The AUD/JPY currency pair is grabbing attention across social media and trading platforms this April.

While some traders highlight it as a technical “work of art,” others are locking in multi-R returns in short bursts. But what exactly is driving this sudden surge of interest?

AUD/JPY is a classic risk-on currency pair—sensitive to both global risk sentiment and interest rate differentials. In early 2025, the combination of resilient equity markets, yield spread favoring the Aussie dollar, and commodity tailwinds has created fertile ground for bullish trades.

But there’s more beneath the surface: sentiment among traders on X (formerly Twitter), COT positioning, and intermarket linkages are all painting a more complex picture.

In this article, we’ll break down why traders are buying AUD/JPY, how to interpret the recent spike in attention, and where the pair may be headed next.

📊 Chapter 1: Market Overview

Risk-On Sentiment and Yield Differentials Fuel AUD/JPY Strength

The recent rally in AUD/JPY isn’t just a fluke—it’s being driven by a combination of global macro factors and market psychology that favors risk assets.

First, risk appetite is back. With U.S. equity indices holding near all-time highs and volatility metrics like the VIX staying low, traders are rotating into high-beta currencies. AUD/JPY, often viewed as a barometer of global sentiment, thrives under these “risk-on” conditions.

Second, interest rate differentials remain a major tailwind. The Reserve Bank of Australia (RBA) has held rates steady, while the Bank of Japan continues to maintain ultra-low or near-zero policy. This gap supports carry trades, where traders borrow in low-yielding yen to fund positions in higher-yielding Aussie dollars.

Adding fuel to the fire, Australia’s economic indicators—particularly in mining exports and employment—have shown surprising resilience. This reinforces demand for AUD as a fundamentally supported currency.

Together, these factors create an environment where upward moves in AUD/JPY are both technically and fundamentally justified—at least for now.

💬 Chapter 2: Trader Sentiment on X

Live Reactions Reveal Confidence, Frustration, and Big Wins

While AUD/JPY continues to climb, trader reactions on X offer a candid glimpse into how the market is feeling in real time. The sentiment? A mix of confidence, missed opportunities, and high-R wins.

🧾 Example Posts:

@uncommonkvng

“AUDJPY – 1:6RR 🎯 AUDNZD – 1:3RR 🔥 EURUSD – 1:5RR ✅ Total of 1:14RR. I’m done for the day.”

→ High conviction, rapid-fire execution. The AUD/JPY setup is clearly rewarding active scalpers with well-defined setups.

@Tobiforex_

“$AUDJPY Work of Art 🎨 Cumulative 18R on AJ 💪”

→ Precision and patience paid off. This trader attributes their success to pure technical execution on the pair.

@BBjedo

“I so much despise BE! Why is BE a good risk management strategy?”

→ A reminder that not every setup is perfect—even profitable trades can leave a psychological sting if price moves beyond a conservative exit.

💬 Summary Insight:

These posts reveal that traders are seeing real opportunity in AUD/JPY—but also experiencing the psychological tensions of break-even exits, missed runs, and rapid decision-making.

In short, volatility is back, and the pair has become a proving ground for technical traders in April 2025.

🔗 Chapter 3: Intermarket Analysis

What Is AUD/JPY Tracking Right Now?

AUD/JPY rarely moves in a vacuum. As a risk-sensitive and yield-driven currency pair, it often mirrors broader shifts across equities, commodities, and even bond yields. In April 2025, several cross-market relationships are shaping its movement.

📈 1. Equity Indices – The Risk-On Proxy

Global equity markets—especially the Nikkei 225 and S&P 500—have remained firm. Since AUD/JPY is considered a barometer for risk sentiment, its direction often aligns with bullish equity momentum. Recent upticks in AUD/JPY have closely tracked rising stock indices.

⛏️ 2. Commodity Prices – Australia’s Macro Backbone

Iron ore and copper, key exports for Australia, have shown signs of strength. While China’s Q1 commodity imports were soft overall, March saw a temporary rebound in crude oil and copper imports—supportive of AUD flows. Any commodity-driven rebound in Australia’s trade balance tends to underpin AUD/JPY.

💹 3. Bond Yields – The Yield Spread Story

The yield differential between Australian and Japanese government bonds remains wide. While the Bank of Japan maintains its dovish stance, the Reserve Bank of Australia is in no rush to cut. This supports carry trades and reinforces bullish sentiment toward AUD/JPY.

💡 Summary:

AUD/JPY is currently tracking global risk sentiment via equities, finding support from commodities, and benefiting from rate differentials via bond markets.

In short, it’s at the crossroads of macro optimism, and traders should monitor intermarket shifts for early warning signals.

🎯 Chapter 4: Strategic Scenarios

Where to Buy and Sell AUD/JPY? Trade Setups for April 2025

With AUD/JPY gaining momentum in April, traders are asking a familiar question:

Where is the optimal entry—and when should you step aside or take profits?

