China has launched large-scale military drills encircling Taiwan, dubbed “Strait Thunder-2025A,” simulating targeted strikes on ports and energy hubs. Simultaneously, TSMC—Taiwan’s crown jewel of the global semiconductor industry—faces elevated geopolitical risk. These events have triggered sharp volatility in the USD/JPY pair, exposing FX markets to a complex mix of risk-off sentiment and tech-sector vulnerabilities. Here’s what traders need to know right now.

🔍 Key Takeaways

- China’s Military Posturing: Beijing’s “Strait Thunder” drills simulated an economic blockade of Taiwan, raising regional security concerns.

- TSMC in the Crosshairs: The world’s top chipmaker is at risk, shaking confidence in global tech supply chains and equity markets.

- USD/JPY Volatility: The yen strengthened on risk aversion, with the pair dropping sharply toward key support levels.

- Market Repricing Safe Havens: Gold rallied to record highs, while U.S. yields edged lower as capital sought refuge.

- Cross-Strait Tensions = Global Shockwaves: The spillover effects reach beyond Asia—touching equities, commodities, and FX.

📰 Background on the China–Taiwan Drills

On April 1, 2025, China’s People’s Liberation Army (PLA) launched a multi-branch joint military exercise around Taiwan, codenamed “Strait Thunder–2025A.” The operation featured live-fire drills, coordinated air-naval maneuvers, and simulated strikes on critical infrastructure, including LNG terminals and petroleum storage facilities in Taiwan. Chinese state media framed the drills as a routine sovereign right, but the scale and intensity suggest they were a direct response to recent diplomatic engagements between Taiwan and Western allies.

According to Taiwan’s Ministry of National Defense (MND), the PLA’s activities were inherently provocative, particularly as they included aerial refueling operations over the Taiwan Strait and the deployment of the aircraft carrier Shandong. The Taiwanese military responded by initiating a “Rapid Response Exercise,” placing its forces on high alert.

These exercises are not just military shows of force—they represent strategic signaling aimed at deterring Taiwan’s independence movement and intimidating U.S. allies in the region. Analysts noted that the drills closely mirrored a full-scale blockade simulation, raising the risk of market-disrupting miscalculations or accidents.

📉 Cross-Market Implications

The Strait Thunder–2025A exercises have triggered a broad cross-market reaction, echoing through forex, equities, commodities, and even crypto markets. Here’s how key asset classes have responded and what intermarket dynamics are now in play:

💴 USD/JPY – Safe-Haven Yen Strengthening

The dollar-yen pair showed a sharp pullback as risk sentiment soured globally. Investors interpreted the Taiwan blockade drills as an escalation of East Asian geopolitical risk, prompting a flight to the Japanese yen—traditionally a safe-haven currency during regional tensions.

🛢️ Oil – Supply Chain Shock Fears

Crude oil prices ticked higher on fears that a potential conflict near Taiwan could disrupt shipping lanes through the East and South China Seas. These routes are critical for global energy and container shipping, raising concerns of a supply-side inflation shock in the event of further escalation.

💻 Semiconductors – TSMC at the Crosshairs

TSMC, the world’s leading chipmaker located in Taiwan, remains a strategic flashpoint. Markets are pricing in heightened risk for tech supply chains—Apple, Nvidia, and other giants depend heavily on TSMC’s uninterrupted output. A full-scale conflict could act as a systemic shock to the global tech ecosystem.

🥇 Gold – Breaking New Highs

Gold surged to a new all-time high above $3,150, signaling a strong defensive rotation. Investors are seeking refuge not just from military uncertainty but also from the broader macroeconomic spillovers, including potential Fed recalibration if global trade is destabilized.

🎯 Key Takeaways for FX Traders

1. Geopolitics > Macroeconomics (for now)

The Taiwan drills mark a phase where geopolitical risk temporarily overshadows traditional macro drivers like inflation or Fed policy. FX traders should monitor headline risks as catalysts for sharp intraday volatility, particularly in USD/JPY, AUD/JPY, and CNY crosses.

