Understanding lot size is one of the most overlooked — yet most critical — aspects of Forex trading.

Whether you’re risking too much without realizing it, or missing out on profits due to tiny positions, your lot size directly determines your outcome in every trade.

In this ultimate 2025 guide, you’ll learn:

- What Forex lot size really means (with clear examples)

- How to calculate the right lot size for your account and strategy

- The link between lot size, leverage, and margin

- Special rules for gold (XAU/USD), indices, and crypto

- The best lot size calculators (apps, MT5, Excel)

We’ll also walk you through visual charts, risk management frameworks, and the most frequently asked questions from real traders — so you can finally stop guessing and start trading with precision.

🎯 Master your lot size. Master your risk. Trade like a professional.

- Chapter 1|What Is Forex Lot Size?

- Chapter 2|Lot Size and Pip Value: How It Affects Your Profit/Loss

- Chapter 3|How to Calculate the Right Lot Size

- Chapter 4|Forex Lot Size Calculator Tools (App, MT5, Excel)

- Chapter 5|Lot Size, Leverage, and Margin: Know the Connection

- Chapter 6|Lot Size and Risk Management Strategy

- Chapter 7|Special Cases: Lot Size for Gold, Indices, and Crypto

- Chapter 8|Forex Lot Size Chart & Table (Visual Guide)

- Chapter 9|Common Questions (FAQ)

- Conclusion|Mastering Lot Size = Mastering Risk

Chapter 1|What Is Forex Lot Size?

In Forex trading, lot size refers to the amount of currency units you buy or sell in a trade.

It’s one of the most fundamental — and often misunderstood — aspects of position sizing and risk control.

Whether you’re a beginner or an experienced trader, understanding lot size is essential to managing risk, calculating profits, and executing trades responsibly.

🔹 1.1 Definition of a Lot in Forex

A lot is a standardized quantity of a financial instrument being traded.

In the context of Forex:

- 1 Standard Lot = 100,000 units of the base currency

- The base currency is the first currency in a currency pair (e.g., EUR in EUR/USD)

So if you’re trading 1 lot of EUR/USD, you’re buying or selling 100,000 euros.

🔹 1.2 Types of Lot Sizes

To accommodate different account sizes and trading styles, brokers offer fractional lot sizes as well:

| Lot Type | Size (in units) | Typical Name | Pip Value (USD/JPY) |

|---|---|---|---|

| Standard Lot | 100,000 units | “1 lot” | ~¥1,000 per pip |

| Mini Lot | 10,000 units | “0.1 lot” | ~¥100 per pip |

| Micro Lot | 1,000 units | “0.01 lot” | ~¥10 per pip |

| Nano Lot (rare) | 100 units | “0.001 lot” | ~¥1 per pip |

💡 Note: Some brokers also support custom lot sizes, like 0.25 or 1.5 lots, allowing more granular control.

🔹 1.3 Lot Size vs. Position Size: What’s the Difference?

These two terms are often used interchangeably — but they’re not always the same:

- Lot Size: The size of one individual trade (e.g., 0.2 lots)

- Position Size: The total size of all open trades for a given instrument

For example:

If you open three trades of 0.3 lots each in EUR/USD, your lot size is 0.3, but your position size is 0.9 lots total.

🔹 1.4 Why Lot Size Matters

Choosing the right lot size is not about “how much you can make” —

it’s about how much you’re willing to risk.

Lot size directly affects:

- 💥 Your profit or loss per pip

- 🧮 Your required margin

- 🧠 Your trading psychology (emotional control)

Even with a solid trading strategy, using an oversized lot can destroy your account in just a few trades.

✅ Key Takeaways

- A lot is the unit size of a trade in Forex (1 lot = 100,000 base units)

- You can trade standard, mini, micro, or even nano lots

- Lot size controls how much you gain or lose per pip

- The right lot size is determined by risk, not greed

Chapter 2|Lot Size and Pip Value: How It Affects Your Profit/Loss

In Forex, even a tiny market move can lead to big gains — or losses.

That’s because your lot size determines how much you earn or lose for every single pip that price moves.

This chapter will help you understand how pip value and lot size interact, so you can size your trades appropriately and manage risk like a pro.

