On May 20, 2025, U.S. President Donald Trump announced that Russia and Ukraine would “immediately begin negotiations” for a ceasefire, following a two-hour call with Russian President Vladimir Putin.

This unexpected statement sparked a wave of optimism in the markets — but not without skepticism.

How are traders really reacting? In this report, we analyze price action in USD/JPY and XAU/USD, review sentiment on X (formerly Twitter), and outline potential trading scenarios amid geopolitical uncertainty.

- 🧭 Chapter 1: Ceasefire Talks Announced — Trump’s Statement and Putin’s Response

- 💬 Chapter 2: What Traders Are Saying on X (formerly Twitter)

- 📈 Chapter 3: USD/JPY Daily Chart Analysis (May 20, 2025)

- 🟡 Chapter 4: XAU/USD Technical Overview — Post-Cross Consolidation

- 🎯 Chapter 5: Strategy Scenarios — From Optimism to Breakdown

- 🧩 Chapter 6: Key Takeaways and What to Watch Next

🧭 Chapter 1: Ceasefire Talks Announced — Trump’s Statement and Putin’s Response

On May 20, 2025, U.S. President Donald Trump announced that Russia and Ukraine would immediately begin negotiations for a ceasefire, following a two-hour phone call with Russian President Vladimir Putin. The announcement marked a rare diplomatic breakthrough in a conflict that has dragged on for years, with devastating human and economic costs.

In a Truth Social post, Trump described the conversation as productive and optimistic. He emphasized that both Russia and Ukraine would benefit greatly from peace and potential trade with the United States. He also mentioned that the Vatican, represented by the Pope, had expressed interest in hosting the peace talks.

“Russia and Ukraine will immediately start negotiations toward a Ceasefire and, more importantly, an END to the War. Russia wants to do largescale TRADE with the United States when this catastrophic ‘bloodbath’ is over — and I agree.”

President Donald Trump, Truth Social (@realDonaldTrump)

— President Donald Trump, Truth Social (@realDonaldTrump)

Meanwhile, President Putin confirmed the duration and tone of the call, calling it “very informative and very frank.” He stated that Moscow was willing to work with Ukraine on a memorandum for a possible peace accord, though the Kremlin signaled that finalizing any agreement would still take time.

From the Ukrainian side, President Volodymyr Zelenskyy acknowledged the talks but stopped short of confirming immediate progress. He indicated that a high-level international meeting involving the U.S., EU, U.K., Russia, and Ukraine was being considered, possibly to be hosted in Turkey, the Vatican, or Switzerland.

💬 Chapter 2: What Traders Are Saying on X (formerly Twitter)

The ceasefire announcement quickly sparked diverse reactions from traders and analysts on X (formerly Twitter). While some welcomed the possibility of peace, others remained skeptical of the political motives and practical implementation of the talks.

Here are some representative posts:

🟢 Optimistic Takes

@WarClandestine:

“Putin speaks after the phone call with Trump. He confirms it lasted over two hours, and described it as ‘very informative, very frank’ and ‘very useful’. It sounds like the call went well, and both sides are interested in a peaceful solution!”

@WarClandestine

@Huberton:

“JUST ANNOUNCED: President Trump: ‘Russia and Ukraine will immediately start negotiations toward a Ceasefire and, more importantly, an END to the War. The Pope of the Vatican will host the talks.'”

@Huberton

@EricLDaugh:

“BREAKING: After his 2+ hour call with Putin, Trump announces Russia and Ukraine will ‘IMMEDIATELY’ begin direct negotiations. The NEW POPE may host the peace talks at the Vatican.”

@EricLDaugh

🔴 Skeptical Voices

@BrianJBerletic:

“Trump again repeats the malicious/deliberate lie that the US is a mediator rather than the instigator of the war. The conflict in Ukraine is a US war. The war can only end if the US ends its capture and control of Ukraine.”

@BrianJBerletic

@RWApodcast:

“The Trump–Putin call lasted over two hours. I wonder what they were actually talking about…”

@RWApodcast

These mixed reactions reflect the deep geopolitical divide among market participants. While some see this as a potential turning point toward de-escalation and risk-on sentiment, others fear it’s another round of political theater with limited real-world impact — at least for now.

