📝 Introduction|Why May 2025 BOE Meeting Matters

The Bank of England (BOE) is set to announce its latest monetary policy decision on May 8, 2025, with growing expectations of a 25-basis-point rate cut. With the policy rate currently at 4.50%, the question isn’t just whether the BOE will ease—but how fast, and for how long.

What’s fueling this anticipation is the global market disruption caused by the Trump administration’s new tariff measures. Since returning to the White House in January 2025, President Donald Trump has introduced sweeping import duties, triggering a risk-off mood across financial markets. The potential spillover into UK trade, inflation, and business confidence has now become a critical consideration for BOE policymakers.

At the same time, the BOE faces a complicated domestic picture: inflation is still hovering well above its 2% target, wage growth remains robust, but economic activity and hiring intentions are showing signs of slowing. This policy crossroads makes the May meeting especially pivotal—not just for sterling traders, but for broader risk sentiment.

This article breaks down:

- Where the BOE stands after its recent decisions

- How inflation, unemployment, and wage trends are shaping the policy debate

- What economists and markets are forecasting for May and beyond

- The likely impact on GBP pairs such as GBP/USD and GBP/JPY

Let’s explore the data and signals ahead of the May 8 MPC meeting—and what it could mean for your next trade.

- Chapter 1: A Quick Recap: Current BOE Rate and Recent Changes

- Chapter 2: BOE Rate Trends vs Inflation: A 10-Year Perspective

- Chapter 3: Economic Indicators Driving BOE Decisions

- Chapter 4: Market Expectations Ahead of the May 2025 BOE Meeting

- Chapter 5: FX Market Impact: GBP/USD Outlook and Chart Signals

- Chapter 6: Upcoming Key Dates and Scenario Planning

- Conclusion: Navigating the BOE Decision in a Shifting Landscape

