📘 Chapter 1: Trade Summary – Long Exit and New Short Entry

On June 12, 2025, I exited my USD/JPY long position manually during the 6:45 AM chart check after the 8-hour candle clearly closed below the 9MA. This marked a technical shift, suggesting a possible trend reversal, especially following the sharp 100+ pip drop triggered by the U.S. Core CPI release the night before.

As per my “Ama-chan’s 3-Times-a-Day Check Method,” a confirmed candle break below the 9MA is a valid exit signal. Although the position hadn’t hit my take-profit level, I secured gains by following the system rules.

Immediately after the exit, I initiated a new short position based on the same 8-hour chart signal. The bearish candle had closed decisively below the 9MA, providing a clean entry point for a downside move.

Here’s a summary of both trades:

✅ Closed Long Position (Demo Trade)

- Pair: USD/JPY

- Timeframe: 8-hour chart

- Entry Price: 143.394

- Exit Price: 144.486

- Take Profit: 145.494 (+210 pips target)

- Stop Loss: 142.694 (−70 pips)

- Reason for Exit: Candle closed below 9MA

- Lot Size: 0.01 (Demo account)

- Strategy Used: Ama-chan’s 3-Times-a-Day Check Method

✅ New Short Position (Demo Trade)

- Pair: USD/JPY

- Timeframe: 8-hour chart

- Entry Time: Around 6:45 AM, June 12

- Entry Price: 144.483

- Take Profit: 142.383 (+210 pips)

- Stop Loss: 145.183 (−70 pips)

- Entry Trigger: Bearish candle closing below the 9MA

- Lot Size: 0.01 (Demo account)

- Strategy Used: Ama-chan’s 3-Times-a-Day Check Method

📊 Chapter 2: Economic Events to Watch on June 12, 2025

Following the volatility sparked by the June 11 U.S. Core CPI release, June 12 brings additional economic events that may further influence USD pairs, especially USD/JPY. Traders should be cautious during these time windows, as intraday volatility may increase.

Here are the key events to monitor:

🇬🇧 United Kingdom

- Time: 15:00 (JST)

- Event: Monthly GDP (April)

- Impact: May influence GBP pairs but generally has limited direct impact on USD/JPY unless it shifts global risk sentiment.

🇺🇸 United States

- Time: 21:30 (JST)

- Events:

- Initial Jobless Claims: Weekly labor data that can affect market sentiment toward the U.S. economy.

- Producer Price Index (PPI) for May (MoM): An important inflation gauge that could confirm or challenge the CPI trend from the previous day.

Given that the June 11 CPI already caused a significant market reaction, these upcoming numbers may either reinforce or reverse the emerging narrative. For short-term traders, timing positions around these releases—or staying flat—is part of prudent risk management.

