex, one of the most powerful forces in a risk-off environment is the unwinding of carry trades.

- Traders who borrowed low-yielding currencies (like JPY) to buy high-yielding ones (like AUD, ZAR)

suddenly reverse those positions. - The result?

High-yielders fall sharply, and the yen surges.

This happens fast, and sometimes regardless of domestic fundamentals, because capital preservation becomes the primary goal.

🪙 Risk-off turns the FX market into a “reverse flow engine” — money doesn’t chase yield, it chases shelter.

🔁 4. Reflexivity and Overreaction: Herding Behavior

Market participants aren’t operating in isolation.

- Media amplification,

- social media panic, and

- algorithmic flows

all accelerate what begins as a rational move into a stampede.

What starts as “let’s reduce risk” quickly becomes “everyone’s running, so I have to.”

This herding behavior often leads to overshoots in JPY strength, gold spikes, and equity selloffs—providing both opportunity and danger for traders.

🧭 Summary: Read the Flows, Not Just the News

- Risk-off isn’t just about events—it’s about perception of those events.

- Smart traders observe how markets reallocate capital, not just react emotionally.

- By tracking real-time capital flows and sentiment shifts, you can anticipate the move before headlines even catch up.

In the next chapter, we’ll review several real-world examples of past risk-off environments—what triggered them, how markets reacted, and what you can learn from them as a trader.

🕰️ Chapter 4: Case Studies – Major Risk-Off Events and Market Reactions

Understanding theory is one thing—but seeing how risk-off plays out in real markets is where the real learning begins.

Here are three significant risk-off episodes in recent history that showcase how markets behave when fear takes over.

📉 1. The 2008 Global Financial Crisis: The Yen’s Historic Rally

Trigger:

The collapse of Lehman Brothers in September 2008 sparked a systemic financial crisis, triggering panic across global markets.

Market Reaction:

- 🏦 Equities: S&P 500 plunged over 50% within months.

- 💱 USD/JPY: Fell from around 110 to below 90—a massive yen appreciation driven by carry trade unwinding.

- 🟡 Gold: Initially fell (margin calls), but then surged as a safe haven.

Key Takeaway for FX Traders:

The crisis revealed the power of the yen in risk-off environments and how quickly carry trades can unwind. Even traditional safe havens like gold can drop in the first wave of panic—but tend to recover strongly.

🦠 2. COVID-19 Market Shock (Feb–Mar 2020): Panic, Then Policy Response

Trigger:

The global spread of COVID-19 and lockdowns led to fears of a deep global recession.

Market Reaction:

- 📉 Equities: The Dow Jones dropped ~35% in 30 days.

- 💱 USD/JPY: Fell from ~112 to 101, then rebounded as Fed liquidity kicked in.

- 🟡 Gold: Dropped briefly (due to forced liquidations), then surged to new highs in mid-2020.

- 📈 Volatility: VIX index spiked to levels higher than during the 2008 crisis.

Key Takeaway:

In extreme uncertainty, even gold and bonds may be sold temporarily. But once central banks intervene, gold and safe havens recover rapidly. Timing matters.

⚔️ 3. Russia-Ukraine War (Feb 2022): Geopolitical Risk Repricing

Trigger:

Russia’s invasion of Ukraine on February 24, 2022, shocked global markets and raised fears of a broader conflict.

Market Reaction:

- 💱 EUR/CHF: Dropped as capital fled the eurozone toward Swiss safety.

- 💱 JPY & USD: Both appreciated in early phases.

- 🟡 Gold: Rallied strongly, surpassing $2,000/oz.

- 🛢️ Oil & Natural Gas: Spiked on supply fears, supporting CAD and NOK short-term.

Key Takeaway:

Not all risk-off reactions lead to JPY dominance. In this case, USD and CHF absorbed more flows. Energy-linked currencies can briefly benefit from conflict-related commodity spikes.