Chapter 1: A Quick Recap: Current BOE Rate and Recent Changes

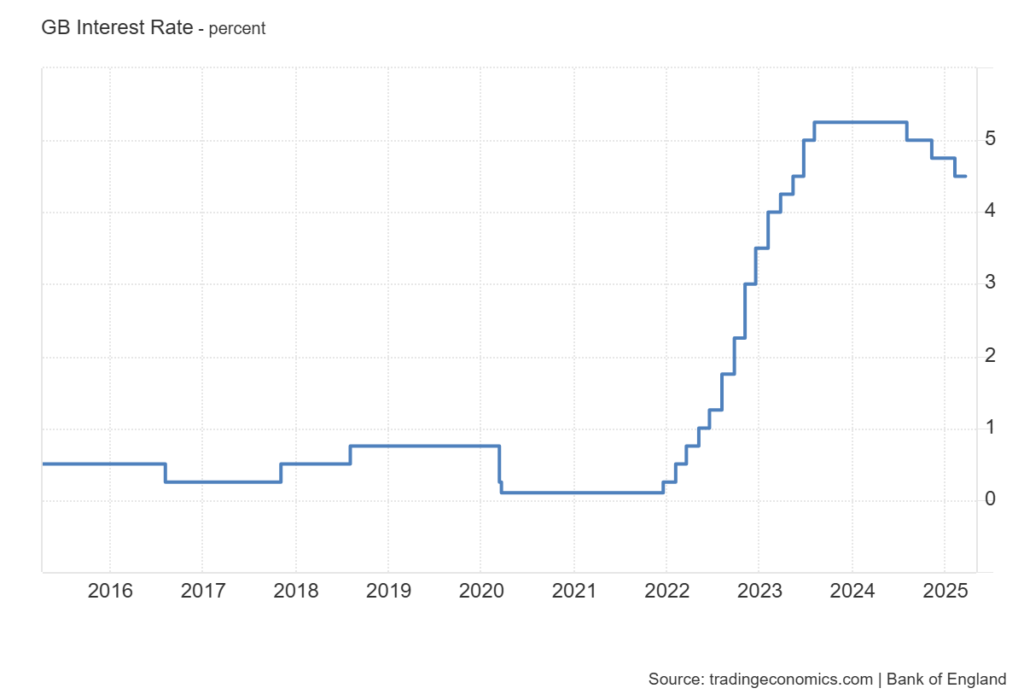

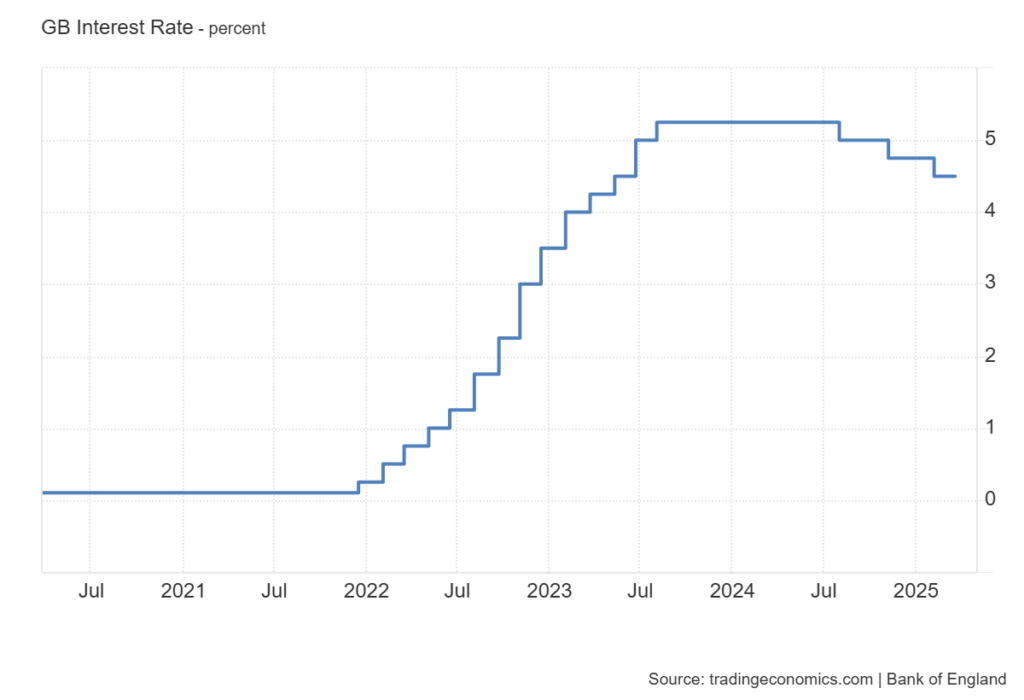

As of the most recent Monetary Policy Committee (MPC) meeting held on March 20, 2025, the Bank of England (BOE) maintained its policy rate at 4.50%. This marks the third consecutive meeting with no rate change, following a gradual shift from the peak rate of 5.25% recorded in mid-2023.

Recent Rate Timeline (Past Year)

- June 2023 – August 2023: Rate peaked at 5.25%

- November 2023 – December 2023: No change at 5.25%

- February 2024: First cut to 5.00%

- December 2024: Further cut to 4.75%

- March 2025: BOE holds rate at 4.50%

This steady decrease in the policy rate indicates a subtle pivot toward monetary easing, but not without restraint. The BOE continues to balance inflation concerns with signs of economic slowdown—especially as geopolitical and trade-related risks intensify, most notably due to newly imposed U.S. tariffs under the Trump administration.

The next scheduled MPC meeting is set for May 8, 2025 at 20:00 JST, where markets widely expect another 25 basis point rate cut to bring the policy rate to 4.25%.

Chapter 2: BOE Rate Trends vs Inflation: A 10-Year Perspective

Over the past decade, the Bank of England’s interest rate policy has undergone dramatic shifts—oscillating between post-Brexit stimulus, pandemic-era emergency cuts, and the aggressive tightening phase of 2022–2023. Understanding how these shifts align with inflation trends is key to interpreting the BOE’s current stance.

2015–2021: Low Rates, Subdued Inflation

From 2015 to early 2022, the UK’s base rate hovered at or below 0.75%, with a notable drop to 0.10% during the COVID-19 crisis. Inflation during this period remained largely stable, often near or slightly above the BOE’s 2% target. The focus was on supporting economic recovery and avoiding deflation.