🔹 2.1 What Is a Pip?

A pip (short for percentage in point) is the smallest price move in most currency pairs.

- For most pairs (like EUR/USD), 1 pip = 0.0001

- For JPY pairs (like USD/JPY), 1 pip = 0.01

✅ Example:

If EUR/USD moves from 1.1050 to 1.1060 → that’s a 10-pip move.

If USD/JPY moves from 150.00 to 150.10 → that’s also a 10-pip move.

🔹 2.2 Pip Value by Lot Size

The monetary value of 1 pip depends on both:

- The lot size you’re trading

- The currency pair (especially whether JPY or not)

💱 Example: USD/JPY (Assume 1 USD = 150 JPY)

| Lot Size | Units | Value of 1 pip (approx) |

|---|---|---|

| 1.0 (Standard) | 100,000 | ¥1,000 / $6.67 |

| 0.1 (Mini) | 10,000 | ¥100 / $0.67 |

| 0.01 (Micro) | 1,000 | ¥10 / $0.067 |

🔸 The higher the lot size, the bigger your profit or loss per pip.

🔹 2.3 Pip Value Calculation Formula

You can calculate pip value manually:

Pip Value = (1 pip in decimal) × Lot Size × Contract Size ÷ Exchange Rate

For most major pairs (USD as quote currency), this simplifies to:

Pip Value = (Lot Size × 0.0001) × 100,000

🔹 2.4 Why This Matters for Risk Control

Let’s say your stop loss is 30 pips.

| Lot Size | Pip Value | 30-pip Loss |

|---|---|---|

| 0.1 lot | ¥100 | ¥3,000 |

| 0.5 lot | ¥500 | ¥15,000 |

| 1.0 lot | ¥1,000 | ¥30,000 |

As you can see, the same stop loss in pips leads to completely different outcomes depending on your lot size.

This is why successful traders always:

- Know their pip value before opening a trade

- Size their positions based on how much they’re willing to lose (not how much they want to gain)

🔹 2.5 Common Mistakes to Avoid

- ❌ Confusing lot size with risk level

→ A large lot with a tight SL can still be high risk. - ❌ Ignoring pip value in exotic pairs (like gold or crypto)

→ Pip values can be drastically different from major pairs. - ❌ Over-leveraging due to small pip movements

→ Big lot × small pip target = high stress, low consistency.

✅ Key Takeaways

- Pip = smallest price movement in a currency pair (usually 0.0001 or 0.01)

- Pip value increases with lot size and varies by pair

- Always calculate your pip value before entering a trade

- Use pip value × SL to determine potential risk in real money

Chapter 3|How to Calculate the Right Lot Size

Choosing the right lot size isn’t about luck or gut feeling — it’s about risk control.

In this chapter, you’ll learn how to calculate lot size based on your account balance, risk tolerance, and stop loss.

Whether you’re a beginner or experienced trader, this is where disciplined trading begins.

🔹 3.1 Why Lot Size Should Be Based on Risk

Many traders ask:

“How many lots should I trade?”

The real question should be:

“How much am I willing to lose if this trade goes wrong?”

That amount — your risk per trade — is what determines your ideal lot size.

Most professionals recommend risking:

- 1% to 2% of your account per trade

- Never more than 5% (even in high-conviction setups)

🔹 3.2 The Core Lot Size Formula

Here’s the basic formula for calculating your lot size:

Lot Size = Risk Amount in Currency / (Stop Loss in Pips × Pip Value per Lot)

Where:

- Risk Amount = How much you’re willing to lose in money (e.g., $50)

- Stop Loss = Number of pips from your entry to your SL

- Pip Value per 1 lot = Value of 1 pip for the pair (see Chapter 2)

🔹 3.3 Step-by-Step Example (USD/JPY)

Let’s say:

- Account Balance: ¥500,000

- Risk per trade: 2% → ¥10,000

- Stop Loss: 25 pips

- Pair: USD/JPY → 1 lot = ¥1,000 per pip

Apply the formula:

Lot Size = 10,000 / (25 × 1,000) = 0.4 lots

So, in this setup, the safe lot size is 0.4

→ If the trade hits SL (25 pips), you’ll lose exactly ¥10,000.