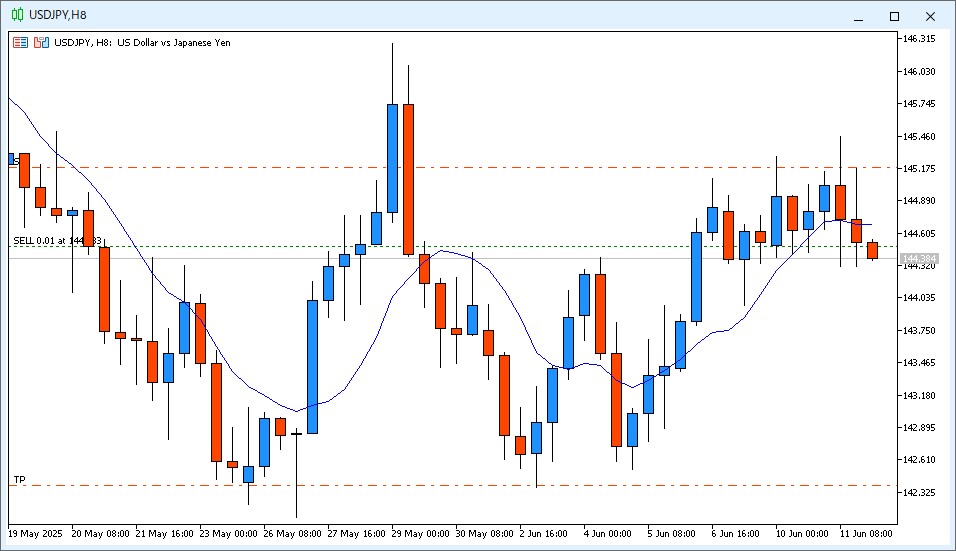

📉 Chapter 3: 6AM Chart Review – 9MA Break Confirmation

At 6:45 AM JST on June 12, I performed my third and final chart check of the day using the “Ama-chan’s 3-Times-a-Day Check Method.” Although I usually check the chart at precisely 6:00 AM, I overslept slightly—but the timing didn’t affect the decision, as the 8-hour candle had already confirmed a decisive move.

🔍 Chart Observation

- The 8-hour candlestick had clearly closed below the 9-period moving average (9MA).

- A bearish candle had formed, breaking below the support line represented by the 9MA.

- This setup satisfied my rule for a trend shift and confirmed the need to close the long position and initiate a short.

This confirmation was consistent with the broader technical context: after the sharp drop triggered by the U.S. CPI report, the market appeared to be rejecting higher prices, favoring a downside continuation. Rather than anticipating or hesitating, I followed the system strictly and executed both the exit and new entry accordingly.

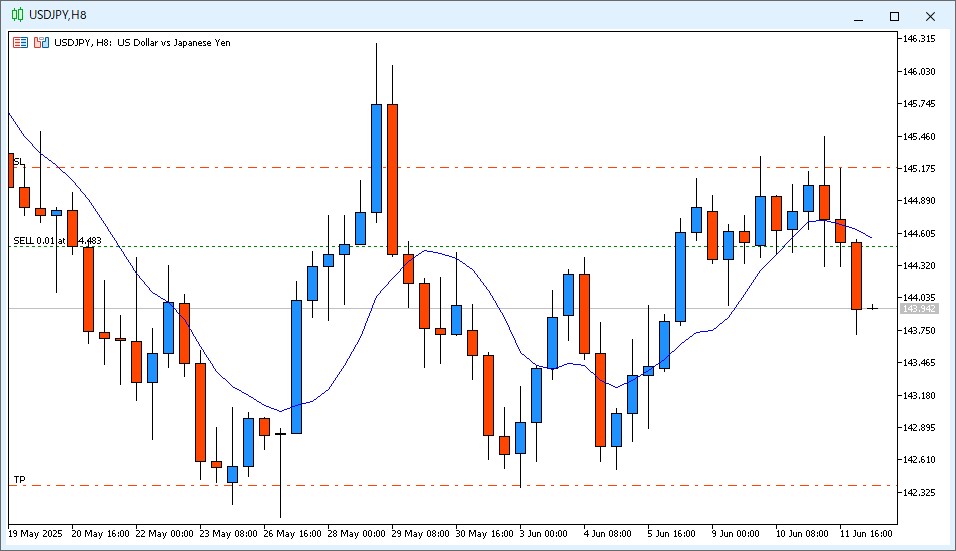

📅 2PM Chart Check – June 12

At around 2:00 PM JST, I conducted the second of three daily chart reviews.

- Candle Status: Another bearish candle had closed.

- 9MA Relationship: The price continued to stay below the 9-period moving average.

- Decision: Hold the short position.

- Emotion: I’m relieved to see the market moving further in favor of JPY strength.

The chart at this point showed a clear “SELL 0.01 at 144.483” label, confirming that the short position remains open and in line with the strategy.

