The latest COT report for copper, released on March 29, reveals a sharp increase in speculative long positions while commercial hedging activity intensifies. This divergence in positioning raises a critical question for traders: is copper poised for another leg higher, or is a pullback around the corner? In this article, we dissect the positioning data and provide a strategic outlook to help you decide whether it’s time to buy the dip—or take profits.

✅ Key Highlights

- Speculators boosted long positions by over 5,000 contracts and cut shorts by nearly 4,000—signaling rising bullish sentiment.

- Commercial players ramped up short positions, reflecting heightened price hedging by producers amid rising copper prices.

- Retail traders remain neutral, suggesting the market hasn’t entered a euphoric or overbought phase yet.

- Copper futures surged past $5/lb, driven by supply concerns and steady demand from the energy sector.

- The current positioning structure suggests we are mid-to-late trend, with room for further gains—but rising risk of volatility.

📊 Key Takeaways from This Week’s Copper COT Report

📝 Explanation :

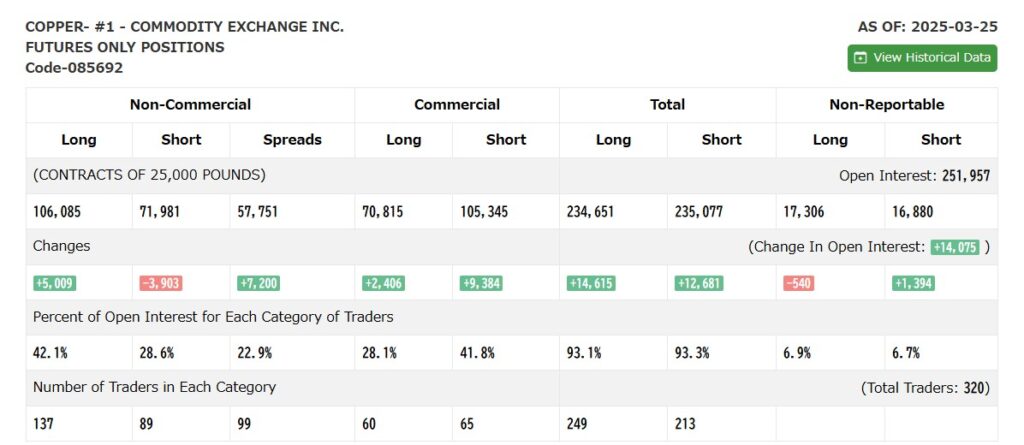

This raw CFTC report displays the latest positioning data for copper futures. It outlines long and short positions by speculators, commercials, and retail traders as of March 25, 2025.

🔹 Speculators Increase Long Positions, Reduce Shorts

📝 Explanation:

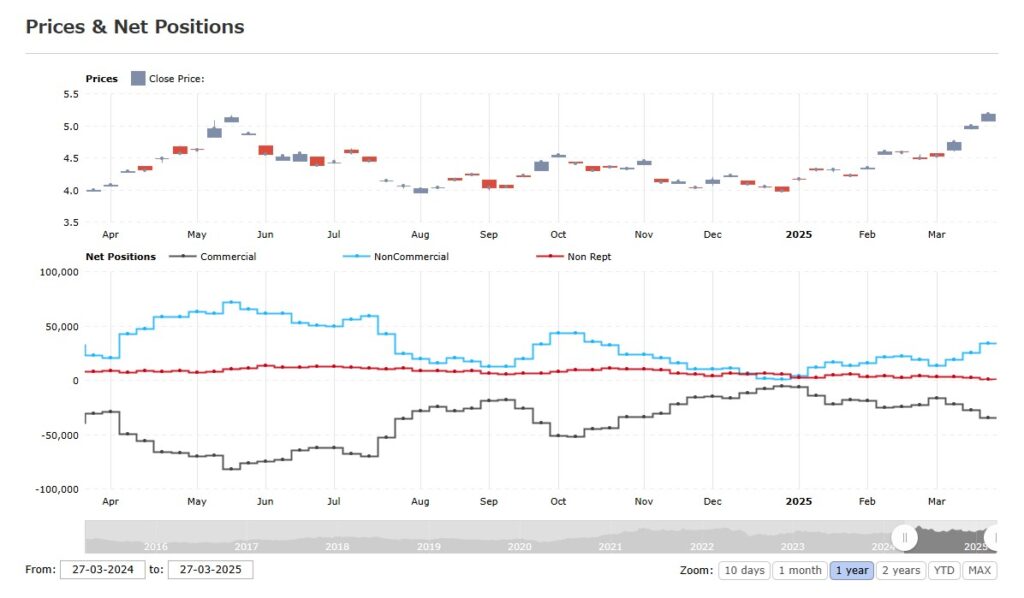

This chart visualizes how each trader group is positioned—speculators show a clear long bias, while commercials hold a dominant short stance. Retail positions remain balanced.