🔹 3.4 Quick Risk Table (for USD/JPY)

| Balance (JPY) | Risk 2% | SL: 20pips | Recommended Lot |

|---|---|---|---|

| ¥100,000 | ¥2,000 | 20pips | 0.1 lot |

| ¥300,000 | ¥6,000 | 20pips | 0.3 lot |

| ¥500,000 | ¥10,000 | 25pips | 0.4 lot |

| ¥1,000,000 | ¥20,000 | 40pips | 0.5 lot |

💡 The more accurate your stop loss, the more optimized your lot size becomes.

🔹 3.5 When to Adjust Your Lot Size

| Scenario | Lot Size Adjustment Strategy |

|---|---|

| ✅ Account grows steadily | Increase lot size gradually (compounding) |

| ✅ Consecutive losing trades | Lower your lot temporarily (defensive) |

| ✅ High market volatility | Reduce lot to stay safe |

| ✅ Highly probable setup (tested) | Optional increase (with discipline) |

🔹 3.6 Don’t Do This: Common Sizing Mistakes

- ❌ “Revenge trade” with doubled lot size

- ❌ Ignoring stop loss and setting big lot to recover losses

- ❌ Guessing lot size instead of calculating it

Remember: Trading is math, not emotion.

✅ Key Takeaways

- Always size your lot based on risk in currency, not on gut feeling

- Use a clear formula to connect lot size, SL, and account size

- Stick to a fixed risk % per trade (1–2%)

- Adjust lot size as your account grows — or shrinks

Chapter 4|Forex Lot Size Calculator Tools (App, MT5, Excel)

Let’s be honest — calculating lot size manually every time can be tedious.

Fortunately, there are tools that make this process faster, more accurate, and completely stress-free.

In this chapter, we’ll explore the best lot size calculators available, including desktop tools, MT4/MT5 plugins, Excel templates, and the most recommended mobile app: Forex Calculators.

🔹 4.1 Why Use a Lot Size Calculator?

Even if you know the formula (as explained in Chapter 3), calculating lot size on the fly can be:

- ❌ Time-consuming

- ❌ Error-prone

- ❌ Emotionally biased (“I’ll just round it up…”)

With a calculator, you can:

✅ Stay consistent

✅ Maintain discipline

✅ Focus on strategy, not math

🔹 4.2 The Best All-in-One App: Forex Calculators

If you’re looking for one app that does it all, the clear standout is the Forex Calculators app.

📲 Download the Forex Calculators app here:

📱 Key Features:

- Position Size Calculator: Input risk amount & stop loss (in pips) → get optimal lot size instantly

- Pip Value Calculator: Know exactly how much each pip is worth for any pair

- SL/TP Calculator: Automatically calculate price levels based on pips

- Fibonacci Calculator: Quickly mark retracement/extension zones

- Risk Management Focus: Designed to help traders protect capital

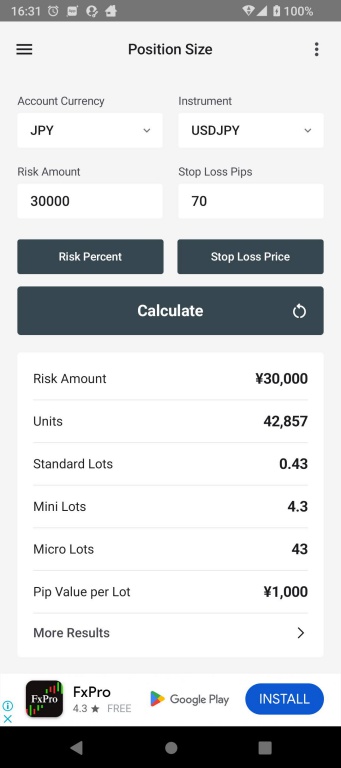

⚙️ How It Works (Position Size):

- Open the app

- Select “Position Size”

- Input your risk amount (e.g., $50)

- Input stop loss (e.g., 25 pips)

- Tap Calculate

→ Your optimal lot size is displayed immediately

✅ Example:

- Risk: ¥30,000

- Stop Loss: 70 pips

→ Result: 0.43 lot

🔒 Why It’s Recommended:

- Works on iOS and Android

- Lightweight and fast

- No login required, no hidden costs

- Only minimal ads (non-intrusive)

💡 With this app, you don’t need Excel sheets or web tools — everything fits in your pocket.