2. Yen Demand as Risk Barometer

The Japanese yen is once again behaving as a barometer of regional risk sentiment. Any signs of escalation—or de-escalation—will likely be reflected first in JPY strength or weakness. This creates tactical trading opportunities during Asia sessions.

3. TSMC = Tail Risk for Tech-Sensitive FX

Taiwan’s centrality to semiconductor production means that currency pairs linked to tech-heavy economies (e.g. USD/JPY, USD/KRW, USD/TWD) may exhibit correlated reactions to TSMC news. Think of TSMC as a hidden FX volatility driver.

4. Gold’s Signal: Risk Aversion is Real

Gold breaking record highs while the yen appreciates confirms a market-wide shift to risk-off positioning. FX traders should be cautious with high-beta currencies like AUD and NZD in this environment.

5. Watch for Policy Response and Headlines

Traders should track real-time developments via sources like MoNDefense (Taiwan’s Defense Ministry), Indo-Pacific military pressers, and US-Philippines drills scheduled in late April. Unexpected official statements may move the FX market faster than economic data.

💬 X Reactions: Market Psychology

Social media platforms—particularly X (formerly Twitter)—have lit up in response to the Taiwan blockade drills and their broader market implications. Here’s a curated snapshot of how traders, analysts, and geopolitical commentators are reacting:

🧠 Macro Strategists: Framing It as a Global Risk Event

“If China invades Taiwan, your portfolio won’t just bleed—it’ll flatline. TSMC goes dark, Apple loses its brain factory, Nvidia’s chips vanish. This is a black swan with nukes in its beak.”

His dramatic framing captures the worst-case market psychology circulating on X: Taiwan risk is not just regional—it’s systemic.

📉 FX Traders: Watching USD/JPY with Precision

“USD/JPY fading hard. Watch 147.50—psychological support and the last daily higher low. Break it and we open 145 real quick.”

Here, technical traders are hyper-focused on key horizontal levels and volatility bursts tied to geopolitical news flow.

🌍 Geopolitical Analysts: Drawing in the Philippines and the U.S.

“The Philippines will be inevitably involved in any Taiwan conflict,” said Gen. Romeo Brawner, highlighting regional risk interlinkage.

“Joint U.S.-Philippines drills begin April 21. All eyes on Northern Luzon.”

This reaction underscores the expanding scope of the crisis, raising the stakes for broader Indo-Pacific involvement.

🔥 Risk-Off Sentiment Echo Chamber

“Geopolitics and tariffs heat up? Exit crypto. Go defense, gold, silver. You’ll thank me later.”

This advice encapsulates a broader market mood: escalating geopolitical tensions and trade risks are triggering a flight from speculative assets toward traditional safe havens.

📈 Strategic Scenarios Based on USD/JPY Daily Chart

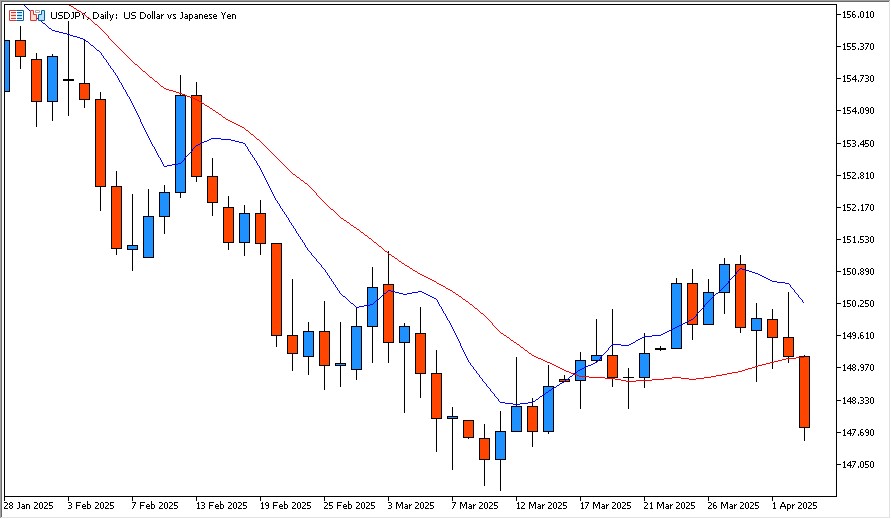

The USD/JPY pair has reacted strongly to geopolitical risk, falling from the 150.30 range to test support levels in the 147s. The daily chart reveals several key zones for tactical positioning, both for short-term scalpers and swing traders.