Speculative traders (non-commercials) significantly increased their exposure to copper during the week of March 25, 2025. The latest COT data shows a net increase of over 9,000 contracts, driven by 5,000+ new long positions and a reduction of nearly 4,000 short positions. This marks one of the most aggressive bullish shifts from speculators in recent months.

Such a pattern often reflects growing momentum expectations, as traders position for trend continuation rather than mean reversion. The fact that this long buildup is happening after copper broke above the psychological $5/lb level further strengthens the case for trend-following behavior.

This type of aggressive positioning typically appears in the mid-to-late stages of a strong uptrend, when confidence is high, but the risk of a reversal also starts to build.

🔹 Commercials Add Shorts to Hedge Higher Prices

On the other side of the market, commercial traders (producers and hedgers) increased their short positions by over 9,000 contracts, bringing total shorts above 105,000. Their long positions also rose slightly, but the net short exposure remains significant.

This suggests that producers are locking in current high prices via hedging, indicating they perceive current levels as favorable—or potentially unsustainable. In previous cycles, such commercial short spikes have coincided with local tops or pre-correction zones.

While this doesn’t guarantee a reversal, it does highlight the growing risk-reward imbalance in the copper market.

🔹 Retail Traders Still on the Sidelines

Retail traders (non-reportables) remain largely flat, with long and short positions both hovering around 17,000 contracts. This neutral stance shows that retail participation hasn’t yet surged, which is often the case during the later stages of a strong trend.

From a contrarian perspective, this could imply that there’s still room for more upside, as the market hasn’t reached peak enthusiasm or “crowded trade” levels. At the same time, a sudden shift in retail sentiment could accelerate volatility in either direction.

📈 One Year in Review: How Copper Prices Moved with Positioning

🔹 Price Action vs Net Positions (Chart Analysis)

📝 Explanation:

A strong correlation is visible between copper’s price action and net speculative positioning. As net longs rose, prices followed upward—especially after breaking the $5 level.

Over the past 12 months, copper prices and net speculative positions have shown a clear directional correlation. From May to August 2024, prices declined alongside a drop in speculative longs and a modest increase in shorts. This period marked a cooling phase after the early-year rally.

However, since late January 2025, the trend has reversed. Net speculative positions turned sharply positive, coinciding with a breakout in copper prices above $4.80/lb. This was further confirmed when prices decisively breached the $5/lb psychological threshold in March, accompanied by aggressive long accumulation.

This dynamic indicates that price movements have been heavily driven by speculative flows, especially during key breakout phases. For trend traders, this reinforces the value of tracking COT shifts as an early signal of potential momentum.

🔹 Commercial Shorts Indicate Caution

While speculative interest tends to drive momentum, commercial positioning often reflects underlying market caution. Over the past year, spikes in commercial short positions have typically occurred near price peaks.

📝 Explanation:

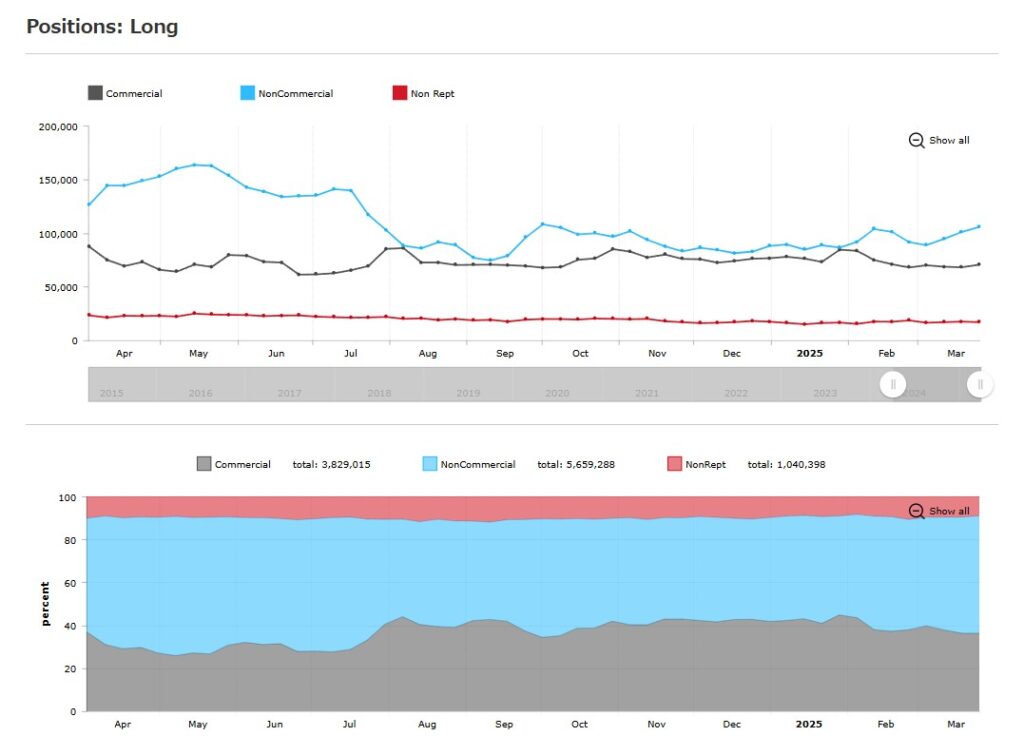

Speculative long positions have climbed sharply in recent weeks, showing aggressive momentum plays. Commercial and retail longs remain stable in comparison.

In recent weeks, commercial shorts have reached their highest level in 12 months, suggesting that producers are bracing for the possibility of a price pullback or at least increased volatility. This aligns with similar setups in 2023 and early 2024, when commercial selling pressure preceded short-term corrections.

Thus, the current positioning may be less about predicting tops and more about protecting against downside risk. For traders, it serves as a valuable risk management indicator rather than a directional signal on its own.

🔹 Long vs Short: The Market’s Bullish Tilt

The current positioning structure across all trader groups shows a bullish bias:

📝 Explanation:

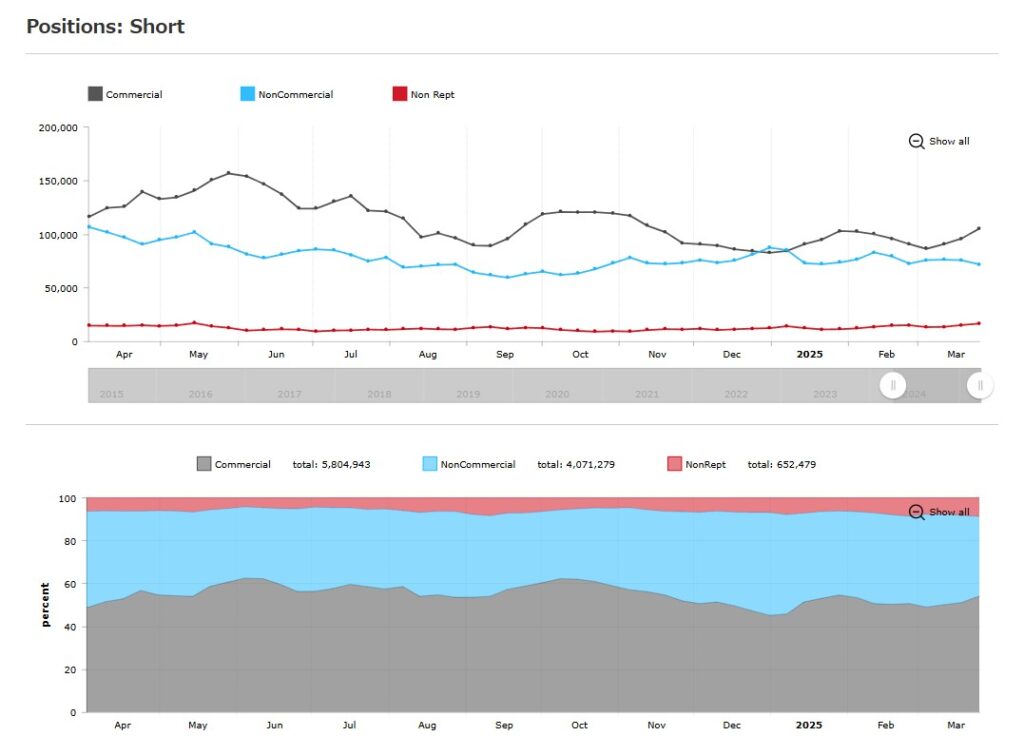

Commercial traders have significantly increased their short exposure—likely reflecting proactive hedging as prices rise. Speculative shorts have been reduced in contrast.

