Ever placed a perfect pending order, only to see it vanish when price hits your level?

Or maybe your EA failed to trigger a trade for no apparent reason?

In most cases, this isn’t a bug or platform glitch — it’s a stop level restriction silently enforced by your broker.

A stop level is the minimum distance allowed between the current price and any pending order (like a limit or stop order). And while many traders are unaware of it, this invisible setting can cause frustrating rejections, failed EA trades, or missed profits.

In this article, we manually tested 9 major FX brokers across 10 popular instruments on MT5, and compiled a complete stop level comparison table.

You’ll also discover which brokers offer true freedom (0-point stop levels), and what risks you still face even with “no restrictions.”

Stop levels affect every trade — if you don’t know them, you’re trading blind.

✅ What You’ll Learn

- What a stop level is and how it causes order rejections or EA errors

- Why brokers set stop levels — 3 key reasons you probably haven’t heard

- Full stop level comparison: 9 brokers × 10 instruments (verified via MT5 specs)

- Which brokers offer 0-point stop levels for all major instruments

- Three hidden risks of trading even with stop level = 0

- Who these findings are for: scalpers, EA users, and precision traders

🧱 What Is a Stop Level? The Hidden Order Block You’ve Probably Never Noticed

You’ve set a pending order.

The price reaches your entry level.

But nothing happens — or worse, the order disappears.

This isn’t a platform bug. It’s likely a stop level restriction.

A stop level is the minimum distance (in points or pips) that a broker requires between the current market price and your pending order — such as:

- Buy Limit / Sell Limit

- Buy Stop / Sell Stop

- Stop Loss / Take Profit (on market orders)

✅ How It Works (With an Example)

Let’s say the current price of USD/JPY is 150.000, and your broker has a stop level of 20 points (2.0 pips).

This means:

- You cannot place a buy limit at 149.995

- You cannot place a stop loss at 149.999

- You cannot use take profit at 150.005

In all these cases, your order would be rejected, even if MT5 lets you enter the values. Some brokers silently block it, others show an error like:

“Invalid S/L or T/P”

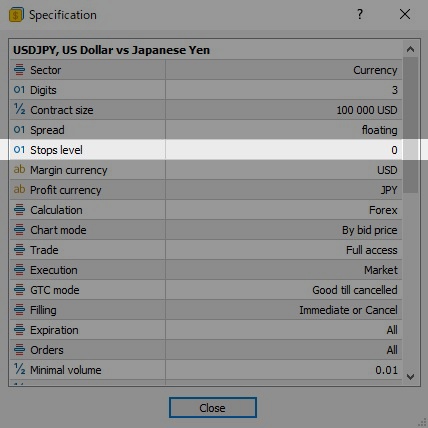

✅ Where to Check It on MT4/MT5

To see the stop level for any instrument:

- Open your Market Watch panel

- Right-click the instrument (e.g., EUR/USD)

- Click “Specifications”

- Look for the field:

Stop Level

✅ A value of 0 means no restriction — you can place orders at any distance from the market price.

❌ A value like 20 means you must place orders 2.0 pips away (minimum).

✅ Why It Matters for Scalping, EA, and Precision Traders

If you’re using scalping strategies or EAs, your logic might rely on tight entry/exit distances. A hidden stop level can:

- Cause your EA to fail silently

- Make your pending orders vanish or reject

- Force you to widen stop loss and take profit, reducing risk-reward efficiency

🧠 In short: Stop levels are broker-side restrictions, not something you control — but they control whether your trades execute as planned.

🛡️ Why Do Brokers Set Stop Levels?

3 Reasons Most Traders Don’t Realize

You might think stop levels are just an annoyance — or worse, a trick to block your trades.

But in reality, there are technical and business-driven reasons why brokers implement them.

Understanding these reasons will help you spot which brokers are truly trader-friendly — and which are not.

Here are the 3 key reasons behind stop level restrictions:

✅ Reason 1: Server Stability & Order Flow Management

In volatile markets, brokers receive thousands of order instructions per second.

