- 📊 Chapter 1: From Goals to Structure — Why Monthly Profit Targets Alone Aren’t Enough

- 🎯 Chapter 2: Realistic Swing Trade Targets — +210 Pips from One Trade

- 🔬 Chapter 3: How to Build Consistency — Testing, Tracking, and Execution Discipline

- ⏰ Chapter 4: The “3-Check Per Day” Swing Strategy (Ama-chan Method)

- 🗺️ Chapter 5: How to Adapt This Strategy to Your Income Goals

- 🏁 Final Chapter: Structure Over Emotion — Why Consistency Wins in the Long Run

📊 Chapter 1: From Goals to Structure — Why Monthly Profit Targets Alone Aren’t Enough

Many Forex traders start with a simple, powerful goal:

“I want to earn $500, $1,000, or even $3,000 per month from trading.”

It’s a great starting point—but without a structured plan behind that number, the goal often stays just that: a dream.

To consistently make money in FX, you need to understand one fundamental equation:

Profit = PIPS × Lot Size

If you focus only on the dollar amount, you ignore the two variables that actually generate your income:

how many pips you can earn, and what lot size you’re trading.

✅ Why PIPS Matter More Than Profit (At First)

Let’s say you want to make $500 this month.

You might think, “I just need a few good trades.” But what defines “good”?

Here’s the truth:

If you can consistently capture 500 pips per month with a proven system, you can scale your income by adjusting lot size.

That’s why tracking your monthly PIPS is far more powerful than chasing profit alone.

| PIPS/month | Lot Size | Monthly Profit |

|---|---|---|

| 500 | 0.01 | $50 |

| 500 | 0.10 | $500 |

| 500 | 0.30 | $1,500 |

This is what we call “structural profitability.”

🎯 Set Your Income Goal Through PIPS, Not Dollars

In this guide, you’ll learn how to reverse-engineer your income goal.

We’ll show you:

- How many pips you need to hit your target

- What lot sizes are realistic based on your capital

- How to trade using a repeatable swing strategy that doesn’t require full-time screen time

This way, whether you’re aiming for $100 or $3,000 a month,

you’ll be building a scalable trading structure—not gambling on lucky trades.

In the next chapter, we’ll walk you through a real swing trade that captured +210 pips using a simple yet powerful setup.

Let’s dive in. 📘

🎯 Chapter 2: Realistic Swing Trade Targets — +210 Pips from One Trade

Swing trading isn’t about taking dozens of small wins.

It’s about waiting for high-quality setups that deliver big moves with minimal screen time.

Here’s what that looks like in practice.

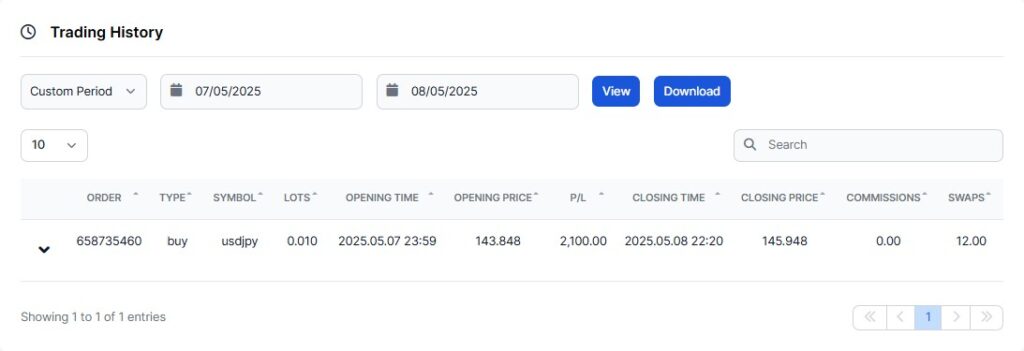

📈 A Real Trade: +210 Pips on USD/JPY

Let’s break down a real swing trade executed using the strategy introduced in this guide.

| Trade Details | Value |

|---|---|

| Pair | USD/JPY |

| Trade Type | Long (Buy) |

| Entry | 143.848 |

| Take Profit (TP) | 145.948 |

| Stop Loss (SL) | 143.148 |

| Profit | +210 pips |

| Lot Size | 0.01 |

| Net Gain | ¥2,100 (≈ $14 USD) |

| Trade Duration | ~22 hours |

| Execution Style | Set-and-forget with limit/stop orders |

This trade was placed based on clear rules, using just two moving averages on the 8-hour chart (we’ll cover the full method in Chapter 4).

No chasing. No watching. Just a systemized approach.

