- 🟦 Chapter 1: What Are Initial Jobless Claims?

- 🟦 Chapter 2: When and Where to Track the Weekly Data

- 🟦 Chapter 3: Why Rising or Falling Claims Matter for Markets

- 🟦 Chapter 4: How USD/JPY Reacts — FX Playbook Examples

- 🟦 Chapter 5: FAQ for Traders and Investors

- 🟦 Final Chapter: Key Takeaways and Strategy Tips for FX Traders

🟦 Chapter 1: What Are Initial Jobless Claims?

Initial Jobless Claims refer to the number of individuals who filed for unemployment benefits for the first time during a given week in the United States.

This data is published every Thursday by the U.S. Department of Labor, and it serves as a timely indicator of changes in the labor market.

Unlike monthly reports such as Non-Farm Payrolls (NFP) or the Unemployment Rate, this is a weekly, high-frequency economic indicator that offers early insight into the health of the U.S. economy.

🧠 Why Should Traders Care?

Because jobless claims often rise before broader economic weakness becomes visible, they act as a leading indicator.

In particular, FX traders monitor this number closely for early signs of:

- An economic slowdown (claims rising)

- A labor market recovery (claims falling)

The implications are direct:

📉 Higher claims → potential recession fears, Fed dovish shift, → USD weakening

📈 Lower claims → stronger labor market → Fed hawkish stance, → USD strengthening

📊 Not to Be Confused With Other Labor Data

| Indicator | Description | Frequency | Market Use |

|---|---|---|---|

| Initial Jobless Claims | New applicants for unemployment benefits | Weekly | Leading signal of labor market shifts |

| Unemployment Rate | % of jobless individuals in the labor force | Monthly | Broader, lagging indicator |

| Non-Farm Payrolls (NFP) | Net job creation in non-farming sectors | Monthly | Major driver of USD volatility |

📘 Quick Terminology Guide

- “Initial Claims” = New applications (not continued claims)

- Common abbreviations: Jobless Claims, Unemployment Claims, Weekly Claims

- Published by: U.S. Department of Labor

In short, Initial Jobless Claims offer early warning signals. They help traders stay ahead of economic trends and anticipate moves in key currency pairs like USD/JPY and EUR/USD.

🟦 Chapter 2: When and Where to Track the Weekly Data

🕒 Release Schedule

Initial Jobless Claims are released every Thursday at 8:30 a.m. Eastern Time by the U.S. Department of Labor.

This translates to:

- Japan Time (JST): 9:30 p.m. (during Daylight Saving Time)

- 10:30 p.m. (during Standard Time)

Because it’s a weekly release, this indicator is often the first major economic data of the week to reflect U.S. economic conditions.

📍 Where to Find It – Top Sources for Traders

Here are the most reliable platforms to check both the actual numbers and market reactions:

| Platform | Purpose | Notes |

|---|---|---|

| U.S. Department of Labor | Official release (PDF) | dol.gov |

| Investing.com | Economic calendar with forecasts & actuals | Easy-to-read, supports alerts |

| Bloomberg / Reuters | Real-time news coverage with market context | Professional tone, FX reactions |

| TradingView | Visualize USD/JPY or S&P 500 price reaction | Add economic events to chart timeline |

| Forexfactory.com | Popular among FX traders | Shows impact level and trader sentiment |

🔄 What to Watch For

Traders should monitor three key values:

- Actual: The released number (e.g., 225K)

- Forecast: Market consensus before the release (e.g., 215K)

- Previous (Revised): Last week’s number, sometimes revised

📌 Surprises matter most. The difference between the actual and forecast figure is what usually moves markets.

📈 Can You Chart It?