📈 Chapter 3: USD/JPY Daily Chart Analysis (May 20, 2025)

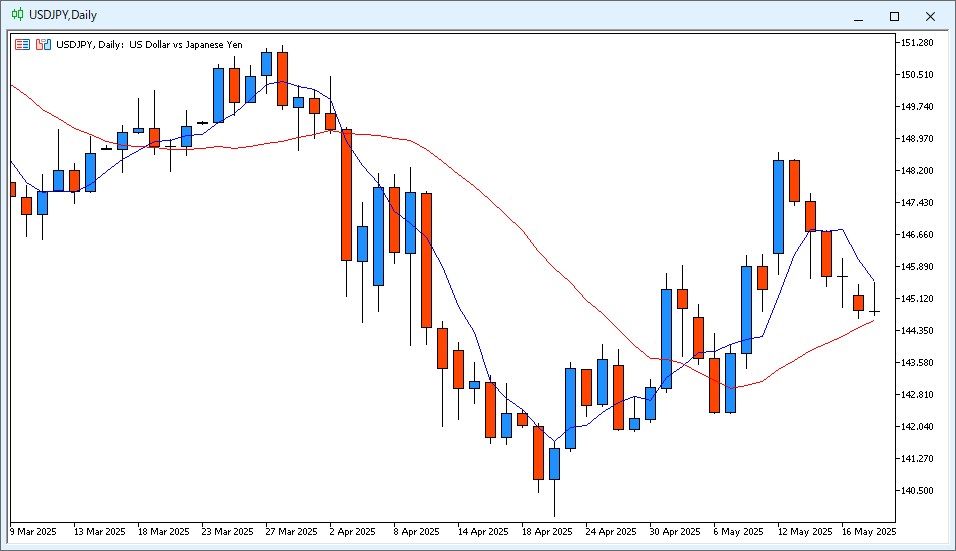

From Ama-chan’s perspective, the USD/JPY daily chart as of 11:25 AM JST on May 20 shows a market in hesitation, caught between technical structure and fundamental uncertainty.

Although the price remains above the 20-day moving average, it has dipped toward it, suggesting growing yen-buying pressure. However, the moving averages are still in a bullish configuration — with the 5-day MA above the 20-day — which means a return of dollar-buying momentum can’t be ruled out.

That said, no clear bullish signal has emerged just yet.

At this point:

- Shorting USD/JPY feels late, as most of the downward move has already played out.

- Going long also lacks technical confirmation, as price hasn’t clearly reversed.

- For swing traders or positional traders, this looks like a classic “sit-and-wait” zone.

In contrast, short-term strategies such as scalping or intraday trading may still find opportunities amid the intraday volatility — especially with macro headlines in play.

🟡 Chapter 4: XAU/USD Technical Overview — Post-Cross Consolidation

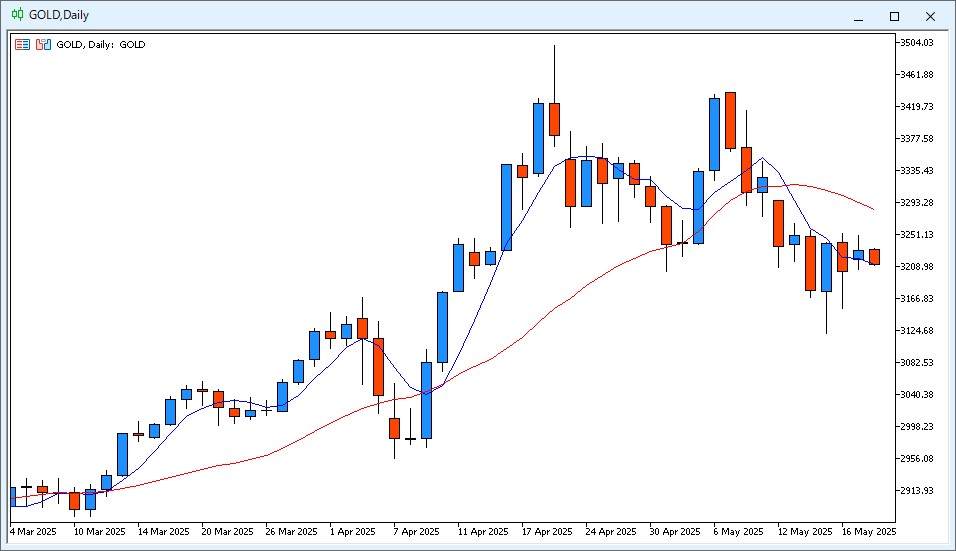

From Ama-chan’s perspective, the XAU/USD daily chart as of 11:30 AM JST on May 20 reflects a technical crossroads, where directional conviction remains muted despite the backdrop of geopolitical headlines.