2022–2023: Inflation Surge and Rate Hikes

Starting in late 2021, inflation began to surge—fueled by energy shocks, global supply chain disruptions, and wage pressures. The Consumer Price Index (CPI) peaked above 10% in late 2022. In response, the BOE hiked rates rapidly, reaching a 5.25% peak by mid-2023.

2024–2025: Cooling Inflation, Gradual Cuts

As inflation began to cool—3.4% as of March 2025—the BOE shifted to a more cautious tone. Rate cuts began in early 2024, with economists viewing the easing cycle as data-dependent. Despite headline inflation falling, persistent wage growth and sticky service prices have kept the BOE from pivoting aggressively.

Chapter 3: Economic Indicators Driving BOE Decisions

Inflation, Unemployment, and Wage Growth in Focus

The Bank of England’s rate decisions are not made in isolation—they’re anchored in a trio of key economic indicators: inflation, unemployment, and wage growth. Each of these metrics provides a distinct lens into the health of the UK economy and shapes the Monetary Policy Committee’s (MPC) policy path.

📌 Inflation: Still Above Target

As of March 2025, UK inflation stands at 3.4%, down significantly from its 2022 peak above 10%. However, it still exceeds the BOE’s 2% target, raising concerns about persistent price pressures.

- 🔺 Short-term risks include higher energy costs and a potential rebound in global commodity prices.

- 🔻 Medium-term disinflation is supported by a stronger pound and lower imported goods prices.

The BOE remains cautious, recognizing that inflation expectations remain sticky, and premature easing could backfire.

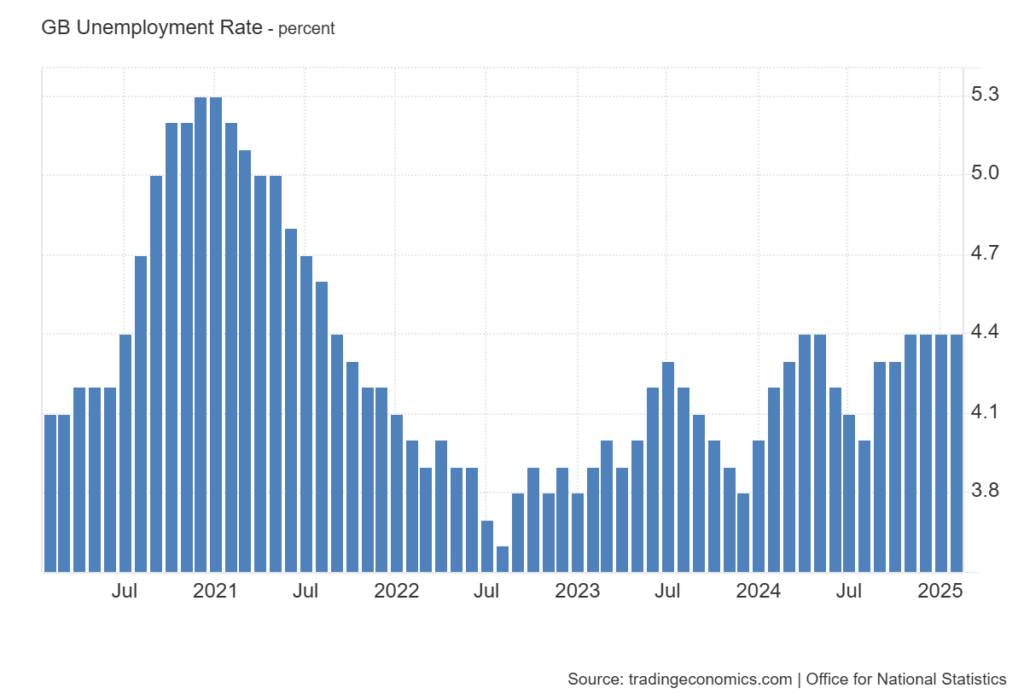

📉 Unemployment: Gradually Rising

Unemployment has begun creeping upward, reaching 4.4% in early 2025—its highest level since 2021. While this is not alarmingly high in historical terms, the trend suggests a cooling labor market.