Yes. While Jobless Claims are a single weekly data point, platforms like TradingView allow you to:

- Overlay economic events on a USD/JPY chart

- Backtest price reactions over past months or years

- Combine with other indicators like NFP or CPI for context

⚠️ Watch the Market Conditions

The same number can trigger very different market reactions depending on the macro backdrop:

- In a rate-sensitive market, a drop in claims may boost USD

- In a risk-off market, a surprise increase may accelerate JPY strength

Understanding the context is just as important as watching the number itself.

🟦 Chapter 3: Why Rising or Falling Claims Matter for Markets

At first glance, a weekly report on unemployment claims might seem like a minor data point—but in reality, it often shifts sentiment across Forex, equities, and bonds.

📉 When Jobless Claims Rise (Worse-than-Expected)

Rising claims typically signal that:

- More people are losing jobs

- Labor market conditions are loosening

- Consumer confidence and spending may weaken

Market Interpretation:

| Market | Typical Reaction |

|---|---|

| USD | Weakens (due to lower rate expectations) |

| JPY | Strengthens (risk-off flows) |

| Stocks | Decline (growth concerns) |

| Bonds | Rally (yields fall as investors seek safety) |

🧠 Especially in rate-sensitive environments, traders interpret rising claims as a dovish signal for the Fed → leading to USD weakness.

📈 When Jobless Claims Fall (Better-than-Expected)

Declining claims suggest:

- A strong labor market

- Higher wage pressures (potentially inflationary)

- Confidence in consumer spending and business hiring

Market Interpretation:

| Market | Typical Reaction |

|---|---|

| USD | Strengthens (rate hike bias remains) |

| JPY | Weakens (risk-on flows) |

| Stocks | Rally (economic optimism) |

| Bonds | Decline (yields rise on inflation/fed fears) |

📌 In times when the Fed is concerned about inflation, strong labor data can delay rate cuts and support the dollar.

🧭 It’s All About Surprise vs. Expectation

Markets don’t just react to the number—they react to how it compares to expectations.

| Scenario | Possible Outcome |

|---|---|

| 🔺 Actual > Forecast | USD weakens (bad surprise) |

| 🔻 Actual < Forecast | USD strengthens (good surprise) |

| ➖ In line with Forecast | Muted market response |

In recent years, even a deviation of 10–20K from the forecast has triggered 30–50 pip moves in USD/JPY within minutes.

📊 Example Snapshot:

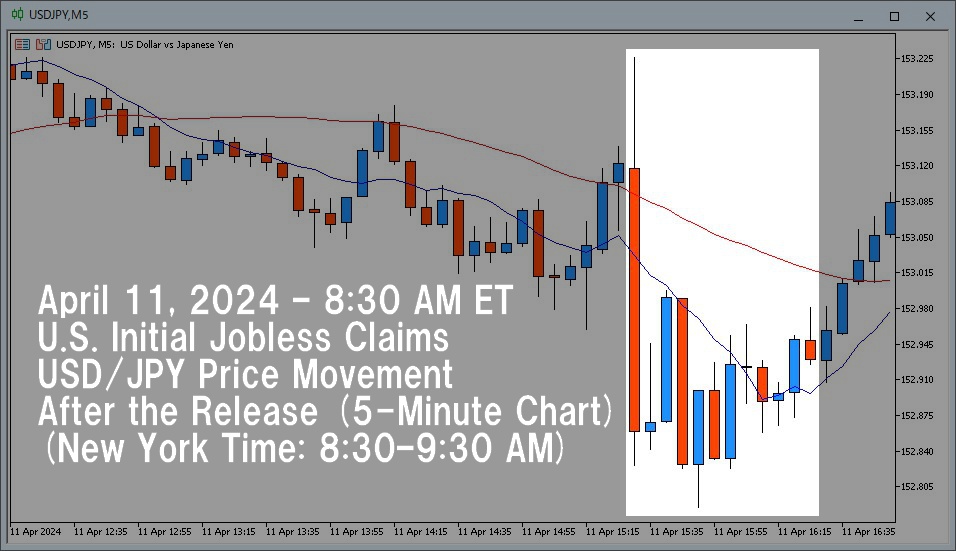

On April 11, 2024, U.S. Initial Jobless Claims came in at 211K,

beating the consensus forecast of 215K and down from the prior week’s revised 222K.