🔹 4.3 MT5/MT4 Plugins & Web Tools

If you prefer desktop platforms or trade directly through MT4/MT5, you can also find helpful plugins:

- MetaTrader Lot Size Indicators: Some custom scripts calculate lot size based on balance and SL

- Cashback Forex Calculator: Web-based, allows advanced parameter input

- Babypips Lot Size Calculator: Simple and trusted in the trading community

🔹 4.4 Excel-Based Lot Size Calculators

For traders who love spreadsheets:

- Build your own tool using the formula:

Lot Size = Risk / (SL × Pip Value) - Set up drop-down menus for:

- Account balance

- Risk %

- Currency pair selection

- Auto-calculated pip value

Great for backtesting or journaling — but not ideal for fast-paced live trading.

✅ Key Takeaways

- Lot size calculators help eliminate emotion and inconsistency in trade sizing

- Forex Calculators app is the best mobile tool for traders on the go

- MT4/MT5 indicators and Excel sheets are great for desktop-based trading

- Choose the method that fits your workflow — but don’t skip the math

Chapter 5|Lot Size, Leverage, and Margin: Know the Connection

Lot size, leverage, and margin are like the three gears of your Forex trading machine.

If you misunderstand one, the whole system can break down.

In this chapter, we’ll explain how these three elements interact — and how to use them strategically, not just technically.

🔹 5.1 What Is Leverage in Forex?

Leverage allows you to control a large position with a relatively small amount of capital.

💡 With 100:1 leverage, you can open a $100,000 position with just $1,000 of margin.

While leverage amplifies both gains and losses, it also affects how much margin is required to place a trade.

🔹 5.2 Margin Explained (in Simple Terms)

Margin is the amount of money that your broker holds as a “security deposit” when you open a trade.

It depends on:

- Your lot size

- The leverage provided

- The currency pair’s current price

🔹 5.3 Margin Calculation Formula

Here’s the basic formula:

Required Margin = (Lot Size × Contract Size × Price) ÷ Leverage

Or simplified for most brokers:

Required Margin (USD) = Notional Trade Size ÷ Leverage

🔹 5.4 Practical Example (USD/JPY, 150.00)

Let’s say you want to trade 1 standard lot (100,000 units) of USD/JPY at 150.00 with different leverage settings:

| Leverage | Required Margin | Control Value | Remarks |

|---|---|---|---|

| 1:1 | $100,000 | $100,000 | No leverage |

| 50:1 | $2,000 | $100,000 | Common in many regions |

| 100:1 | $1,000 | $100,000 | Popular for retail FX |

| 500:1 | $200 | $100,000 | High leverage, low margin |

🚨 The higher the leverage, the lower the required margin — but also the higher the risk if not managed properly.

🔹 5.5 Lot Size and Leverage: The Trade-Off

| You want to… | Consider this… |

|---|---|

| Open larger positions with small capital | Use higher leverage, but watch margin levels |

| Limit risk and preserve capital | Trade smaller lots or reduce leverage |

| Scale in with multiple entries | Ensure enough free margin to handle extra lots |

🔹 5.6 Free Margin and Margin Call

Your free margin = Account Equity – Used Margin

If your equity drops too close to your used margin, your broker may issue a margin call or start auto-closing positions (stop-out).

Proper lot sizing and leverage selection prevents this.

✅ Key Takeaways

- Leverage amplifies your buying power — and your risk

- Margin is the capital required to open a trade based on your lot size

- Higher leverage = smaller margin, but faster account depletion if misused

- Always know how lot size affects your margin usage and available equity

Chapter 6|Lot Size and Risk Management Strategy

Ask any professional trader the key to long-term success in Forex, and they’ll probably say:

“Risk management is everything.”

Lot size isn’t just a number — it’s your risk engine.

This chapter will show how to make lot size the centerpiece of your risk management strategy.