- Recruitment surveys indicate declining job openings.

- Employers cite wage pressures and geopolitical uncertainties as key headwinds.

A further rise in unemployment could strengthen the case for rate cuts, especially if inflation continues to fall.

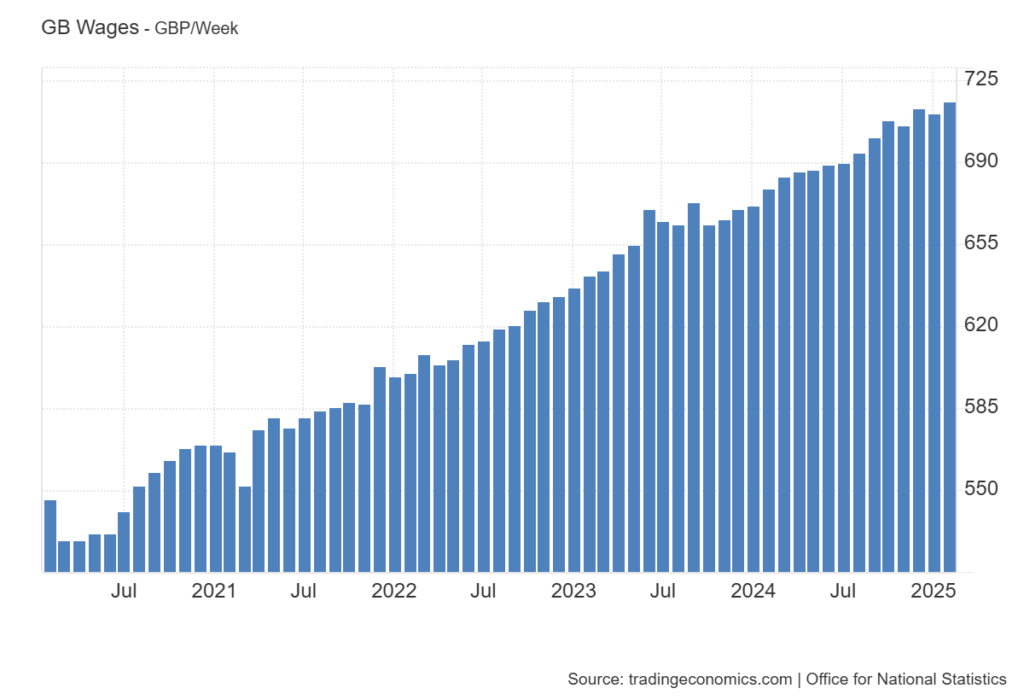

💷 Wage Growth: A Persistent Concern

Wages are still growing at an annual pace of nearly 6%, well above the BOE’s comfort zone. This real wage resilience complicates the rate-cut narrative, as it could reignite inflation through demand-side pressures.

- The BOE must weigh the trade-off between controlling inflation and supporting employment.

- Sustained wage growth could delay aggressive easing despite rising jobless figures.

Chapter 4: Market Expectations Ahead of the May 2025 BOE Meeting

As the Bank of England’s May 2025 meeting approaches, both economists and financial markets are broadly aligned in their expectations: a 25 basis point rate cut is widely anticipated. This would bring the benchmark interest rate from 4.50% to 4.25%, marking the fourth consecutive cut since August 2024. However, what’s garnering even more attention is the potential acceleration of the easing pace, driven in part by external economic shocks—most notably, U.S. President Donald Trump’s aggressive tariff policies.

Economists: From “Cautious Easing” to “Proactive Defense”

Until recently, the BOE maintained a “cautious and gradual” easing stance, balancing the disinflationary trend against persistently high wage growth. But several key economists, including Rob Wood of Pantheon Macroeconomics, are calling for a strategic shift. According to Wood:

“Prior to the tariff announcement, the UK economy was on a soft-landing trajectory. But with Trump’s trade policies chilling global demand, faster and more frequent rate cuts are now justified.”

He projects back-to-back cuts in May and June—something not seen since 2020 during the early COVID crisis.