A bearish crossover (death cross) has recently formed, with the 5-day moving average crossing below the 20-day moving average. However, this is not yet a clean signal to enter a short, as price action shows signs of indecision rather than clear breakdown.

Currently, gold is hovering around $3,210, caught in a congestion zone where bulls and bears continue to battle for control.

While a drop toward the $3,000 area cannot be ruled out, such a move could ultimately set the stage for a longer-term rebound, especially if geopolitical risks resurface or the Fed pivots unexpectedly.

At this stage:

- Shorts are risky unless further downside momentum confirms breakdown below support zones.

- Longs are premature without a technical reversal pattern or catalyst.

- For now, neutral to cautious positioning is advised until the market chooses a direction.

In short, this is not yet a breakout nor a breakdown — just a pause with potential.

🎯 Chapter 5: Strategy Scenarios — From Optimism to Breakdown

Geopolitical headlines rarely translate into clean, one-directional moves. Instead, traders must consider multiple outcomes and their potential market implications.

Here’s how Ama-chan frames the two dominant ceasefire-related scenarios:

🟢 Scenario 1: Ceasefire Talks Gain Momentum — Market Turns Risk-On

If Russia and Ukraine make tangible progress toward a ceasefire and a summit is confirmed, risk appetite may strengthen across global markets.

Possible Reactions:

- USD/JPY: Bullish bias may resume as equities rise and U.S. yields rebound.

- XAU/USD: May weaken as safe-haven demand fades.

- EUR/USD: Could strengthen (euro appreciation), especially if European equities rally and energy security concerns ease.

- USD/CHF: Likely to rise as the Swiss franc loses its safe-haven premium.

Strategy Idea:

Favor long positions in risk pairs (e.g., AUD/JPY, EUR/JPY) and look to fade gold rallies near resistance zones.

🔴 Scenario 2: Ceasefire Talks Stall or Lose Credibility — Market Reverts to Risk-Off

If skepticism grows, or talks collapse due to lack of trust or battlefield escalations, markets may return to safety-seeking behavior.

Possible Reactions:

- USD/JPY: May decline toward MA support as yen demand rises.

- XAU/USD: Could surge toward previous highs on renewed uncertainty.

- EUR/USD: Could weaken, especially if eurozone remains vulnerable to energy or political instability.

- USD/CHF: May fall as Swiss franc regains safe-haven flows.

Strategy Idea:

Reenter long gold trades on dips and consider shorting USD/JPY on failure to hold above the 20-day MA.

Markets are often forward-looking, but execution depends on confirmation, not just headlines.

Traders should watch for price action and volume shifts to align with either scenario before committing.

🧩 Chapter 6: Key Takeaways and What to Watch Next

The ceasefire narrative emerging from the Trump–Putin call has injected a fresh layer of geopolitical sensitivity into markets. While headlines may suggest progress, traders are well aware that “talks” are not “peace.”

Here’s a summary of key insights from Ama-chan’s analysis:

✅ Key Takeaways

- Trump’s announcement of immediate ceasefire negotiations sparked temporary optimism, but price action remains cautious across major pairs.

- USD/JPY is caught near the 20-day MA — not yet reversing, but not collapsing either.

- XAU/USD is consolidating under a death cross, lacking momentum but holding ground near $3,210.

- Market sentiment on X (formerly Twitter) is divided: some applaud the diplomatic breakthrough, others call it political theater.

- Traders are in “show me” mode — waiting for actions, not words.

👀 What to Watch Next

- Confirmation of Ceasefire Talks Venue:

Will the Vatican or another neutral location host the summit? - Statements from Zelenskyy or EU leaders:

Concrete steps or skepticism could tilt risk sentiment sharply. - Gold’s reaction to macro data and Fed speeches:

Especially in context of falling safe-haven demand. - USD/JPY holding above or breaking below the 20-day MA:

A key line in the sand for swing traders. - Upcoming economic events:

- May 21: UK CPI

- May 22: US Jobless Claims, PMI

- May 23: Japan CPI, US New Home Sales

“Markets don’t reward everyone. At some point, they shake out the weak hands.”

But with patience and clarity, you don’t have to be the one getting shaken.