Markets viewed this as a sign of continued labor market strength.

🔍 USD/JPY Reaction (5-minute chart):

- Release time: 21:30 JST

- Open: 153.117

- High: 153.226

- Low: 152.826

- Close: 152.859

➡️ Price dropped nearly 30 pips in the first 5 minutes, despite the positive data.

💡 Interpretation:

While the headline number beat expectations, the sharp drop in USD/JPY suggests the market may have been:

- Focused on broader risk sentiment or positioning

- Pricing in profit-taking after prior dollar strength

- Reacting to other concurrent macro factors (e.g., bond yields or geopolitical news)

📌 Even “good news” can trigger short-term USD selling, especially if the market was already leaning heavily long on the dollar.

✅ Summary Takeaway

- Rising claims = potential economic slowdown → dovish Fed → USD softens

- Falling claims = labor strength → hawkish Fed or risk-on sentiment → USD strengthens

- Always compare the actual figure to the consensus forecast and consider the macro context before trading.

🟦 Chapter 4: How USD/JPY Reacts — FX Playbook Examples

The USD/JPY currency pair is highly sensitive to U.S. labor market data, especially Initial Jobless Claims.

Because this indicator impacts Fed policy expectations and risk sentiment, even a small surprise can trigger sharp moves — particularly in short-term trading.

📉 Reaction Mechanics: Why USD/JPY Moves

| Scenario | Market Interpretation | USD/JPY Reaction |

|---|---|---|

| 🔺 Higher-than-expected claims | Labor weakness → Fed may ease → Risk-off mood | 📉 USD/JPY falls (USD weakens, JPY strengthens) |

| 🔻 Lower-than-expected claims | Labor strength → Fed may stay hawkish → Risk-on mood | 📈 USD/JPY rises (USD strengthens, JPY weakens) |

But actual price action often depends on context, including:

- Overall market sentiment

- Upcoming major events (e.g. CPI, FOMC)

- Trader positioning and liquidity at release time

📊 Real-World Example: April 11, 2024

U.S. Initial Jobless Claims:

Actual: 211K

Forecast: 215K

Previous (revised): 222K

A positive surprise — claims fell more than expected.

But what happened in the market?

📉 USD/JPY (5-Minute Chart: 8:30–9:30 AM ET):

- Open: 153.117

- High: 153.226

- Low: 152.826

- Close: 152.859

➡️ A nearly 30-pip drop within minutes, despite stronger-than-expected data.

🎯 What This Means for Traders

This “paradoxical” move highlights a key lesson:

Market expectations aren’t everything — positioning and risk sentiment often dominate short-term price behavior.

📌 Possible reasons for the drop:

- Dollar was overbought heading into the release

- Traders took profit on long USD positions

- Broader macro flows (e.g., falling U.S. yields, geopolitical risk) overshadowed the headline

🛠️ Trading Playbook: How to Approach the Data

| Strategy | When to Use | Notes |

|---|---|---|

| Fade the Spike | If price overreacts to a minor beat/miss | Watch for exhaustion candles on 1- or 5-min charts |

| Breakout Follow-Through | If surprise is large AND confirmed by momentum | Use volume and RSI to confirm direction |

| Wait-and-See Mode | If data is in line with forecasts | Avoid forced trades in a directionless market |

✅ Key Takeaway

- USD/JPY doesn’t just move on numbers — it moves on surprise + context + flow

- Use economic data + technical setups + sentiment together to build trade ideas

- Always zoom out: one strong or weak print doesn’t change the trend alone

🟦 Chapter 5: FAQ for Traders and Investors

❓ What’s the difference between Initial Jobless Claims and the Unemployment Rate?

| Metric | Description | Frequency | Use Case |

|---|---|---|---|

| Initial Jobless Claims | Weekly number of new unemployment benefit applicants | Weekly | Short-term labor trend signal |

| Unemployment Rate | % of unemployed in the labor force | Monthly | Broad macro snapshot, lagging indicator |

🧠 Jobless Claims are leading, while the unemployment rate is more retrospective. Claims react faster to economic shifts.