🔻 Scenario 1: Bearish Continuation – Sell the Bounce

- Entry Zone: 149.50 – 150.00 (previous resistance and 20-day moving average)

- Initial Target: 148.00

- Extended Target: 146.00 – 145.00 (gap-fill and prior demand zone)

This scenario assumes continued risk-off sentiment, where rallies are sold into. If geopolitical tensions persist and USD/JPY fails to reclaim 150, the pair could retest the 147.50 support and break lower.

Confirmation trigger: Failure to close above 149.80 on a daily basis.

🔄 Scenario 2: Short-Term Rebound – Buy on Dip

- Entry Zone: 147.50 – 147.80 (technical support)

- Target: 149.00 – 149.50

- Stop Loss: Below 147.00

For traders betting on a temporary relief rally (e.g. from calming headlines or bounce in U.S. yields), this strategy targets a reversion move back toward the mid-149s.

Watch for: Positive U.S. economic data or risk-on flows in equities.

📈 Scenario 3: Bullish Resumption – Buy Breakout

- Breakout Trigger: Daily close above 150.60

- Target: 151.80 – 152.50 (year-to-date highs)

Should geopolitical tensions ease or the dollar regain strength from strong macro data, a break above 150.60 would signal resumption of the medium-term uptrend. This scenario would invalidate bearish structures and target retests of previous highs.

💡 FX Trading Tip:

As of now, USD/JPY is consolidating just above 147.80, a key pivot zone. The next directional move likely hinges on either a headline shock (China/Taiwan) or a decisive move in U.S. yields. Set alerts and prepare for both directions.

🔮 Outlook and What to Watch Next

🧭 Geopolitical Flashpoints

The Strait Thunder–2025A drills may only be the first phase. Chinese military spokesmen have hinted at follow-up operations, potentially under the “2025B” label. Any escalation—especially involving blockade-style maneuvers or missile tests near Taiwan—could reignite volatility across global markets.

Watch for:

- Satellite tracking of PLA naval deployments

- Cross-strait airspace violations

- Statements from the U.S., Japan, and the Philippines

💹 Central Banks on Alert

If geopolitical tensions disrupt supply chains or cause energy prices to spike, central banks (including the Fed and BoJ) may recalibrate their rate path expectations. This introduces another dimension of uncertainty into USD/JPY, especially as the BoJ recently hinted at adjusting its ultra-easy policy.

💱 USD/JPY Technical Outlook

The pair sits in a pivotal zone between risk-off yen flows and dollar resilience from U.S. macro strength. Expect:

- Range-bound action between 147.50–150.60 if headlines remain neutral

- Breakouts on unexpected news (e.g., military clash, U.S. payrolls surprise)

📅 Events to Watch

- April 5: U.S. Non-Farm Payrolls

- April 10: U.S. CPI

- April 21: U.S.–Philippines joint military drills begin in Luzon

- Any day: Surprise headlines from the Taiwan Strait

🧩 Final Thoughts

The USD/JPY’s sharp reaction to China’s Taiwan drills highlights just how quickly geopolitical shocks can reshape currency dynamics. While markets often discount political risks until they erupt, this episode served as a real-time stress test for the assumption of regional stability in East Asia.

For FX traders, the interplay between military developments, tech supply chain fragility, and safe-haven flows is now front and center. Whether you’re scalping intraday volatility or positioning for swing trades, this is a time to stay flexible, risk-aware, and strategically informed.

In geopolitically charged markets, headlines can move charts faster than fundamentals.

Keep your charts open, your alerts active, and your strategy adaptable.

The Strait may be thundering—but with preparation, traders can still find clarity amid the noise.