📝 Chapter 1: Introduction – Calm Battle Above the 9MA

This morning, I imagined myself at a lakeside café in Zurich, quietly checking the USD/JPY 8-hour chart on my smartphone. That peaceful atmosphere reflects today’s market – calm on the surface, yet full of potential energy.

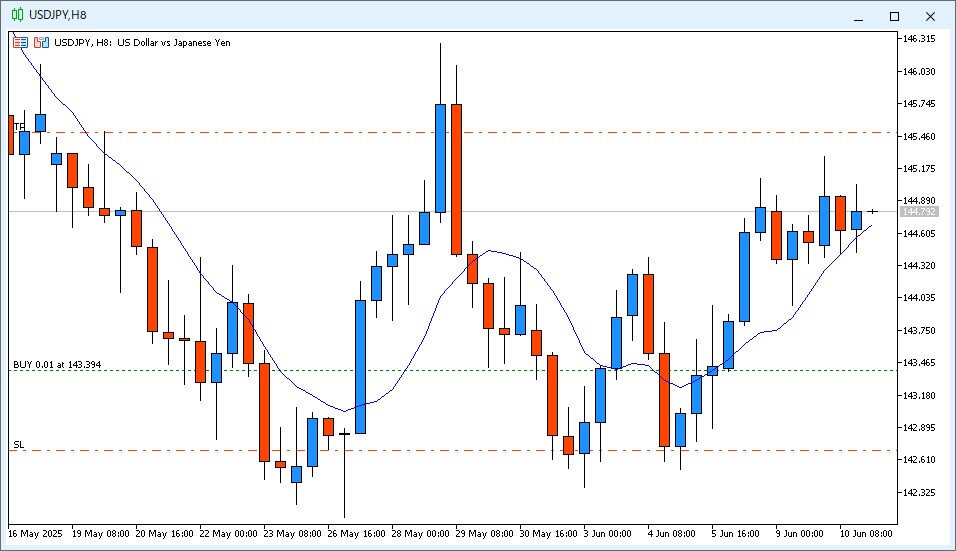

As of 6:00 AM JST on June 11, the USD/JPY long position I entered on June 5 remains open. Price action has been moving sideways, but the pair continues to stay above the 9-period moving average (9MA), maintaining the rationale for holding.

In this log, I’ll share the key trade details, my technical view as of this morning’s check, and the economic indicators scheduled for today. A potential shift may come as early as the next check at 14:00 JST — if price dips below the 9MA, it may trigger an exit. Until then, patience is the strategy.

📊 Chapter 2: Current Position Overview

Here is the current status of the demo trade, based on the USD/JPY 8-hour chart. This long position was opened on June 5 following a bullish candle close above the 9-period moving average (9MA).

| Item | Details |

|---|---|

| Currency Pair | USD/JPY |

| Timeframe | 8-hour chart |

| Entry Time | June 5, around 23:50 JST |

| Entry Price | 143.394 |

| Stop-Loss (SL) | 142.694 (−70 pips) |

| Take-Profit (TP) | 145.494 (+210 pips) |

| Position Size | 0.01 lots (demo trade) |

| Entry Rationale | Bullish candle close above the 9MA |

| Trading Strategy | Ama-chan’s 3-times-a-day chart check method |

This setup is part of a structured strategy that only checks charts at three specific times daily — 6:00, 14:00, and 22:00 JST — reducing noise and encouraging discipline.

🕕 Chapter 3: Market Conditions on June 11, 2025

📅 6:00 JST Check

At the 6:00 AM chart check on June 11, the USD/JPY 8-hour candle had closed bullish, with price still trading above the 9MA. Despite the lack of directional momentum, the position remains technically valid according to the strategy rules.

- Candle Status: Bullish close

- Price vs. 9MA: Price remains above the 9-period moving average

- Decision: Continue holding the long position

- Market Sentiment: Sideways movement has now lasted for 9 candles — indicating a potential breakout could be near

While the position was never expected to become a long-hold scenario, the market’s reluctance to break down keeps the trade alive. The next chart check at 14:00 JST will be critical: if price closes below the 9MA, it may signal an exit. Otherwise, the hold continues.