- Speculative longs > shorts by a significant margin

- Commercial shorts > longs, but rising long interest suggests some hedging diversification

- Retail positioning remains neutral

This asymmetry highlights a “buy-heavy” market structure, where upside potential is being actively pursued by institutional traders. While this does not rule out corrections, it reinforces that bulls still have control—for now.

🧭 Where Are We Now? Mid-Trend or Nearing a Top?

🔹 Speculative Behavior Hints at Late-Stage Buying

The recent surge in speculative long positions—without a corresponding spike in retail participation—suggests that institutional traders are chasing momentum, not initiating a new trend. Historically, such positioning behavior appears in the middle-to-late stages of a bull run, often right before volatility picks up.

This doesn’t necessarily mean a top is imminent. However, it raises the probability that the easy part of the rally may be behind us, and any further upside will require stronger fundamental support or broader market risk-on sentiment.

🔹 Commercial Hedging Suggests Overheating

The sharp rise in commercial short positions shows that producers are increasingly uncomfortable with current price levels. In previous cycles, similar hedging waves either capped rallies or preceded short-term corrections.

That said, the current environment—tight supply, strong energy-related demand, and a weak Australian dollar—may give copper prices some breathing room. Still, the presence of this commercial wall of selling means that upside targets will face growing resistance unless fresh catalysts emerge.

🔹 Lack of Retail Activity = Room to Run?

Interestingly, retail traders remain largely neutral, with no signs of emotional buying or panic shorting. This absence of crowd behavior suggests we are not yet in a euphoric market phase, which is often where trends reverse.

From a contrarian standpoint, this can be seen as a positive sign—there may still be room for the trend to extend if retail participation picks up gradually rather than in a surge. The key is to watch whether retail longs start to spike suddenly, which often signals “too late to chase.”

🧠 Scenario Planning and Trade Setups

🔹 Scenario 1: Trend Continuation with Dip-Buying

If speculative buying continues and commercial selling stabilizes, copper could maintain its bullish momentum.

In this scenario:

- Pullbacks toward $4.90–$5.00 may attract new buyers, especially if accompanied by stable speculative positioning.

- A gradual increase in retail longs could actually support the trend, as the market climbs the “wall of worry.”

- Breakouts above $5.15–$5.20 would likely trigger new technical momentum and algorithmic entries.

Strategy Tip: Look for consolidation near support zones followed by higher lows—classic trend continuation signals.

🔹 Scenario 2: Commercial Pressure Triggers a Pullback

If speculative longs plateau or begin to unwind, while commercial shorting persists, copper may face a short-term correction.

In this case:

- The $5.00–$5.10 range could act as resistance, with failed breakout attempts triggering profit-taking.

- Commercial hedging can act as a “ceiling,” especially if macro data weakens or demand signals fade.

- Volatility could increase sharply if retail traders suddenly shift to risk-off behavior.

Strategy Tip: Avoid chasing highs. Instead, monitor speculative net positions for early signs of unwinding, and consider short setups below key support.

🔹 Tactical Play: What to Watch Before Taking a Position

Regardless of the scenario, traders should keep an eye on:

- Net speculative positioning trend: Are longs accelerating or fading?

- Commercial short build-up: Is hedging still rising or leveling off?

- Retail sentiment: Has crowd enthusiasm (or fear) started spiking?

These elements help define the risk-reward landscape for both long and short setups.

Bonus tip: Use COT data in conjunction with copper-AUD/USD correlations—especially when trading commodity-linked FX pairs.

🎯 Conclusion: Understanding Who’s in Control of the Copper Market

The copper market, as revealed by the latest COT report, is currently shaped by an aggressive wave of speculative buying and strategic commercial hedging. This dynamic tells us that the recent rally isn’t purely a function of supply and demand—it’s a reflection of positioning psychology and risk management tactics.

Speculators are clearly betting on continuation, while producers are preparing for potential downside.

Retail traders? Still largely silent.

This sets the stage for a market where momentum may carry prices higher in the short term, but increased volatility and profit-taking risks are also lurking beneath the surface.

For traders, the key question is no longer just “Where is copper going?”

It’s “Who’s driving it—and when might they change course?”

By tracking positioning shifts week to week, especially in relation to price breakouts and sentiment extremes, traders can stay aligned with the dominant forces in the market—without getting caught in the noise.