Allowing traders to place pending orders 1 point away from current price could lead to:

- Massive processing strain on servers

- Order flooding during high-volatility events

- Delayed or failed executions for everyone

By enforcing a stop level (e.g., 10 or 20 points), brokers reduce order collision risk and maintain execution stability for all clients.

📌 Especially important for STP/ECN brokers processing orders to external liquidity providers.

✅ Reason 2: Protection Against Client Errors & Noise Trades

Some traders — especially beginners — may set pending orders or SL/TP levels way too close to the market price without realizing the consequences.

This can cause:

- Premature stop outs due to minor fluctuations

- Accidental instant triggers (orders behaving like market orders)

- Poor trading experiences, leading to support tickets and complaints

By enforcing a minimal distance, brokers add a “safety buffer” to prevent unintentional losses and reduce system misuse.

💡 Ironically, stop levels sometimes exist to protect you — not to limit you.

✅ Reason 3: Risk Management vs. Scalpers & EA Bots

Here’s the controversial part.

Some brokers — particularly those running B-book models (market makers) — may use stop levels as a way to:

- Limit the effectiveness of scalping and latency arbitrage

- Avoid ultra-tight SL/TP setups common with EA bots

- Reduce exposure to high-frequency profitable traders

In other words, not all stop levels are technical — some are strategic.

👉 If you’re a scalper or EA trader, always check whether a broker’s stop level policy aligns with your style.

✅ Summary Table: Why Stop Levels Exist

| Reason | Who It Protects | Trade-Off for Traders |

|---|---|---|

| Server load reduction | Broker infrastructure | Limits flexibility near price |

| Error prevention & trader safety | New traders | Prevents tight risk/reward setups |

| Risk control against scalpers | Broker’s profit model | Blocks precision entries for pros |

🧠 Bottom line: Some stop levels are reasonable. Others are red flags.

That’s why we tested 9 brokers and 10 instruments to find out who’s really scalper-friendly.

📊 Stop Level Comparison — 9 Brokers × 10 Instruments (Tested on MT5)

To cut through the marketing claims and fine print, we manually checked the stop level settings for 9 major FX brokers using MT5’s “Specification” feature.

We tested 10 commonly traded instruments across forex, commodities, and crypto, including:

- 6 Forex Pairs: USD/JPY, EUR/USD, GBP/JPY, AUD/JPY, NZD/USD, USD/CAD

- 2 Metals: XAU/USD (Gold), XAG/USD (Silver)

- 2 Cryptos: BTC/USD, ETH/USD

✅ Full Stop Level Comparison Table (in points)

| Broker | USD/JPY | EUR/USD | GBP/JPY | AUD/JPY | NZD/USD | USD/CAD | XAU/USD | XAG/USD | BTC/USD | ETH/USD |

|---|---|---|---|---|---|---|---|---|---|---|

| XMTrading | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Exness | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| HFM | 0 | 0 | 0 | 40 | 30 | 0 | 0 | 10 | ❌ | ❌ |

| TitanFX | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| VantageTrading | 0 | 0 | 0 | 0 | 0 | 0 | 20 | 10 | 0 | 0 |

| ThreeTrader | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Axiory | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ❌ | ❌ |

| SwiftTrader | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 |

| BigBoss | 10 | 10 | 10 | 10 | 10 | 10 | ❌ | ❌ | ❌ | ❌ |

🔍 Key Takeaways

- ✅ 100% Zero Stop Level on All Instruments:

XMTrading, Exness, TitanFX, ThreeTrader - ⚠️ Zero on Forex, Limited on Metals or Crypto:

VantageTrading, HFM, Axiory - ❌ All Instruments Have Restrictions:

SwiftTrader (20 pts fixed), BigBoss (10 pts on FX only)

📌 Why This Table Matters

| Use Case | What to Look For |

|---|---|

| Scalping | Brokers with 0 stop levels on FX pairs & gold |

| EA Automation | No restrictions on SL/TP for all 10 instruments |

| Manual Trading | Awareness of metals/crypto limitations to avoid rejection errors |

⚠️ Many “trusted” brokers still apply silent restrictions.

Always check the Stop Level in MT5 specs — or just refer to this table.

🚀 Who Offers True Freedom?