🔹 6.1 Why Lot Size = Risk

Every time you place a trade, you’re putting real money on the line.

Your lot size, combined with your stop loss, determines exactly how much you can lose.

This is why smart traders always ask:

“If this trade fails, how much am I okay losing?”

And from that answer, they calculate their lot size — not the other way around.

🔹 6.2 Risk-Based Lot Sizing Formula (Quick Recap)

As covered in Chapter 3:

Lot Size = Risk Amount ÷ (Pip Value × Stop Loss in Pips)

This formula ensures:

- You risk only what you can afford

- You stay consistent regardless of trade setup

- You avoid emotional, impulsive position sizing

🔹 6.3 Fixed Lot vs Dynamic Lot (Compounding)

| Strategy | Description | Best For |

|---|---|---|

| Fixed Lot | Use the same lot size for all trades | Beginners, stability |

| Dynamic Lot | Adjust lot size based on current balance/risk % | Intermediate–Advanced |

| Hybrid | Increase lot size in tiers as capital grows | Low-frequency traders |

✅ Example:

With a ¥500,000 account:

- Fixed: Always trade 0.2 lots

- Dynamic: Risk 2% = ¥10,000 → SL: 50pips → Lot = 0.2

- As account grows, dynamic lot increases too (compounding effect)

🔹 6.4 Risk-to-Reward Ratio and Expected Value (EV)

Great traders don’t just look at win rate — they focus on reward vs risk.

Formula:

Expected Value (EV) = (Win Rate × Avg Win) − (Loss Rate × Avg Loss)

✅ Winning system example:

- Win rate: 40%

- Reward:risk = 2.5:1 (e.g., SL = ¥20,000, TP = ¥50,000)

EV = (0.4 × 50,000) − (0.6 × 20,000) = ¥20,000 − ¥12,000 = ¥8,000

→ Even with 40% win rate, you’re making ¥8,000 per trade on average — if lot size is properly aligned.

🔹 6.5 Risk Management Checklist

Before placing any trade, ask yourself:

✅ Have I calculated the risk in actual currency?

✅ Is my lot size aligned with my risk tolerance?

✅ Is the reward at least 1.5x or 2x the risk?

✅ Am I consistent with my sizing — win or lose?

If not, stop. Don’t trade until you’ve answered “yes” to all.

✅ Key Takeaways

- Lot size is the bridge between risk theory and actual money

- Use fixed lots for simplicity, dynamic lots for compounding growth

- Focus on risk-to-reward, not just win rate

- Consistency in lot sizing builds discipline — and account longevity

Chapter 7|Special Cases: Lot Size for Gold, Indices, and Crypto

Not all trading instruments follow the same rules as Forex currency pairs.

Gold, indices, and crypto may look similar on a chart, but their lot sizing, pip value, and volatility are completely different.

If you apply standard Forex logic to these assets, you could be taking on way more risk than intended.

Let’s break down the key differences and how to adjust lot size properly for each.

🔹 7.1 Lot Size for Gold (XAU/USD)

Gold is one of the most popular assets outside major currency pairs — and it behaves very differently.

⚠ Key Differences:

- 1 lot = 100 ounces of gold

- Pip value is much higher than currency pairs

- Volatility is extreme (20–100+ pips swings are normal)

- Spread can be wider during off-hours or news

✅ Example:

You open a 1.0 lot trade on XAU/USD.

Gold moves $1 per ounce → Total move = $100 gain/loss.

→ If gold moves $5 → You’re up or down $500 in a single candle.

| Gold Move | 1 Lot (100 oz) | 0.1 Lot | 0.01 Lot |

|---|---|---|---|

| $1 | $100 | $10 | $1 |

| $10 | $1,000 | $100 | $10 |

💡 Even 0.1 lot can be risky in volatile sessions — size down if uncertain.

🔹 7.2 Lot Size for Indices (e.g., US30, NAS100)

Indices like the Dow Jones or Nasdaq aren’t traded in pips — they move in points.

