Introduction

If you’re new to Forex trading, mastering the concept of “pips” is one of the very first and most crucial steps to take.

Pips are the fundamental unit used to measure price movements—and your profits or losses—in the Forex market.

Without a solid understanding of pips, it’s easy to misjudge trade setups, miscalculate risk, and let small mistakes snowball into major setbacks.

This complete guide will walk you through:

- What exactly pips are

- How to calculate them properly

- How to set realistic daily targets using pips

- The best tools to make pip management effortless

- How smart pip management can dramatically boost your trading performance

By the end of this guide, you won’t just “know” what a pip is—you’ll be able to actively manage your trades with clarity and confidence.

Whether you’re just starting out or revisiting the basics to sharpen your edge, this is the foundation every successful Forex trader builds on.

Let’s dive in!

- Chapter 1: What Are Pips?|Understanding the Basic Unit of Forex Trading

- Chapter 2: How to Calculate Pips|Simple Methods You Can Use

- Chapter 3: Setting Realistic Pips Targets|Building a Practical Trading Plan

- Chapter 4: Essential Tools for Easy Pips Calculation

- Chapter 5: Boosting Your Trading Performance Through Pips Management

- Final Summary and Takeaways

Chapter 1: What Are Pips?|Understanding the Basic Unit of Forex Trading

In Forex trading, a “pip” (short for “percentage in point”) is the standard unit for measuring price movement between two currencies.

It represents the smallest price change that an exchange rate can make based on market convention.

While the concept may seem simple, mastering the role of pips is essential for accurate trade management, risk calculation, and profit targeting.

1-1. Basic Definition of a Pip

- For most currency pairs (like EUR/USD):

1 pip = 0.0001 change in price. - For currency pairs involving the Japanese yen (like USD/JPY):

1 pip = 0.01 change in price.

✅ Example:

- If EUR/USD moves from 1.1350 to 1.1351, that’s a 1-pip increase.

- If USD/JPY moves from 143.50 to 143.51, that’s a 1-pip increase.

1-2. Pips vs Points: Understanding the Difference

Modern trading platforms like MT4 and MT5 often display prices with an extra decimal place for more precision.

- A “point” refers to the smallest change at the last digit (fifth decimal place for EUR/USD, third decimal place for USD/JPY).

- A “pip” still follows the traditional fourth decimal place (EUR/USD) or second decimal place (USD/JPY).

✅ Example:

- EUR/USD moves from 1.13528 to 1.13538 → 1 pip move (plus 10 points).

- USD/JPY moves from 143.507 to 143.517 → 1 pip move (plus 10 points).

1-3. Why Understanding Pips Is Crucial

Getting comfortable with pips is not just about memorizing definitions.

It’s about learning to think and manage your trades in terms of risk, reward, and realistic targets.

If you don’t fully grasp pip value:

- You may miscalculate your stop-loss and take-profit levels.

- You may incorrectly size your positions, risking too much or too little.

- You may misinterpret small market movements, leading to emotional decisions.

✅ In short:

Pip awareness is trade management awareness.

Chapter 1 Summary

By mastering the basics of pips, you lay a strong foundation for building a logical, controlled trading style—essential for lasting success in the Forex market.

In the next chapter, we’ll dig deeper into how to actually calculate pips step-by-step!

Chapter 2: How to Calculate Pips|Simple Methods You Can Use

Understanding what a pip is lays the groundwork, but to apply it in real trading, you need to know how to calculate pips correctly.

Fortunately, the calculation itself is simple once you get used to it.

Let’s go through the basic method step-by-step.

2-1. Basic Pip Calculation Formula

Here’s the general formula for pip calculation:

✅ Pips = (Exit Price – Entry Price) ÷ Pip Value

- For USD/JPY and other yen pairs, pip value = 0.01

- For EUR/USD and most major pairs, pip value = 0.0001

2-2. Example 1: USD/JPY (Japanese Yen Pair)

Suppose you enter a trade at 143.50 and exit at 143.80.

Calculation:

(143.80 - 143.50) ÷ 0.01 = 30 pips

✅ This trade results in a 30-pip gain.

2-3. Example 2: EUR/USD (Major Currency Pair)

Suppose you enter a trade at 1.13500 and exit at 1.13700.

Calculation:

(1.13700 - 1.13500) ÷ 0.0001 = 20 pips

✅ This trade results in a 20-pip gain.

2-4. Key Points to Avoid Mistakes

- Always check which decimal place matters based on the currency pair.

(2nd decimal for JPY pairs, 4th decimal for most others.) - Mind the platform settings: MT4/MT5 often show extra digits (“points”), but pip calculation should stick to the standard decimal place.

- Use simple checks when unsure: a 0.10 move in USD/JPY usually equals 10 pips.