Here are two primary trade scenarios to consider:

🟢 Bullish Continuation: Buying the Pullback

If AUD/JPY maintains its bullish structure above key moving averages and price action holds above previous support zones (e.g., 97.20–97.50), traders may look for opportunities to buy dips.

Key confirmation signals:

- Support holding above the 20-day moving average

- Bullish candlestick patterns near retracement levels

- Continuation of risk-on sentiment in global equities

Target zone: 98.50–99.20

Invalidation: Daily close below 96.80

🔴 Reversal Setup: Selling a Breakdown

Should momentum fade and AUD/JPY close below short-term support (e.g., 96.80), a correction may be underway. A reversal could trigger short setups targeting previous demand zones.

Bearish confirmation signals:

- Break and close below rising trendline or 20DMA

- Negative divergence on RSI or MACD

- Risk-off shift in equities or commodities

Target zone: 95.20–94.50

Invalidation: Reclaim of 97.50 with strong bullish volume

🎯 Strategy Insight:

AUD/JPY is at a technically extended level, so patience is key.

Traders should wait for confirmation—not chase—and align entries with broader market sentiment for higher-probability setups.

🔮 Chapter 5: Outlook

Can the AUD/JPY Rally Continue, or Is a Pullback Looming?

The bullish momentum in AUD/JPY has been impressive, supported by macro fundamentals, strong risk sentiment, and favorable yield differentials. But the big question now is:

How much further can it go?

⚖️ Balancing Tailwinds and Overextension

Tailwinds remain strong:

- Equities and commodities are stable to bullish

- Yield spread continues to favor AUD

- Intermarket correlations support continued strength

However, warning signs are emerging:

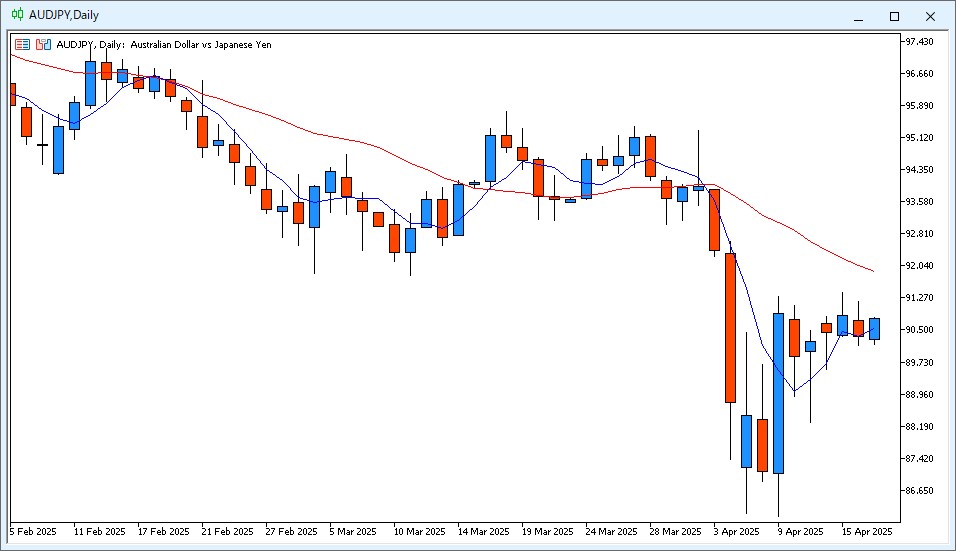

- AUD/JPY is stalling around 90.50–91.20, with strong resistance just above

- RSI and other momentum indicators are entering overbought territory

- Market sentiment is heating up quickly—sometimes a sign of late-stage exuberance

🔄 Likely Scenarios Ahead

- Consolidation phase above 97.50 may offer support-building and reset overbought indicators

- Break above 99.20 could trigger stops and invite momentum traders toward 100.00

- Failure to hold 96.80 would signal broader risk-off tone and open room for correction

🔮 Forecast Summary:

While there is no clear sign of exhaustion yet, AUD/JPY bulls are entering a zone where risk management becomes as important as directionality.

The outlook is cautiously bullish—but traders should prepare for higher volatility and sudden sentiment shifts as global macro dynamics evolve.

🧭 Chapter 6: Conclusion

Positioning Ahead of a Potential Trend Shift

AUD/JPY has become one of the most talked-about FX pairs in April 2025—and for good reason. The macro tailwinds, risk-on appetite, and yield dynamics have all converged to support a strong bullish run.

But with sentiment heating up, technicals overstretched, and volatility creeping back into global markets, this could be the calm before a trend shift.

🧭 Key Takeaways:

- Watch for sentiment extremes—what feels like breakout euphoria may quickly reverse

- Don’t chase rallies; let price come to you

- Intermarket signals matter—equities, commodities, and bonds hold the clues

- Define your risk clearly before entering late-stage trends