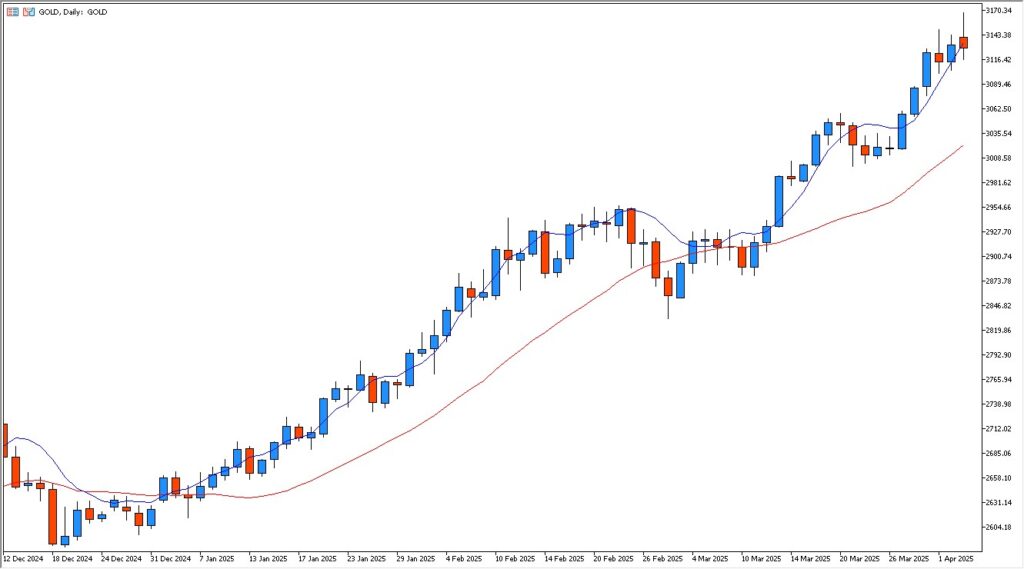

🟨 Bonus: 2025 Gold Surge Amid China–Taiwan Tensions

Trigger:

In April 2025, escalating military drills by China around Taiwan led to a rise in geopolitical tensions and global market jitters.

Market Reaction:

- 🟡 Gold (XAU/USD): Spiked to $3,167.69 on April 3, 2025, as capital flowed into safe havens.

- 💱 JPY & CHF: Gained modestly, while equity markets in Asia sold off.

Key Takeaway:

Gold remains a reliable indicator of global fear. When both USD and equity markets are uncertain, capital gravitates toward physical assets like gold—especially when real interest rates decline.

💬 Summary: Patterns, But No Guarantees

While the assets that react to risk-off are fairly consistent—JPY, CHF, gold, and bonds—each event is unique in context and magnitude.

Understanding the underlying trigger and policy backdrop is key to positioning correctly.

🎯 Chapter 5: How to Trade Risk-Off Sentiment in Forex Markets

Knowing what risk-off sentiment is and how it moves markets is crucial—but turning that knowledge into profitable trades is where the real edge lies.

In this chapter, we’ll explore how FX traders can identify, adapt to, and capitalize on risk-off phases with confidence.

💱 1. Identify High-Probability Currency Pairs

Certain FX pairs react more reliably to risk-off conditions due to their structural characteristics and global macro roles.

🔼 Safe-Haven Buy Candidates:

- USD/JPY → Short bias

(JPY tends to strengthen as capital flows home to Japan) - AUD/JPY → Strong short candidate

(Risk currency vs. safe haven—ideal for carry trade unwinds) - EUR/CHF → Short bias

(CHF gains on Eurozone uncertainty)

🔽 Risk Currency Sell Candidates:

- AUD, NZD, ZAR, TRY → Generally weaken as yield-seeking flows reverse

- Emerging market currencies → Often hit hardest due to capital flight

📈 2. Strategy Tips for Risk-Off Trading

✔ Use Trend-Following Approaches

- In strong risk-off environments, momentum builds quickly.

- Breakouts (especially on daily charts) are more reliable as fear drives directional moves.

✔ Watch for Retests and Pullbacks

- Instead of chasing the first wave, wait for pullbacks to key moving averages (e.g., 20 EMA) or broken support/resistance zones.

✔ Prioritize Liquid Pairs

- Stick to majors and liquid crosses like USD/JPY, EUR/USD, AUD/JPY during volatile times to avoid slippage or wild spreads.

✔ Scale Your Position Size

- Risk-off often means higher volatility → widen stops, reduce lot size.

- Consider trading smaller positions with tighter risk control.

⚠️ 3. Common Pitfalls to Avoid

❗ Assuming All Risk-Off Moves = JPY Strength

- USD can sometimes strengthen instead (e.g., dollar liquidity crunch).

- CHF may outperform in European crisis scenarios.

- Always assess which safe-haven is in demand right now.

❗ Ignoring Central Bank Interventions

- Central banks may step in to stabilize markets (e.g., BOJ verbal jawboning to stop JPY surges).

- Watch for policy shifts, unscheduled pressers, or liquidity injections.

❗ Overtrading Volatility

- Risk-off isn’t just “big moves” — it’s emotional volatility.

- Don’t get whipsawed chasing every spike. Be selective and focused.