Market Pricing: Dovish Expectations Firming

Short-term interest rate futures reflect the growing dovish sentiment. Markets now price in a BOE rate of 3.50% by year-end 2025, more aggressive than the consensus among economists (3.75%). This pricing suggests that traders believe the BOE may eventually go beyond the “every-three-months” easing pace.

The divergence between market pricing and economist forecasts highlights uncertainty around how global risk factors—especially U.S. trade disruptions—will evolve and influence BOE policy.

Inflation and Wages: The Counterweights

While inflation has cooled (March CPI: 2.6%), and is projected to decline further to 2.1% by year-end according to UBS, wage growth remains stubbornly high, hovering just under 6%. This puts BOE policymakers in a bind: while macroeconomic headwinds call for easing, strong domestic wage inflation argues for restraint.

Nevertheless, even traditionally hawkish voices, such as BOE’s Greene, have acknowledged that Trump’s tariffs may exert downward pressure on prices, by rerouting cheaper foreign goods into the UK market.

Chapter 5: FX Market Impact: GBP/USD Outlook and Chart Signals

As the May 2025 BOE meeting nears, GBP/USD finds itself at a critical technical juncture. Despite short-term bullish momentum, longer-term resistance levels are testing the pair’s ability to sustain gains—making the policy decision and forward guidance all the more impactful for currency traders.

📊 Monthly Chart: Resistance at 1.33747

On the monthly timeframe, GBP/USD has staged a notable rally since early 2025, with three consecutive bullish candles from February through April. However, April’s candle touched the 1.33747 level—the closing price from September 2024—which now acts as a clear horizontal resistance.

This zone has already triggered a pause in the uptrend, indicating market hesitation ahead of key macroeconomic catalysts.

If the pair can decisively close above 1.33747 on a monthly basis, the next major target emerges around 1.4000, a psychologically significant round number and structural resistance.

⚠️ Until a breakout is confirmed, upward movement may remain capped, and traders should be alert for false breakouts or rejections.

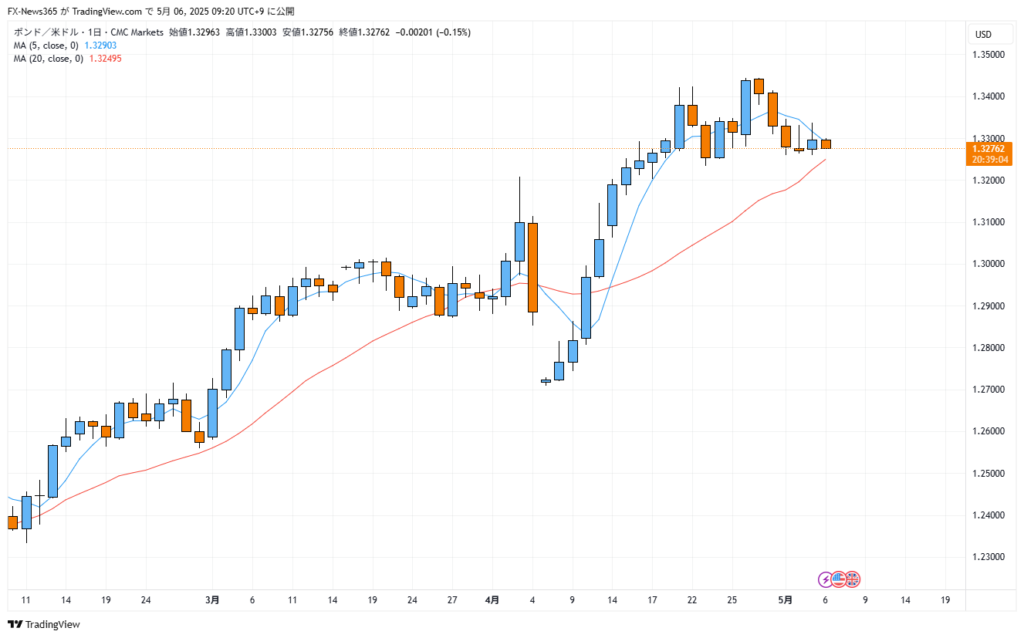

📉 Daily Chart: 20-Day MA as a Tactical Pivot

On the daily chart, GBP/USD is hovering just above the 20-day moving average (currently near 1.32495), which has acted as dynamic support throughout the recent uptrend.