2-5. Practice Makes Perfect

In the beginning, you might hesitate with pip calculations. That’s normal!

Over time, your eyes will naturally “see” pips when looking at price charts—no manual calculation required.

Think of pip calculation as a basic “mental math” skill for Forex traders.

Once you master it, you’ll be faster, more confident, and better prepared to plan your trades.

Chapter 2 Summary

Pip calculation is straightforward: find the difference between your entry and exit price, divide by the pip value, and you have your result.

In the next chapter, we’ll explore how to set realistic daily pip targets that match your trading goals!

Chapter 3: Setting Realistic Pips Targets|Building a Practical Trading Plan

Many new traders make the mistake of setting overly ambitious pip targets.

They aim for 50, 100, or even 200 pips per trade—only to find that such large moves don’t happen consistently, leading to frustration and poor decision-making.

Instead, the key to consistent trading success is setting realistic daily pip targets based on your personal goals and trading style.

Let’s walk through how to do it properly.

3-1. Start by Defining Your Daily Income Goal

The first step is simple:

Decide how much you want to earn per day through trading.

Example:

- You aim to make 10,000 yen (around $70 USD) per day.

From here, we can reverse-engineer how many pips and how much lot size you need to achieve that.

3-2. How Many Pips You Need: Working Backwards

Let’s use USD/JPY as an example:

- 1 pip in 0.01 lots = about 10 yen

- 1 pip in 0.1 lots = about 100 yen

- 1 pip in 1.0 lots = about 1,000 yen

So to earn 10,000 yen,

you could either:

- Take 100 pips in 0.1 lots

- Take 10 pips in 1.0 lots

Which sounds easier?

Clearly, aiming for 10 pips with 1.0 lots is far more realistic and practical.

3-3. Realistic Daily Target Strategy: The “10 Pips Plan”

Rather than dreaming about 50 or 100-pip moves daily,

set a simple goal: capture 10 pips per day with an appropriate lot size.

✅ Advantages:

- Market often gives multiple 10-pip opportunities daily.

- Lower emotional pressure—less waiting, fewer second guesses.

- Easier to repeat and build trading discipline.

3-4. How Much Margin Do You Need?

To trade 1.0 lots safely, you need enough margin.

Example calculation (assuming 1 USD = 143.435 yen, and 1,000x leverage):

- Required margin = (100,000 units ÷ 1,000) × 143.435 ÷ 100

- = about 14,344 yen minimum

But realistically, at least 200,000 yen or better yet 500,000 yen should be secured in your trading account to absorb volatility and avoid forced stop-outs.

✅ Remember:

Always maintain sufficient margin to stay calm under pressure.

3-5. Focus on “Taking What the Market Gives You”

When you lock onto a 10-pip target,

you don’t have to force trades or chase unrealistic moves.

Instead, your mindset becomes:

- Take small, quick wins.

- Don’t wait endlessly for bigger moves that may never come.

- Build confidence through repetition.

Consistent small victories lead to long-term growth much more reliably than chasing lottery wins.

Chapter Summary

Forget about chasing huge moves every day.

Instead, set clear, simple targets—like earning 10 pips with 1 lot—and focus on consistently executing small, achievable trades.

In the next chapter, we’ll introduce powerful tools that can make pip management even easier and smarter!

Chapter 4: Essential Tools for Easy Pips Calculation

While manual pip calculation is a valuable skill,

using the right tools can dramatically speed up your trading workflow and reduce the risk of errors.

In this chapter, we’ll introduce the best tool to help you manage pip calculations, lot sizing, and risk control effortlessly.

4-1. The Best App: Forex Calculators

Among the many tools available,

Forex Calculators app stands out for its simplicity, functionality, and ease of use.

✅ Key Features:

- Pips Calculator: Quickly calculate pips between two prices.

- Position Size Calculator: Determine the ideal lot size based on your risk amount and stop-loss distance.

- Stop Loss & Take Profit Calculator: Easily calculate your exit points.

- Fibonacci Calculator: Find retracement and extension levels in seconds.

✅ Usability:

- Available on both iPhone and Android.

- Ads are minimal and non-intrusive (small banner at the bottom).

- Simple and intuitive interface for beginners and pros alike.

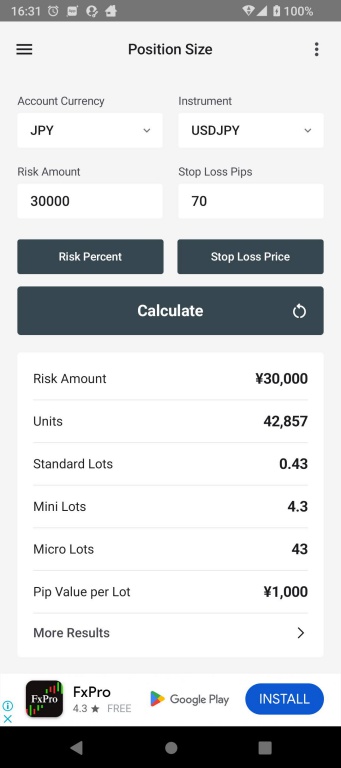

4-2. Example: Using the Position Size Calculator

One of the app’s most powerful features is the Position Size Calculator.