- 1 lot on US30 may equal $1 per point, but brokers differ

- Some use contract-based sizing, others offer CFD mini lots

🔍 Always check:

- The contract size (1 lot = ? units)

- The value per point movement

- The minimum lot allowed (e.g., 0.01 lots)

Example: US30 rises 200 points → With 1 lot, you gain $200.

🔹 7.3 Lot Size for Crypto (e.g., BTC/USD, ETH/USD)

Cryptos are highly volatile, and pip/point values vary drastically across brokers.

- 1 lot of BTC/USD is often equal to 1 BTC

- A $500 move = $500 gain/loss per lot

- Some brokers offer micro lots (0.01 = 0.01 BTC)

⚠ Watch out for:

- Massive overnight gaps

- Increased spread and slippage

- Lot sizing based on contract, not pip

🔹 7.4 Tools That Support Non-FX Lot Calculations

Most standard calculators don’t support gold or indices.

But the Forex Calculators app (featured in Chapter 4) has a “Gold/XAUUSD” mode that lets you:

- Enter contract size

- Input SL in points or pips

- Calculate risk per trade like with currency pairs

✅ Recommended for gold traders or crypto scalpers needing mobile lot size control.

✅ Key Takeaways

- Gold (XAU/USD) = high pip value × high volatility → start with small lots

- Indices and crypto use points, not pips, and may have custom contract sizes

- Always verify the lot size mechanics with your broker

- Use a calculator that supports gold/crypto/indices for safer trading

Chapter 8|Forex Lot Size Chart & Table (Visual Guide)

Understanding lot size calculations is one thing — seeing it in action is another.

This chapter provides visual tables to help you quickly estimate pip values, potential risks, and proper sizing based on your account and trade setup.

Perfect for beginners who want a reference before every trade.

🔹 8.1 Lot Size vs Pip Value Table (USD/JPY Example)

| Lot Size | Units | Pip Value (¥) | Pip Value (USD)* |

|---|---|---|---|

| 1.00 (Standard) | 100,000 | ¥1,000 | ~$6.67 |

| 0.10 (Mini) | 10,000 | ¥100 | ~$0.67 |

| 0.01 (Micro) | 1,000 | ¥10 | ~$0.067 |

*Assuming exchange rate of 150.00 USD/JPY

💡 Use this table to estimate your gain/loss per pip before placing a trade.

🔹 8.2 Risk Estimate Table Based on Stop Loss (USD/JPY)

Let’s assume you’re trading USD/JPY and want to estimate how much you’d lose if your stop loss is triggered.

| Lot Size | 10 pips SL | 30 pips SL | 50 pips SL | 70 pips SL |

|---|---|---|---|---|

| 1.00 | ¥10,000 | ¥30,000 | ¥50,000 | ¥70,000 |

| 0.10 | ¥1,000 | ¥3,000 | ¥5,000 | ¥7,000 |

| 0.01 | ¥100 | ¥300 | ¥500 | ¥700 |

⚠️ Be aware: increasing your lot size directly increases your risk.

→ Use this to match your SL + lot size = risk cap (e.g., 2% of your account).

🔹 8.3 Position Size Guidelines by Account Size (Risk = 2%)

| Account Balance | Risk ¥ (2%) | SL: 30pips | Suggested Lot Size |

|---|---|---|---|

| ¥100,000 | ¥2,000 | 30 pips | 0.06 lot |

| ¥300,000 | ¥6,000 | 30 pips | 0.20 lot |

| ¥500,000 | ¥10,000 | 30 pips | 0.33 lot |

| ¥1,000,000 | ¥20,000 | 30 pips | 0.66 lot |

✅ Keep this table handy to avoid overexposure based on your balance.

🔹 8.4 Printable / Downloadable Reference Option

If you want to carry a quick-reference version:

📝 Coming Soon:

- [Download PDF Chart for USD/JPY Lot Sizes]

- [Download Excel Sheet: Customizable Position Size Tool]

✅ You can also bookmark this chapter or save the chart to your phone for mobile reference.

✅ Key Takeaways

- Visual charts make pip value and risk tangible — not abstract

- Use pre-calculated tables to reduce decision fatigue

- Always know your loss potential before opening a position

- Print or save a reference guide to use alongside your calculator app

Chapter 9|Common Questions (FAQ)

Below are the most frequently asked questions about Forex lot size, based on real-world search trends and beginner confusion.