If this support holds and bullish momentum resumes, the pair may once again test and potentially break above the 1.33747 ceiling.

Conversely, a daily close below the 20-day MA could shift sentiment more decisively in favor of the U.S. dollar, opening the door to a retracement toward 1.28400, the next visible support zone.

🧭 BOE Guidance = Directional Cue

While technicals show critical thresholds on both sides, the BOE’s tone and pace of easing will likely determine the next major move. A dovish surprise or accelerated rate cut path could pressure the pound, whereas a more cautious stance—especially if paired with softer U.S. data—could provide GBP with room to break higher.

Chapter 6: Upcoming Key Dates and Scenario Planning

With the Bank of England’s next rate decision scheduled for May 9, 2025, traders are watching key economic indicators and geopolitical developments closely. Let’s map out the crucial dates ahead and explore potential market scenarios based on likely policy paths.

📅 Key Upcoming Events (as of May 6, 2025)

| Date | Event | Relevance |

|---|---|---|

| May 7, 2025 | U.S. FOMC Meeting Minutes Release | May influence USD strength |

| May 9, 2025 | BOE Rate Decision & Monetary Policy Report | Key driver for GBP pairs |

| May 13, 2025 | U.S. CPI (April) | Affects GBP/USD via USD reaction |

| May 13, 2025 | UK Unemployment & Wage Data (March–April) | Will shape BOE’s tone for June |

| May 21, 2025 | UK CPI (April) | Crucial for next inflation outlook |

| June 19, 2025 | Next BOE Rate Decision | May see a second consecutive cut |

🧭 Scenario Planning: How Markets Might React

🟩 Scenario A: BOE Cuts Rates by 25bps (as Expected)

- Market View: Already priced in by bond yields and futures.

- GBP/USD Reaction: Likely limited if the messaging is neutral.

- GBP/JPY Reaction: May see yen buying if risk sentiment deteriorates alongside dovish BOE.

🟥 Scenario B: BOE Surprises with 50bps Cut

- Market View: Unexpected acceleration in easing.

- GBP/USD: Sharp downside likely toward 1.3000 or below.

- GBP/JPY: Break of technical support zones possible, with risk-off flows favoring JPY.

🟨 Scenario C: BOE Holds Rates Steady (No Cut)

- Market View: Hawkish surprise amid sticky inflation.

- GBP/USD: Rally toward 1.3400 possible, especially if U.S. data underwhelms.

- GBP/JPY: Could break above 195.00 depending on risk appetite.

🔎 What to Watch After the May Decision

- Forward Guidance Language: Does the BOE shift from “gradual and cautious” to “data-dependent”?

- BOE Inflation Forecasts: Lower CPI projections could justify additional easing.

- Wage Growth vs. Core CPI: Will wage momentum stay uncomfortably strong?

This chapter prepares traders not just for the May decision but for a broader path of UK monetary policy in Q2–Q3 2025. Whether the BOE stays in easing mode or shifts gears will shape GBP volatility in the months ahead.

Conclusion: Navigating the BOE Decision in a Shifting Landscape

As the May 2025 BOE meeting approaches, the landscape for UK monetary policy is anything but settled. A weakening labor market, persistent inflation concerns, and rising geopolitical risks—particularly from the renewed U.S. trade stance under President Trump—all collide at a critical juncture.

Whether the BOE opts for a rate cut, stands pat, or signals an accelerated easing path, traders must stay nimble. The GBP’s direction hinges not only on the policy rate itself but on how markets interpret forward guidance, macroeconomic data, and global risk sentiment.

Technical charts—especially for GBP/JPY and GBP/USD—suggest we’re at potential inflection points. Meanwhile, inflation data, wage growth, and unemployment trends will continue to guide the Bank’s thinking through the rest of 2025.

In volatile times like these, informed decisions start with staying current. Revisit this article after the BOE’s announcement for a clearer view of where policy and price action are headed next.