Brokers with 0-Point Stop Levels Across All Instruments

When it comes to precision trading — whether you’re scalping, using EAs, or placing tight SL/TPs — nothing beats the flexibility of zero stop level restrictions.

From our test results (see Chapter 3), only four brokers provided true zero-point stop levels across all 10 instruments tested:

🏆 Brokers Offering 0 Stop Level on All Tested Instruments

| Broker | FX Pairs | Metals | Crypto | Notes |

|---|---|---|---|---|

| XMTrading | ✅ | ✅ | ✅ | Universal compatibility, good for bonus hunters |

| Exness | ✅ | ✅ | ✅ | Excellent for automated trading and API integration |

| TitanFX | ✅ | ✅ | ✅ | Ultra-tight spreads, true ECN environment |

| ThreeTrader | ✅ | ✅ | ✅ | Fast execution and great for precision scalping |

✅ = Stop Level = 0 across all 10 instruments

🔍 Why These Brokers Stand Out

- No hidden execution blocks

- EA-compatible even on volatile pairs like GBP/JPY or BTC/USD

- SL/TP orders can be placed right next to market price

- Ideal for traders who rely on tight entries, exits, and fast reactivity

⚠️ Not All “0 Stop Level” Claims Are Equal

Some brokers advertise “0 stop level” — but only on certain pairs or only during normal market hours.

In contrast, these 4 brokers were tested and confirmed across all 10 instruments, under real MT5 conditions.

🧠 If you want to trade with no restrictions, these are your go-to brokers.

✅ Use Case Snapshots

| Trader Type | Best Broker Match |

|---|---|

| Scalpers | TitanFX, ThreeTrader |

| EA Users | Exness, XMTrading |

| Bonus + Flexibility | XMTrading |

| Cross-market (FX, Gold, Crypto) | All four are reliable |

🎯 Trader-Focused Broker Guide

Match Your Style to the Right Platform

Finding a broker with 0-point stop levels is a huge win —

but the real power comes from aligning that broker with your trading style.

Whether you’re a scalper, EA trader, or discretionary trader, the right broker will make your strategy more efficient, not more stressful.

Here’s how the top-performing brokers from Chapter 4 stack up by trading type:

🎯 For Scalpers: Precision + Execution Speed

| Recommended Brokers | ✅ TitanFX / ✅ ThreeTrader |

|---|---|

| Why? | Tight spreads, zero stop level, and high-speed execution |

| Best for: | 1–5 pip targets, breakout scalping, manual fast entries |

⚡ Scalping requires split-second execution and micro-level order control — these brokers deliver.

🤖 For EA Traders: Consistency + No Restrictions

| Recommended Brokers | ✅ Exness / ✅ XMTrading |

|---|---|

| Why? | Zero restrictions on SL/TP, stable MT5 infrastructure, EA-friendly terms |

| Best for: | Grid bots, trend-followers, custom-coded systems |

🤖 EA users need predictable environments. No minimum distance = no logic failure.

🧠 For Discretionary Traders: Flexibility + Safety Net

| Recommended Brokers | ✅ XMTrading / ✅ ThreeTrader |

|---|---|

| Why? | Manual trading friendly, easy SL/TP adjustments, bonus campaigns available |

| Best for: | Swing traders, position traders, mixed strategies |

🧘 If you use both limit/market orders and want full control over exits — stop level zero keeps you in charge.

💡 Bonus Strategy: Combine Two Brokers for Optimization

Sometimes the best approach is to use two brokers, each optimized for a different role:

| Scenario | Setup Example |

|---|---|

| EA testing + real execution | Exness + TitanFX |

| Bonus account + scalping account | XMTrading + ThreeTrader |

| Crypto + metals + forex specialist | ThreeTrader (main) + XMTrading (backup) |

🧩 Think of brokers like tools — use the right one for each trade.

✅ Summary Table

| Style | Broker Match | Highlights |

|---|---|---|

| Scalping | TitanFX, ThreeTrader | Speed, precision, low latency |

| EA Automation | Exness, XMTrading | No limits, reliable performance |

| Manual Trading | XMTrading, ThreeTrader | Control, bonuses, SL/TP flexibility |

| Mixed Approach | Pair from above | Best of both worlds |

⚠️ The Hidden Risks of “Zero Stop Level”

What Traders Still Overlook (But Shouldn’t)

On paper, a 0-point stop level sounds like perfection.