Here’s how you can use it:

- Open the app and select “Position Size Calculator.”

- Enter your intended risk amount (e.g., 30,000 yen).

- Enter your stop-loss distance in pips (e.g., 70 pips).

- Tap “Calculate.”

✅ Result:

The app instantly suggests the correct lot size (e.g., 0.43 lots) for your trade.

No need to build complicated Excel sheets—everything is done in a few taps.

4-3. Optional: Remove Ads with a One-Time Upgrade

If you prefer an even cleaner interface,

the app offers a premium upgrade with options:

- Monthly Plan: 300 yen

- Annual Plan: 2,250 yen

- Lifetime Plan (one-time payment): 3,380 yen

✅ The lifetime plan offers excellent value if you plan to trade long term.

✅ However, the free version is fully functional—there’s no need to upgrade unless you want to.

Chapter Summary

Mastering pip calculation is important,

but using a smart tool like Forex Calculators lets you focus more on trading decisions—not on tedious math.

In the next chapter, we’ll explore how to use pips management strategies to boost your trading results even further!

Chapter 5: Boosting Your Trading Performance Through Pips Management

Simply knowing how to calculate pips isn’t enough.

The real value lies in how you use pips to control risk, structure trades, and manage your psychology.

In this final chapter, let’s explore how pip management can significantly boost your trading performance—and how a small mindset shift can make a huge difference.

5-1. Set Your Risk Before Setting Your Target

Smart traders always decide on their acceptable loss first—before thinking about profits.

Here’s the basic process:

- Define how many pips you are willing to risk (e.g., 30 pips).

- Set a target at a multiple of your risk (e.g., 90 pips if aiming for a 1:3 risk-reward ratio).

✅ Why this matters:

- You protect your account from big emotional mistakes.

- Even with a lower win rate, proper risk/reward keeps you profitable over time.

5-2. Example: 1:3 Risk-Reward Setup

Suppose you set:

- Stop-loss at 30 pips

- Take-profit at 90 pips

Even if you win only 40% of your trades,

you can still grow your account steadily because your wins are larger than your losses.

✅ Risk management beats high win rates in the long run.

5-3. Adopting the “Entry Fee” Mindset

Most traders see a losing trade as a “failure.”

But what if you looked at it differently?

Imagine treating each trade like:

- Paying an entrance fee to a theme park.

- Buying a movie ticket.

You pay a small fee to experience the ride—or in this case, to engage with the market.

Not every experience leads to instant rewards, but it’s part of the journey.

✅ Benefits of this mindset:

- Reduces emotional stress.

- Makes you view losses as normal, manageable costs.

- Helps you focus on executing your strategy instead of fearing outcomes.

5-4. Stay Process-Oriented, Not Outcome-Oriented

Focus on:

- Executing good setups

- Managing risk consistently

- Reviewing your process after every trade

Over time, this will naturally lead to better outcomes—even if not every trade is a winner.

✅ Pips are not just numbers—they are tools to build discipline, patience, and consistency.

Chapter Summary

Mastering pips is about more than just calculation.

It’s about controlling risk, managing psychology, and thinking like a professional trader.

By setting clear risk limits, aiming for logical rewards, and shifting your mindset around losses,

you can create a stable and sustainable trading style that grows over time.

In the final section, we’ll wrap up the key takeaways from this guide!

Final Summary and Takeaways

Congratulations—you’ve completed the full guide on mastering pips in Forex trading!

Let’s quickly recap the key lessons you’ve learned:

📌 Key Points to Remember

- Pips are the basic unit to measure price movements in Forex, essential for understanding profits and losses.

- Pip Calculation is simple:

(Exit Price – Entry Price) ÷ Pip Value = Number of Pips. - Realistic Target Setting is critical:

Aim for achievable goals like capturing 10 pips per day instead of chasing huge moves. - Forex Calculators App can automate pip calculation, lot sizing, and risk management, making your trading faster and smarter.

- Pips Management boosts your trading success by promoting logical risk control and steady psychological discipline.

🚀 Final Takeaway

Pips are not just a technical detail—they’re the language of successful trading.

By mastering pip management, you lay the foundation for consistent, confident, and professional-level trading performance.

Stay patient. Stay disciplined.

And remember:

Every pip you manage wisely today is a step closer to your long-term trading success.