📊 Why This Trade Matters

✅ 1. Scalable Outcome

A +210 pip trade is powerful—even at 0.01 lots, it produced a modest gain. But here’s the real power:

| Lot Size | Profit from +210 Pips |

|---|---|

| 0.01 | ~$14 |

| 0.10 | ~$140 |

| 0.30 | ~$420 |

| 0.50 | ~$700 |

With consistency, you don’t need more trades—you just scale what already works.

✅ 2. Defined Risk and Reward

This trade had a stop loss of 60 pips and a take profit of 210 pips.

That’s a risk-reward ratio of 1:3.5.

Even if your win rate is below 50%, this setup structure is mathematically profitable over time.

✅ 3. No Emotional Interference

Once the trade was entered, no further action was needed.

The trader wasn’t tempted to exit early or move the stop—because all decisions were made before entry.

That’s the benefit of a rules-based swing strategy.

🧠 Key Takeaway: Big Moves, Small Time Commitment

This one trade proves that you don’t need dozens of daily trades or complex indicators.

You need:

- A solid setup

- A favorable reward-to-risk ratio

- A process you can repeat

In the next chapter, we’ll focus on how to build that consistency through backtesting, journaling, and execution discipline—so you can stop guessing and start scaling.

Let’s move on. 🔬

🔬 Chapter 3: How to Build Consistency — Testing, Tracking, and Execution Discipline

Winning in Forex is not about predicting every move.

It’s about doing the same right thing over and over again—and letting the numbers work in your favor.

This chapter is all about how to turn your swing trading into a structured, repeatable system by building three core habits:

✅ 1. Backtesting: Prove the Strategy Before You Risk Real Money

Before trading live, test your setup on historical charts.

Use the same rules every time:

- Entry based on moving averages

- Fixed stop loss (e.g., 60 pips)

- Fixed take profit (e.g., 210 pips)

Track your win rate and the average number of trades per month.

You’re not looking for perfection—you’re looking for a positive expectancy.

Expectancy formula:

(Win Rate × Average Win) – (Loss Rate × Average Loss)

Even a 40% win rate with a 1:3.5 risk-reward ratio is profitable long-term.

📓 2. Trade Journaling: Track Every Decision and Outcome

Every trade you take should be documented—especially losses.

Log:

- Entry and exit price

- Setup confirmation

- SL/TP

- Screenshots of chart before entry

- Emotional state (were you calm or impulsive?)

After 10–20 trades, patterns will emerge.

You’ll see what works and what doesn’t—and that clarity leads to growth.

🧘♂️ 3. Execution Discipline: Follow Your Rules, No Matter What

Most traders fail not because of bad setups, but because they:

- Exit early due to fear

- Skip entries due to doubt

- Move stop losses emotionally

With a swing strategy like the Ama-chan Method, all decisions are made in advance.

You only check the chart three times per day, and once you enter a trade, it’s “set and forget.”

The fewer decisions you make during a trade, the better your results will be.

🔁 Consistency Builds Confidence

When you see your strategy work over and over—both in backtesting and live trading—you stop second-guessing.

You trust the system.

And that’s when your trading really levels up.

In the next chapter, we’ll reveal the Ama-chan Method in detail:

A swing strategy that uses just two moving averages, three chart checks per day, and a powerful 1:3.5 risk-reward ratio.

Let’s go. ⏰

⏰ Chapter 4: The “3-Check Per Day” Swing Strategy (Ama-chan Method)

If you’re tired of staring at charts all day or getting overwhelmed by noisy indicators,

this chapter is your answer.

The Ama-chan Method is a minimalist swing trading strategy designed for people with real lives—jobs, families, and limited screen time.

You check the charts just three times per day and let the system do the work.

🧩 Strategy Overview

- Chart timeframe: 8-hour (H8)

- Indicators used:

→ 9-period moving average (9MA)

→ 36-period moving average (36MA) - Risk/reward ratio: 1:3.5

- Average trade duration: 1–3 days

- Ideal pair: USD/JPY

- Style: “Set and forget” with predefined entry, stop loss, and take profit

📌 Why 8-Hour Charts?

The 8H timeframe offers a sweet spot between:

- High enough to avoid noise

- Low enough to get 1–2 trades per week

- Aligned with major global market sessions (Tokyo, London, NY)

With just three daily check-ins (e.g., 6 AM, 2 PM, 10 PM Japan time),

you’ll never feel chained to your trading screen again.

📈 Entry Rules

🟢 Long Entry (Buy):

- 9MA is above 36MA

- A candle closes above the 9MA (after crossing it from below)

- Enter at the open of the next candle

🔴 Short Entry (Sell):

- 9MA is below 36MA

- A candle closes below the 9MA (after crossing it from above)

- Enter at the open of the next candle

🎯 SL/TP Settings (Fixed Every Time)

- Stop Loss: 60 pips

- Take Profit: 210 pips

→ Risk-to-reward ratio = 1:3.5

Once you’re in the trade, you set both SL and TP and do nothing else.