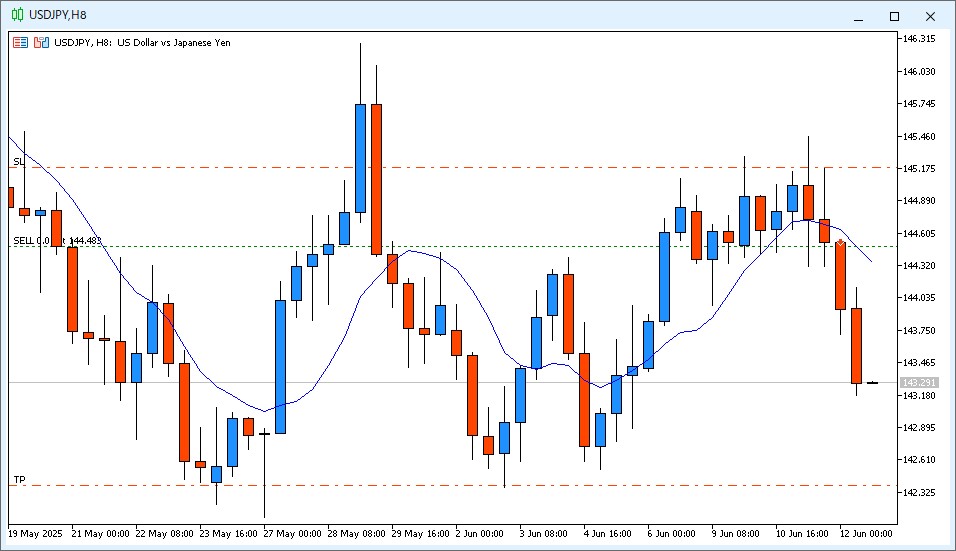

📅 10PM Chart Check – June 12

At around 10:00 PM JST on June 12, I completed the final chart check of the day.

- Candle Status: Another bearish candle had closed.

- 9MA Relationship: The price continued to stay below the 9-period moving average.

- Decision: Hold the short position.

- Emotion: The sharp drop made me genuinely happy. It seems the movement was triggered by the release of U.S. Initial Jobless Claims and the May Producer Price Index (MoM).

When I looked at the 5-minute chart, the sell-off felt inevitable in hindsight—a clean technical reaction to the news.

The chart still shows “SELL 0.01 at 144.483”, indicating the short trade remains active and technically valid.

🔄 Chapter 4: Strategy Outlook – Why the Trend May Be Reversing

The decision to shift from long to short wasn’t made solely on the basis of the 9MA break—it aligned with the broader context and recent price action.

🧩 Key Factors Behind the Reversal Outlook:

- Post-CPI Momentum Shift

The Core CPI release on June 11 triggered a sharp downside move in USD/JPY, with the pair dropping over 100 pips in a single 8-hour candle. This kind of move often signals institutional rebalancing and could mark the beginning of a trend change. - MA Structure Weakening

Before the break, the 9MA had been acting as dynamic support during the uptrend. The clean break below it, especially after multiple touches, weakens bullish momentum and introduces the possibility of a downward phase. - Lower Highs Forming (Price Behavior)

Recent price action failed to reach new highs, hinting at buyer exhaustion. The lower high pattern, combined with a 9MA breakdown, builds the case for a sell-side bias. - Risk-to-Reward Alignment

The short setup maintained the standard +210/-70 pip configuration, offering a 3:1 reward-to-risk ratio—consistent with the strategy logic and offering high payoff potential if the downtrend confirms.

💡 Strategic Implication:

Instead of guessing the market top, I let the system confirm it. This transition shows the importance of rule-based trading, especially when emotions (like fear of giving back profit) tempt premature exits. Now holding a short position, I’ll continue to monitor each 8-hour candle for potential invalidation or continuation signals.

📝 Reflection on the Day

Closing the long position this morning and switching to a short was clearly the right call.

Once again, I’m reminded that following the rules of the system is the most mentally stress-free way to trade.

What makes me even happier is that this trade took place in a range-bound environment, not a clean trend.

Managing to capture profit in such conditions shows how powerful backtested strategies can be.

That confidence—rooted in evidence, not emotion—makes all the difference.