Forex Guides for Beginners

Forex Guides for Beginners Awaken: The Brutal Truth of Forex and the Only Way to Survive the Financial Arena

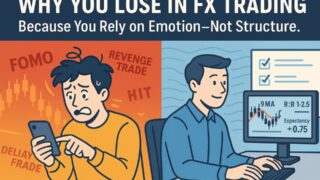

Discover the brutal truth behind the forex market — a battlefield where emotions are liabilities and only structure leads to survival. This guide reveals the mindset, tools, and actions you need to reclaim your financial power and fight like a true warrior.