You can place your SL/TP wherever you want.

Your EA can fire off ultra-precise orders.

No restrictions, no friction… right?

Not quite.

Even in a “restriction-free” environment, there are three key risks that can still disrupt your trades — especially for scalpers, EA users, and high-frequency manual traders.

⚠️ Risk 1: Instant-Triggered Orders from Accidental Placement

With stop level = 0, you can set pending orders or SL/TP values just 0.1 pips away from market price.

Sounds powerful… until you place an order too close and it instantly triggers, or gets hit by a tiny price spike.

| Example: | You place a Buy Stop 0.2 pips above market — price moves slightly and the order activates immediately. | | Result: | You’re now in a position you didn’t really mean to take. |

✅ Zero restriction = more freedom, but also more room for human error.

⚠️ Risk 2: EA Malfunction Due to Over-Precision

Some Expert Advisors (especially free or community-made ones) are coded to place SL/TP with ultra-tight logic —

like setting a stop loss just 0.5 pips below entry.

In theory, this should work.

But in practice, brokers may still reject such orders silently, or the EA might:

- Spam the server with repeated rejections

- Enter partial positions

- Freeze or stop functioning entirely

🤖 Zero stop level doesn’t mean your EA is immune to broker-side filters or platform quirks.

⚠️ Risk 3: Widened Spreads During News Can Still Trigger SL

Even if your SL is close by design, it’s still at the mercy of the spread.

During high-impact news or volatile periods, spreads can widen from:

- 1.5 pips → 10+ pips (especially on gold or crypto)

- Bid/Ask differences can eat into your SL buffer

So even with a tight SL, your position can be closed without the actual price ever hitting your stop on the chart.

📉 Your SL was technically hit — but only because the spread exploded.

✅ Summary: Zero Stop Level = Powerful Tool, Not a Safety Net

| Risk | When It Happens | How to Mitigate |

|---|---|---|

| Instant order execution | Human error with tight placement | Always double-check SL/TP input |

| EA malfunction | Faulty logic + no distance buffer | Test EA in demo + build safeguards |

| Spread-triggered SL | News events, low-liquidity hours | Avoid tight SL around news |

🧠 Just because your broker gives you full freedom, doesn’t mean you should use all of it.

Zero stop level is a scalper’s dream — if you know how to use it properly.

✅ Final Takeaways

Freedom to Execute Begins with the Right Broker

In trading, strategy is everything — but execution is what brings it to life.

You can have the most sophisticated EA, the sharpest scalping logic, or the most precise entry plans…

But if your broker limits your ability to place orders when and where you need to —

your edge disappears.

That’s why understanding stop levels — especially the hidden ones — is critical to performance.

✅ Here’s What You Now Know

| Key Insight | Summary |

|---|---|

| ✅ What a stop level is | A broker-side restriction that defines how close you can place SL, TP, or pending orders |

| ✅ Why brokers use them | Technical reasons (server load), safety reasons (user protection), and strategic reasons (risk control) |

| ✅ Which brokers offer true freedom | XMTrading, Exness, TitanFX, and ThreeTrader have 0-point stop levels across all key instruments |

| ✅ What risks still exist | Even with zero restrictions, human error, EA bugs, or spread spikes can still ruin your trade |

🧠 The New Rule of Broker Selection

“Tight spreads” and “high leverage” don’t matter if your order doesn’t execute.

Choose brokers that give you execution freedom, not just flashy specs.

🎯 Your Next Steps

- ✅ Check your current broker’s stop level settings in MT5 (“Specifications” panel)

- ✅ Switch to a zero-stop-level broker if your strategy depends on precision

- ✅ Test your EA or scalping strategy in a real zero-restriction environment

- ✅ Bookmark our comparison table — and check back as broker conditions change

🚀 When your broker stops blocking you, your strategy starts working.

Trade with full control. Trade where your orders actually execute.