📊 4. Summary Playbook for Risk-Off FX Trading

| Step | Action |

|---|---|

| 1️⃣ | Monitor headlines for geopolitical/economic risk triggers |

| 2️⃣ | Check capital flow indicators (JPY/CHF strength, gold, VIX) |

| 3️⃣ | Identify breakout or reversal setups on safe-haven pairs |

| 4️⃣ | Use defensive risk management (scaled entries, wide stops) |

| 5️⃣ | Stay flexible—risk sentiment can flip fast |

Risk-off environments can feel chaotic—but to the prepared trader, they offer some of the cleanest trend opportunities in FX.

In the next chapter, we’ll explore how to distinguish risk-off from risk-on, and what clues tell us when the mood is shifting.

🔁 Chapter 6: Risk-On vs. Risk-Off – Key Differences and How to Tell Them Apart

In FX trading, being able to distinguish risk-on from risk-off isn’t just helpful—it’s essential.

These opposing market moods shift the flow of capital, impact volatility, and change the behavior of currency pairs.

Let’s break down the key differences and give you actionable tips to spot which environment you’re in.

⚖️ 1. Risk-On vs. Risk-Off: Core Differences

| Category | Risk-On | Risk-Off |

|---|---|---|

| Investor Sentiment | Confident, growth-focused | Fearful, defensive |

| Goal | Maximize returns | Preserve capital |

| Stocks | Rally (especially tech, EMs) | Sell-off |

| Bond Yields | Rise (sell bonds) | Fall (buy bonds) |

| Safe-Haven FX | Weaken (e.g., JPY, CHF) | Strengthen |

| Risk FX | Strengthen (e.g., AUD, NZD) | Weaken |

| Gold (XAU/USD) | Tends to fall or stay flat | Tends to rise |

| VIX (Volatility) | Low and stable | Spikes |

📌 The “risk switch” in markets is subtle but powerful—and often priced in before headlines catch up.

🧠 2. How to Tell Which Regime You’re In

✅ Watch Price Action in Key Assets

- If JPY and CHF are gaining, especially against AUD or NZD → likely risk-off

- If gold is rising along with bonds, and equities are falling → strong risk-off

- If stocks and high-yield FX pairs are climbing and VIX is low → risk-on likely

✅ Monitor Headlines for Triggers

- Risk-on often follows positive data, dovish central bank commentary, or resolution of uncertainty

- Risk-off follows surprises, conflicts, or panic headlines (default, war, etc.)

✅ Use Correlation Clues

- In risk-on, correlations break down (more selective rotation)

- In risk-off, correlations tighten—everything risky sells together, and safe-havens surge

🔄 3. Beware of Transitional Phases

Market sentiment doesn’t always flip cleanly.

Sometimes, you’re in a gray zone where:

- Equities are bouncing, but JPY is still firm

- Gold and USD are rising together

- VIX is elevated, but stock dips are bought

These are fragile environments—perfect for short-term trading, but risky for directional conviction.

🎯 Pro Tip: Think in Terms of “Relative Risk”

Risk-on/off isn’t binary—it’s often relative across regions and sectors.

For example:

- The U.S. may be in risk-on (tech rally)

- Europe may be in risk-off (debt crisis)

- Japan may be neutral

Understanding where capital is flowing from and to helps you trade smarter.

✅ Summary

Recognizing whether the market is in risk-on or risk-off mode lets you:

- Align trades with momentum

- Choose the right currency pairs

- Avoid taking trades against sentiment flow

Always ask yourself:

🧭 “Are traders chasing returns—or running for cover?”

🧭 Conclusion: Mastering Risk-Off for Smarter FX Decisions

Risk-off sentiment isn’t just a market buzzword—it’s a window into the collective fear, priorities, and capital flows of global investors.

For FX traders, mastering the dynamics of risk-off gives you more than just trade setups:

it gives you a framework for reading the market’s mood and acting with precision.

🧠 Key Lessons to Remember

- Risk-off = capital preservation

When fear dominates, traders don’t chase yield—they protect it. - Watch the safe havens

JPY, CHF, gold, and Treasuries are your compass during market turmoil. - Risk-off isn’t always textbook

USD can rise, gold can dip, and news can be priced in early. Context matters. - Psychology drives price before fundamentals catch up

Understanding investor emotion often gives you the head start.

📈 From Knowledge to Execution

Whether you’re a beginner or experienced trader, turning theory into profit means:

- 🗺️ Mapping sentiment shifts to price action

- 🎯 Selecting the right currency pairs for the moment

- 📊 Managing risk aggressively in volatile environments

With every new crisis or shock, you’ll gain clarity—because you know what to look for, and how to respond.

🔍 “Markets run on fear and greed. Master both, and you master the flow.”

Stay sharp. Stay flexible. And let risk sentiment guide your edge in FX.