❓ Do Jobless Claims directly predict Non-Farm Payrolls (NFP)?

Not precisely — but they offer useful context.

- Rising jobless claims may hint at soft NFP numbers to come

- Falling claims could support stronger payroll growth

- Best used in combination with 4-week average trends and other indicators (e.g. JOLTS, ADP)

📌 Traders often use claims as a “temperature check” in the weeks leading up to NFP.

❓ What is the 4-week moving average, and why does it matter?

The 4-week average smooths out weekly volatility caused by:

- Holidays

- Weather disruptions

- Temporary layoffs

✅ Markets pay attention to it because it reflects underlying labor trends more clearly than a single week’s data.

❓ Why do markets sometimes ignore a “good” or “bad” result?

Because:

- The result may already be priced in

- There’s a bigger event (like CPI or FOMC) looming

- Risk sentiment is dominating (e.g. equity selloffs, geopolitical risk)

- Positioning and flow matter more than data in the short term

🧠 Data is just one part of the puzzle — reaction > number.

❓ Who else follows Jobless Claims besides FX traders?

| Audience | Reason |

|---|---|

| 📊 Equity traders | Labor signals → corporate earnings impact |

| 🏦 Bond investors | Labor weakness → rate cuts → yields fall |

| 📰 Financial media | Easy-to-understand economic health check |

| 🎓 Students & researchers | Common in macroeconomic case studies |

✅ Summary

Understanding the mechanics and context behind jobless claims helps you:

- Avoid overreacting to noisy weekly prints

- Spot trend shifts before they hit the headlines

- Build confidence in short-term and swing FX setups

🟦 Final Chapter: Key Takeaways and Strategy Tips for FX Traders

🧩 Summary: Why Jobless Claims Matter in FX

- Initial Jobless Claims offer one of the earliest insights into U.S. labor market health each week.

- While not as headline-grabbing as NFP or CPI, they often set the tone for short-term market sentiment.

- USD/JPY is particularly reactive, especially when the data deviates from expectations.

🎯 Strategy Tip #1: Focus on Surprise vs. Forecast

“It’s not the number — it’s the surprise.”

- Always check the consensus forecast before the release

- Prepare trading scenarios for both upside and downside surprises

- Use alert tools (e.g. Economic Calendar, TradingView notifications)

🕵️ Strategy Tip #2: Combine with Macro Context

- A strong number in a dovish macro backdrop may still lead to USD selling

- A weak number during a hawkish Fed narrative might be brushed off

✅ Before the release, ask:

- Is the Fed currently leaning hawkish or dovish?

- What are bond yields doing?

- Is the market in risk-on or risk-off mode?

📊 Strategy Tip #3: Use the 5-Minute Chart, but Avoid the First 30 Seconds

- Spikes can be fades or fakeouts in the first few seconds

- Let spreads normalize before entering

- Look for confirmation patterns like engulfing candles or volume spikes

🛠 Strategy Tip #4: Use the 4-Week Moving Average for Swing Trades

- If the 4-week average is trending higher, it could signal labor market deterioration

- If it’s consistently falling, that’s a bullish labor signal

🧠 This can shape your directional bias for USD/JPY or even equities.

✅ Final Takeaway

Initial Jobless Claims are small in size but big in signaling power.

By understanding how traders interpret these weekly reports, you’ll be better equipped to:

- Avoid emotional trades

- Anticipate potential volatility

- Build smarter FX strategies aligned with macro flows

🎯 In a data-driven market, knowing the data is your edge.