Let the market work for you.

💡 Why USD/JPY?

USD/JPY offers:

- High liquidity: You can enter/exit trades any time without major slippage

- Strong volatility: Weekly ranges average 350+ pips, giving you room to hit big targets

- Lower spreads: Making it cost-effective for frequent entries

🧪 Tested. Simple. Repeatable.

You don’t need a thousand indicators or dozens of trades.

This strategy:

- Works with minimal time

- Avoids emotional trading

- Is easy to test, track, and scale

In the next chapter, we’ll help you map this strategy to your personal income goals—whether you’re aiming for $100 or $3,000 per month.

Let’s break it down together. 🗺️

🗺️ Chapter 5: How to Adapt This Strategy to Your Income Goals

Now that you understand the Ama-chan Method,

it’s time to connect your strategy to your financial goals.

Whether your target is $100, $500, or $3,000 per month, the path is the same:

🎯 PIPS × Lot Size = Monthly Profit

In this chapter, we’ll help you design your personal income model using this formula.

📊 Monthly Income Simulation Table

Assuming you aim to earn 500 pips/month using 4 trades (125 pips average gain per trade),

here’s how your monthly profit scales by lot size:

| 🎯 Target Profit | 📈 Required Pips | 🔁 Suggested Lot Size | 📆 Monthly Trades | 💰 Est. Margin (USDJPY @150) |

|---|---|---|---|---|

| $100 / mo | 500 pips | 0.02 lots | 4 trades | ~$4 |

| $300 / mo | 500 pips | 0.06 lots | 4 trades | ~$12 |

| $500 / mo | 500 pips | 0.10 lots | 4 trades | ~$20 |

| $1,000 / mo | 500 pips | 0.20 lots | 4 trades | ~$40 |

| $3,000 / mo | 500 pips | 0.60 lots | 4 trades | ~$120 |

These are estimates based on 1:500 leverage on USD/JPY. Always adjust for your broker and risk tolerance.

🧠 Why PIPS Stay the Same (But Profits Grow)

This model emphasizes skill first.

- You don’t need to chase more trades

- You don’t need higher win rates

- You just need to capture consistent PIPS and slowly increase your lot size as your account grows

This is how professionals scale: with structure, not with luck.

📌 Strategy Map by Trader Type

🟢 Beginner

- Target: 100–300 pips/month

- Lot Size: 0.01–0.05

- Focus: Learning execution discipline, backtesting

🟡 Side Hustler / Part-Time Trader

- Target: 300–600 pips/month

- Lot Size: 0.05–0.2

- Focus: Reliable setups, compounding gains

🔵 Advanced / Full-Time

- Target: 600+ pips/month

- Lot Size: 0.2+

- Focus: Scaling capital, risk diversification

🛠️ Start Small, Scale Smart

If you can earn 500 pips/month,

you already have the foundation to grow your income.

The secret isn’t to trade more—it’s to repeat what already works, with gradually increasing size.

In the final chapter, we’ll wrap up everything and show why structure always beats emotion in the long game of FX.

Let’s finish strong. 🏁

🏁 Final Chapter: Structure Over Emotion — Why Consistency Wins in the Long Run

Many traders chase the thrill:

the next big move, the perfect indicator, or the hottest strategy.

But the truth is simple:

It’s not the smartest or fastest traders who win.

It’s the most consistent.

And consistency comes from structure.

🧩 What You’ve Learned in This Guide

Let’s recap the key principles behind building income through swing trading:

- PIPS × Lot = Profit

Focus on capturing pips first—money follows naturally. - Use a rules-based method

The Ama-chan Method lets you trade without constant monitoring or emotional interference. - Test, track, improve

Backtesting and journaling remove guesswork and increase confidence. - Set realistic income goals

You now know how to simulate $100 to $3,000 per month based on PIPS and capital. - Trade less, earn more

With a 1:3.5 risk-reward setup, a few high-quality trades per month are all you need.

💡 The Real Edge? Emotional Discipline

The real difference-maker isn’t the setup—it’s your ability to follow it.

If you can:

- Stick to your rules

- Avoid second-guessing

- Control your position size

…then the math takes care of the rest.

🚀 Final Message

You don’t need to become a market genius.

You just need to execute a solid plan, over and over again.

Trade like an engineer. Think in systems. Let the market do the heavy lifting.

📌 Bookmark this guide, revisit the strategy, and start with one simple question:

“Can I capture 500 pips per month, consistently?”

If the answer is yes,

then your income goals are only a matter of time and structure.