Use this as your go-to reference when setting up your trades.

❓ Q1. What is the standard lot size in Forex?

A standard lot equals 100,000 units of the base currency.

For example, 1 lot of EUR/USD means you’re buying/selling 100,000 euros.

❓ Q2. What is the smallest lot size I can trade?

Most brokers allow 0.01 lots (also called micro lots), which equals 1,000 units.

Some brokers even offer nano lots (0.001), though they’re less common.

❓ Q3. How much is 1 pip worth per lot?

It depends on:

- The lot size

- The currency pair

Example (USD/JPY):

- 1 lot → ¥1,000 per pip

- 0.1 lot → ¥100

- 0.01 lot → ¥10

Use a pip value calculator or refer to Chapter 2 for detailed tables.

❓ Q4. How do I calculate the right lot size?

Use this formula:

Lot Size = Risk Amount / (Pip Value × Stop Loss in Pips)

Or use an app like Forex Calculators (see Chapter 4).

It lets you set your risk in currency and calculates lot size instantly.

❓ Q5. What’s the difference between lot size and position size?

- Lot size = the size of a single trade

- Position size = total exposure across multiple open trades

E.g., 3 trades of 0.2 lots each → Position size = 0.6 lots

❓ Q6. Is it better to use fixed or dynamic lot sizing?

- Fixed lot sizing: safer for beginners

- Dynamic lot sizing: allows compounding based on account growth

More on this in Chapter 6.

❓ Q7. Does leverage affect lot size?

Not directly.

Leverage affects the margin required, not the lot size you can choose.

But it indirectly increases your risk if you overtrade.

❓ Q8. Can I use the same lot size for gold (XAU/USD)?

No — pip values for gold are much higher than for currency pairs.

Even 0.1 lot of gold can move hundreds of dollars quickly.

Check Chapter 7 for gold-specific examples.

❓ Q9. How much margin do I need per lot?

That depends on:

- The lot size

- The leverage ratio

- The price of the pair

See Chapter 5 for margin calculation examples.

❓ Q10. Is there a quick tool I can use to calculate lot size?

Yes! We recommend:

👉 Forex Calculators App – Android

This app handles everything: pip value, SL/TP, risk % and more.

✅ Bonus Tip

Bookmark this FAQ or print it as a cheat sheet.

The faster you size trades correctly, the more confident and consistent you’ll become.

Conclusion|Mastering Lot Size = Mastering Risk

Forex trading isn’t just about predicting price direction.

It’s about controlling risk, staying consistent, and surviving long enough to let your edge play out.

And at the heart of that?

Your lot size.

🔹 What You’ve Learned

Throughout this guide, we’ve covered:

✅ What lot size means and how it affects pip value

✅ How to calculate lot size based on your risk tolerance

✅ The role of leverage and margin in trade sizing

✅ How lot sizing differs across instruments like gold and crypto

✅ Tools and apps to simplify the process

✅ Visual charts to support quick decisions

✅ The mindset of a trader who respects risk

🔹 Why Lot Size Is More Than Just a Number

Choosing the wrong lot size can turn a good setup into a costly mistake.

Choosing the right lot size turns a losing trade into a manageable lesson — and a winning trade into sustainable progress.

Lot size reflects your:

- Risk discipline

- Emotional control

- Professional mindset

It’s not flashy. But it’s what separates amateurs from long-term survivors.

🔹 Final Advice for Every Trader

- 🎯 Always know how much you’re risking before you click “buy” or “sell”

- 📏 Use calculators — not gut feeling — to set your lot size

- 📈 Track your trades and learn from size-related mistakes

- 🧠 Think in systems and probabilities, not wins and losses

💬 “Trading is not about being right. It’s about managing risk when you’re wrong — and pressing advantage when you’re right.”

🔹 Ready to Trade Smarter?

Before your next trade, ask:

“Is my lot size aligned with my risk?”

If the answer is yes, you’re already ahead of 90% of retail traders.

✅ Download the Forex Calculators App to start sizing your trades the smart way:

→ iOS | Android