📅 14:00 JST Check

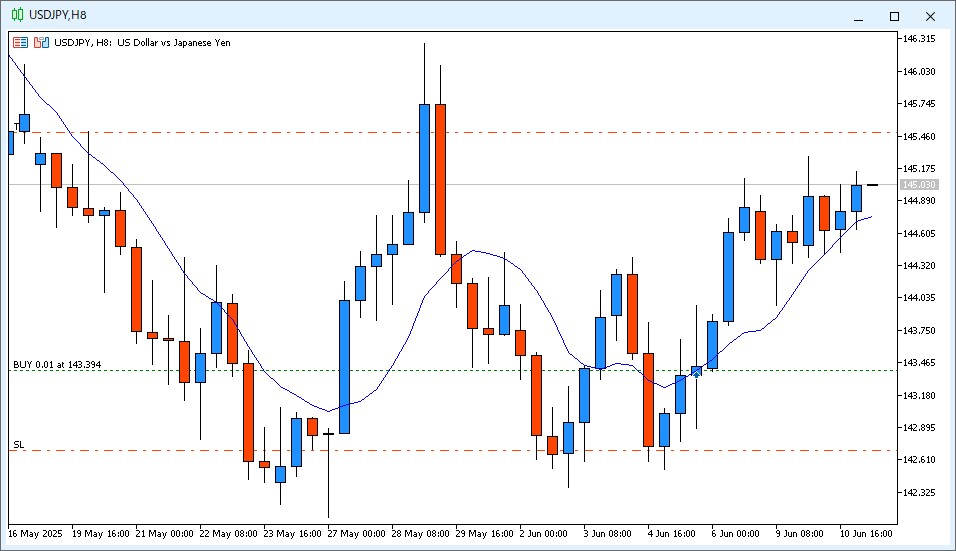

As of the 14:00 JST chart check on June 11, the USD/JPY 8-hour candle closed bullish once again. Price rebounded from the 9MA, and the candlestick from 6:00 to 14:00 shows a clear upward move.

- Candle Status: Bullish close

- Price vs. 9MA: Price continues to hold above the 9MA

- Decision: Continue holding the long position

- Market Observation: An ascending wedge pattern appears to be forming, with both higher highs and higher lows emerging. Although I was mentally prepared to exit if price fell below the 9MA, the pair unexpectedly moved toward the upside. There’s now a chance the position could reach the take-profit level.

📅 Chapter 4: Key Economic Events to Watch Today

Several high-impact U.S. economic indicators are scheduled for release today at 21:30 JST (12:30 UTC). These reports could significantly influence USD volatility and potentially trigger movement in the currently stagnant USD/JPY pair.

| Time (UTC) | Currency | Event |

|---|---|---|

| 12:30 | USD | Core CPI (MoM) for May |

| 12:30 | USD | Consumer Price Index (YoY) for May |

| 12:30 | USD | Consumer Price Index (MoM) for May |

| 12:30 | USD | Crude Oil Inventories |

📌 Why It Matters:

- CPI readings are among the most closely watched inflation indicators by the Fed and market participants. Surprises here can move the dollar sharply.

- Although Crude Oil Inventories are less impactful on USD/JPY directly, they can still influence broader risk sentiment.

With USD/JPY hovering above a key moving average, today’s CPI print could act as a catalyst for a breakout — up or down.

⏱️ Chapter 5: Strategy Outlook – What to Expect at 14:00 JST

The next scheduled chart check is at 14:00 JST (05:00 UTC). This moment will be pivotal in determining whether the current long position should be maintained or closed.

🔍 Strategy Criteria:

- If price remains above the 9MA → Continue holding the long position

- If price closes below the 9MA → Exit the position (manual close)

This binary rule structure is a core component of the “Ama-chan 3-times-a-day check method.” It removes overthinking and emotion from the decision-making process, allowing the market to dictate the next move.

Even though the trade has lasted much longer than initially expected, the 9MA remains intact, which validates the hold — until it doesn’t.

Patience and discipline remain the priorities.

🧘 Chapter 6: Final Thoughts

This trade is a reminder that not every opportunity leads to immediate action — sometimes, holding patiently is the hardest but most effective move.

Since June 5, the USD/JPY pair has been locked in a quiet range, testing the patience of any trader seeking momentum. Yet the strategy has held firm: no 9MA break, no exit. That’s the power of rules-based trading.

Whether the position ends in a win or loss, the process itself reinforces the importance of staying consistent. It also highlights the value of reducing chart noise by limiting check-ins to three times a day.

Let the market move on its own schedule. Our job is simply to stay ready.